Otc 974 Form

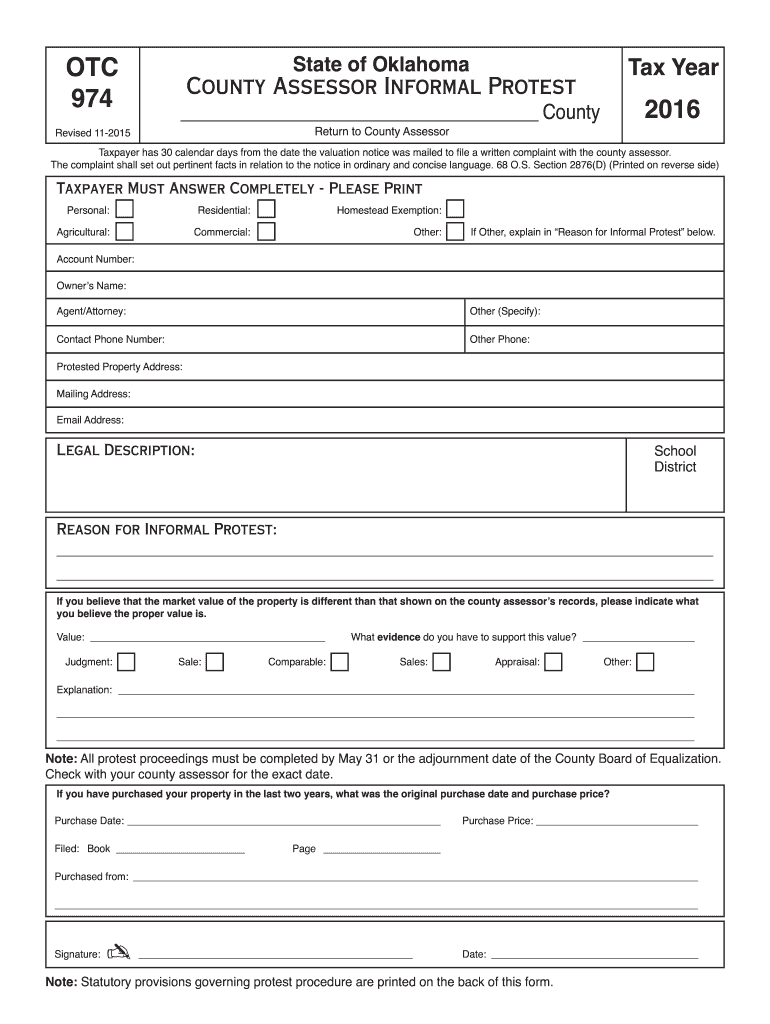

What is the OTC 974?

The OTC 974 form is an official document used primarily for tax purposes in the United States. It is designed to facilitate the reporting of certain transactions and activities that may affect an individual's or business's tax obligations. Understanding the purpose of this form is essential for compliance with federal tax regulations.

How to Use the OTC 974

Using the OTC 974 form involves several steps that ensure accurate reporting. First, gather all necessary information related to the transactions or activities you need to report. This may include financial records, identification numbers, and other relevant documentation. Next, fill out the form carefully, ensuring that all fields are completed accurately. Once completed, the form can be submitted electronically or via mail, depending on the specific requirements outlined by the IRS.

Steps to Complete the OTC 974

Completing the OTC 974 form requires attention to detail. Follow these steps:

- Review the form to understand the required information.

- Collect all necessary documents and data.

- Fill in the form, ensuring accuracy in all entries.

- Double-check for any errors or omissions.

- Submit the form according to IRS guidelines.

Legal Use of the OTC 974

The OTC 974 form holds legal significance in the realm of tax compliance. It must be filled out and submitted in accordance with IRS regulations to ensure that the information reported is legally binding. Failure to comply with these regulations can result in penalties or legal repercussions. It is crucial to understand the legal implications of submitting this form to maintain compliance with tax laws.

Key Elements of the OTC 974

Several key elements are essential when dealing with the OTC 974 form. These include:

- Identification of the filer, including name and tax identification number.

- Details of the transactions or activities being reported.

- Dates relevant to the transactions.

- Any supporting documentation that may be required.

Form Submission Methods

The OTC 974 form can be submitted through various methods, ensuring flexibility for users. The primary submission methods include:

- Online submission through the IRS e-filing system.

- Mailing a physical copy to the designated IRS address.

- In-person submission at local IRS offices, if applicable.

Quick guide on how to complete otc 974

Complete Otc 974 effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal sustainable alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents promptly without setbacks. Manage Otc 974 on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

The easiest way to modify and eSign Otc 974 seamlessly

- Obtain Otc 974 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Alter and eSign Otc 974 and ensure exceptional communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the otc 974

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fillable OTC form 974?

A fillable OTC form 974 is a document used for requesting over-the-counter medication reimbursements. This digitized form simplifies the submission process for consumers and helps streamline the approval and reimbursement workflow.

-

How can I create a fillable OTC form 974 using airSlate SignNow?

Creating a fillable OTC form 974 with airSlate SignNow is easy. Simply select the template option, customize the fields according to your needs, and then save it as a fillable document. This allows users to fill out the form digitally without the hassle of printing and scanning.

-

Is there a cost associated with using the fillable OTC form 974 in airSlate SignNow?

Yes, there are pricing plans available for businesses that want to utilize the fillable OTC form 974 through airSlate SignNow. These plans are designed to be cost-effective and can vary based on the number of users and features needed. You can check our pricing page for more details.

-

What features does the fillable OTC form 974 offer?

The fillable OTC form 974 offers a range of features, including customizable fields, digital signatures, and easy sharing options. These features enhance the user experience and ensure that submissions are completed accurately and efficiently.

-

Can I integrate the fillable OTC form 974 with other software solutions?

Absolutely, the fillable OTC form 974 can seamlessly integrate with various third-party applications via airSlate SignNow's API. This integration allows for smoother processes and helps maintain workflow continuity between different software platforms.

-

What are the benefits of using a fillable OTC form 974?

Using a fillable OTC form 974 simplifies the process of requesting reimbursements and enhances accuracy. It reduces paperwork, minimizes errors, and expedites the processing times for both consumers and businesses, leading to greater efficiency.

-

Is the fillable OTC form 974 secure?

Yes, the fillable OTC form 974 created with airSlate SignNow is designed with security in mind. Our platform employs advanced encryption and compliance measures to ensure that your documents are safe and protected from unauthorized access.

Get more for Otc 974

- Studies in diabetes it is a well established fact that in diabetes the jbc form

- Air permit applicationslouisiana department of environmental quality form

- Medicaid hospice discharge bformb indianamedicaidcom

- Va form 29 8636 780762476

- Dentist contract template form

- Event design contract template form

- Pain contract template form

- Paint and sip contract template form

Find out other Otc 974

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile