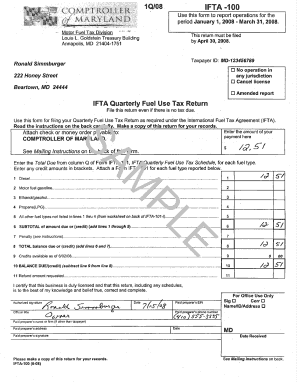

Maryland Ifta Form

What is the Maryland IFTA?

The Maryland International Fuel Tax Agreement (IFTA) is a tax collection agreement among the contiguous United States and Canadian provinces. It simplifies the reporting of fuel use by motor carriers operating in multiple jurisdictions. Under IFTA, carriers pay fuel taxes based on the miles driven in each state or province, rather than filing separate tax returns for each jurisdiction. This system aims to streamline the tax process for commercial vehicle operators, ensuring compliance and efficiency.

How to obtain the Maryland IFTA

To obtain the Maryland IFTA, businesses must complete the Maryland IFTA application form. This form requires essential details, including the business name, address, and the type of vehicles operated. Applicants must also provide their federal employer identification number (EIN) and any relevant business licenses. Once the application is submitted, the Maryland Comptroller's Office reviews it and issues the IFTA license along with decals for each qualified vehicle. It is important to ensure that all information is accurate to avoid delays in processing.

Steps to complete the Maryland IFTA

Completing the Maryland IFTA involves several key steps:

- Gather necessary documentation, including mileage records and fuel purchases.

- Access the IFTA quarterly fuel tax report form.

- Fill out the form with accurate information regarding miles traveled and fuel consumed in each jurisdiction.

- Calculate the total tax due based on the provided data.

- Submit the completed report by the designated deadline, either online or by mail.

Maintaining accurate records throughout the quarter simplifies this process significantly.

Key elements of the Maryland IFTA

Key elements of the Maryland IFTA include the following:

- Decals: Each vehicle must display an IFTA decal, which indicates compliance with the agreement.

- Quarterly Reporting: Carriers must file quarterly fuel tax reports detailing miles traveled and fuel purchased.

- Tax Calculation: Taxes are calculated based on the miles driven in each jurisdiction and the fuel consumed.

- Record Keeping: Accurate records of fuel purchases and mileage are essential for compliance and reporting.

Filing Deadlines / Important Dates

Maryland IFTA filing deadlines are crucial for compliance. Reports are due quarterly:

- First Quarter: Due April 30

- Second Quarter: Due July 31

- Third Quarter: Due October 31

- Fourth Quarter: Due January 31

It is important to submit reports on time to avoid penalties and maintain good standing within the IFTA framework.

Penalties for Non-Compliance

Non-compliance with Maryland IFTA regulations can result in various penalties. These may include:

- Fines for late filing or failure to file.

- Interest on unpaid taxes.

- Revocation of IFTA license.

Maintaining accurate records and adhering to filing deadlines helps prevent these consequences.

Quick guide on how to complete maryland ifta

Complete Maryland Ifta effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, enabling you to locate the correct form and securely store it online. airSlate SignNow supplies you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Maryland Ifta on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest method to modify and eSign Maryland Ifta effortlessly

- Locate Maryland Ifta and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow specially provides for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and has the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your modifications.

- Select how you want to submit your form, by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tiresome form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs with a few clicks from any device you prefer. Adjust and eSign Maryland Ifta while ensuring excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland ifta

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Maryland IFTA and why is it important?

Maryland IFTA stands for the International Fuel Tax Agreement, which simplifies the fuel tax reporting for motor carriers operating in multiple jurisdictions. It is crucial for compliance with fuel tax regulations and ensures that carriers pay the correct amount of taxes based on the miles traveled in each state.

-

How can airSlate SignNow help with Maryland IFTA reporting?

airSlate SignNow provides a streamlined platform for eSigning and sending documents, making it easier to manage Maryland IFTA paperwork. With automated workflows, you can quickly gather necessary signatures and keep track of all your compliance documents in one secure place.

-

What features does airSlate SignNow offer for managing Maryland IFTA forms?

airSlate SignNow includes features like customizable templates, document tracking, and notifications, which all enhance the efficiency of managing Maryland IFTA forms. These tools ensure that you can complete and submit your documents accurately and on time.

-

What are the pricing options for using airSlate SignNow for Maryland IFTA?

airSlate SignNow offers different pricing plans that cater to various business sizes and needs. Each plan is designed to provide cost-effective solutions for managing your Maryland IFTA documentation, helping businesses save time and resources.

-

Can airSlate SignNow integrate with other software for Maryland IFTA management?

Yes, airSlate SignNow integrates seamlessly with various accounting and fleet management software platforms. This capability allows you to enhance your Maryland IFTA reporting process by consolidating your tools and maximizing efficiency.

-

How does airSlate SignNow ensure the security of Maryland IFTA documents?

Security is a top priority for airSlate SignNow, which employs industry-leading encryption and compliance measures to protect your Maryland IFTA documents. You can rest assured that your sensitive information remains safe from unauthorized access.

-

Is there a mobile app for airSlate SignNow to manage Maryland IFTA on the go?

Yes, airSlate SignNow offers a mobile app that allows you to manage your Maryland IFTA documents from anywhere. This convenience is perfect for busy professionals who need to sign and send documents while on the road.

Get more for Maryland Ifta

- Application for driver training instructors license dps mn form

- Disability parking certificate form

- Minnesota department of labor and industry labor standards prevailing wage 443 lafayette road north st dli mn form

- Mn dept of health class f license application form

- Application for motor vheicle refund mn form

- Commercial driver fillable application form

- Lien release form mn

- Notice minnesota department of public safety state of minnesota dps mn form

Find out other Maryland Ifta

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation