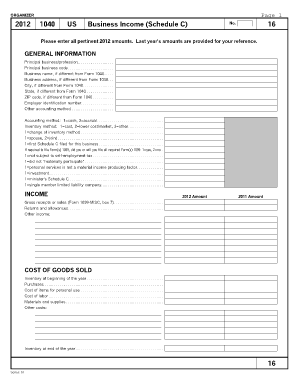

Business Income Schedule C Organizer Form

What is the Business Income Schedule C Organizer

The Business Income Schedule C Organizer is a crucial document for self-employed individuals and small business owners in the United States. It helps in systematically gathering all necessary information related to business income and expenses for tax reporting purposes. This form is essential for those who file their taxes using the IRS Form 1040, as it provides a comprehensive overview of the financial activities of the business throughout the tax year.

How to use the Business Income Schedule C Organizer

Using the Business Income Schedule C Organizer involves several steps to ensure accurate and complete information is collected. Begin by reviewing the sections of the organizer, which typically include income details, expenses, and deductions. Gather all relevant financial documents, such as receipts, invoices, and bank statements. As you fill out the organizer, categorize your income and expenses appropriately, ensuring that you have documentation to support each entry. This organized approach not only simplifies the tax filing process but also helps in maximizing potential deductions.

Steps to complete the Business Income Schedule C Organizer

Completing the Business Income Schedule C Organizer can be broken down into a few key steps:

- Gather Documentation: Collect all financial records, including income statements and expense receipts.

- Fill Out Income Section: Record all sources of income from your business activities.

- Document Expenses: List all business-related expenses, categorizing them into appropriate sections like operating costs, supplies, and travel.

- Review for Accuracy: Double-check all entries for accuracy and completeness before finalizing the document.

Legal use of the Business Income Schedule C Organizer

The Business Income Schedule C Organizer is legally recognized for tax purposes when properly completed and submitted. It serves as a supporting document for the IRS Form 1040 and must adhere to IRS guidelines to ensure compliance. Accurate reporting of income and expenses is essential to avoid penalties or audits. Utilizing an electronic solution, such as signNow, can enhance the security and validity of your submissions, ensuring that all signatures and data are captured in compliance with eSignature laws.

Required Documents

To effectively complete the Business Income Schedule C Organizer, several documents are typically required:

- Income statements from all business activities

- Receipts for business expenses

- Bank statements that reflect business transactions

- Previous year’s tax return for reference

Filing Deadlines / Important Dates

Filing deadlines for the Business Income Schedule C Organizer align with the general tax filing deadlines in the United States. Typically, individual tax returns, including the Schedule C, are due on April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to tax laws or deadlines that may affect your filing requirements.

Quick guide on how to complete business income schedule c organizer

Prepare Business Income Schedule C Organizer effortlessly on any gadget

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, enabling you to locate the necessary form and securely store it online. airSlate SignNow offers you all the resources required to create, adjust, and electronically sign your documents quickly and efficiently. Handle Business Income Schedule C Organizer on any device with airSlate SignNow apps for Android or iOS and enhance any document-based process today.

The easiest method to adjust and electronically sign Business Income Schedule C Organizer seamlessly

- Find Business Income Schedule C Organizer and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to store your modifications.

- Choose how you'd like to send your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing additional copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign Business Income Schedule C Organizer and guarantee effective communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business income schedule c organizer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Schedule C organizer?

A Schedule C organizer is a tool that helps self-employed individuals and small business owners compile their income and expenses for tax reporting. By utilizing a schedule C organizer, you can streamline the process of preparing your tax return, ensuring compliance and accuracy in your financial statements.

-

How can airSlate SignNow assist with my Schedule C organizer needs?

airSlate SignNow offers a digital solution that simplifies the document signing process, making it easier to manage your Schedule C organizer. With our intuitive platform, you can securely collect signatures on essential documents, allowing you to stay organized and focused on your business operations.

-

What are the key features of the airSlate SignNow Schedule C organizer?

The airSlate SignNow Schedule C organizer comes with several key features, including customizable templates, electronic signature capabilities, and document tracking. These features allow users to efficiently gather necessary information and signatures, thus enhancing their overall productivity when managing their Schedule C tax filings.

-

Is airSlate SignNow cost-effective for using a Schedule C organizer?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing your Schedule C organizer. With various pricing plans tailored for different business needs, you can choose an option that fits your budget while still benefiting from a feature-rich platform that enhances your document workflows.

-

Can I integrate airSlate SignNow with other tools for my Schedule C organizer?

Absolutely! airSlate SignNow offers seamless integrations with a variety of popular applications and tools. This capability allows you to enhance your Schedule C organizer process by connecting it with platforms like accounting software, ensuring a smoother workflow and better data management.

-

What are the benefits of using a Schedule C organizer with airSlate SignNow?

Using a Schedule C organizer with airSlate SignNow provides numerous benefits, including increased efficiency, reduced paperwork, and improved document security. This digital solution allows you to focus on growing your business rather than being bogged down by administrative tasks related to tax preparation.

-

How does airSlate SignNow ensure the security of my Schedule C organizer documents?

airSlate SignNow prioritizes document security by implementing advanced encryption protocols and secure data storage practices. This means your Schedule C organizer documents are safe from unauthorized access, helping you maintain confidentiality and compliance with legal standards.

Get more for Business Income Schedule C Organizer

- Cfe exam application form

- Au pair medical certificate form

- 50018 doc forms in

- Basic outline for hypertension form

- Library presentation for research methodology uakron form

- Property tax appeals when how ampamp why to submit plus a form

- Medical packag statement of work contract template form

- Medical receptionist contract template form

Find out other Business Income Schedule C Organizer

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement