Indiana State Business Report Forms 2016-2026

What is the Indiana State Business Report Form?

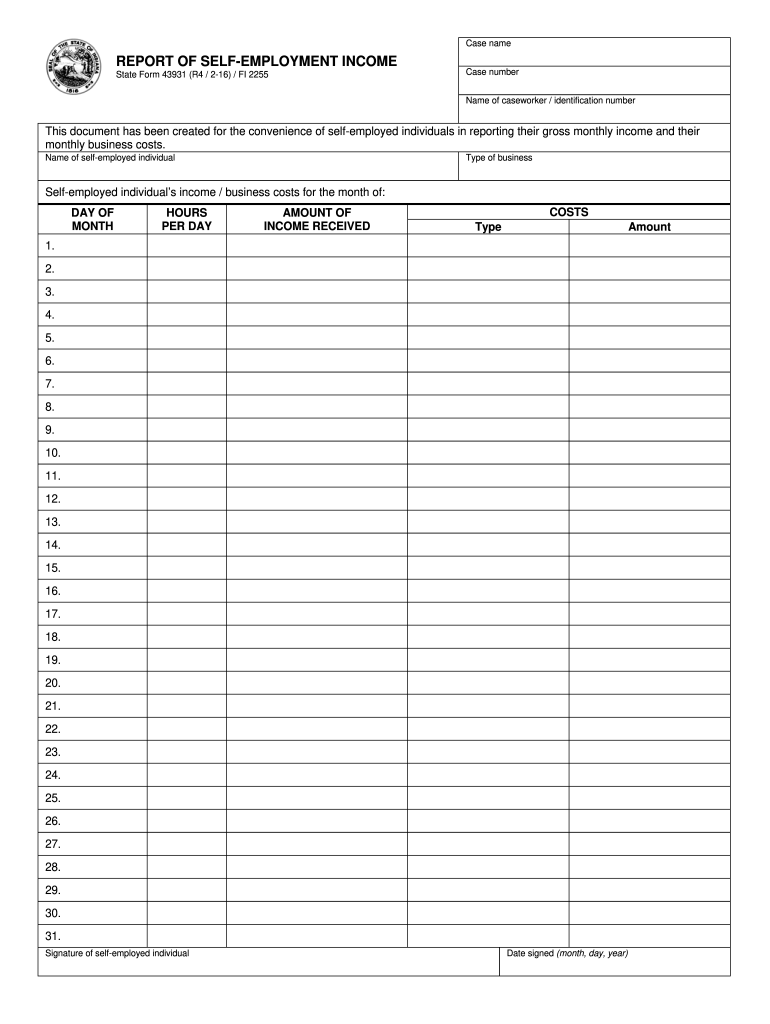

The Indiana State Business Report Form, commonly known as the FSSA self-employment form or state form 43931, is a crucial document for individuals who operate their own businesses in Indiana. This form is designed to report self-employment income and is essential for meeting state and federal tax obligations. It provides the necessary information to the Indiana Department of Revenue, allowing self-employed individuals to accurately report their earnings and calculate their tax liabilities.

Steps to Complete the Indiana State Business Report Form

Completing the Indiana State Business Report Form involves several key steps to ensure accuracy and compliance. Follow these steps:

- Gather necessary information: Collect all relevant financial documents, including income statements, expense receipts, and any prior tax returns.

- Fill out the form: Enter your personal information, including your name, address, and Social Security number. Report your total income and itemized deductions accurately.

- Review for accuracy: Double-check all entries for completeness and correctness. Ensure that all calculations are accurate to avoid penalties.

- Sign and date the form: Provide your signature and the date to validate the form before submission.

Required Documents for the Indiana State Business Report Form

When preparing to complete the FSSA self-employment form, it is important to have the following documents on hand:

- Income statements from your business activities.

- Receipts for any business-related expenses.

- Previous tax returns, if applicable, to provide context for your current income.

- Any additional documentation that supports your deductions or claims.

Form Submission Methods

The Indiana State Business Report Form can be submitted through various methods, providing flexibility for self-employed individuals. You can choose from the following options:

- Online Submission: Complete and submit the form electronically through the Indiana Department of Revenue's online portal.

- Mail Submission: Print the completed form and send it via postal service to the appropriate state office.

- In-Person Submission: Visit a local Indiana Department of Revenue office to submit your form directly.

Key Elements of the Indiana State Business Report Form

The FSSA self-employment form includes several key elements that are essential for accurate reporting. These elements typically comprise:

- Personal Information: Your name, address, and Social Security number.

- Income Reporting: A section to report total income from self-employment.

- Deductions: Areas to itemize any deductions that may apply to your business.

- Signature Section: A space for your signature to validate the form.

Legal Use of the Indiana State Business Report Form

The Indiana State Business Report Form is legally binding and must be completed accurately to comply with state tax laws. Failing to submit this form or providing false information can lead to penalties or legal repercussions. It is important to ensure that all information is truthful and that the form is submitted by the required deadlines to avoid any issues with the Indiana Department of Revenue.

Quick guide on how to complete forms in

Your assistance manual on how to prepare your Indiana State Business Report Forms

If you’re seeking to understand how to generate and dispatch your Indiana State Business Report Forms, here are some straightforward guidelines on how to simplify tax submission.

To begin, you just need to set up your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is a highly user-friendly and robust document management tool that enables you to modify, draft, and finalize your income tax documents with ease. With its editor, you can toggle between text, checkboxes, and eSignatures and revert to adjust information as necessary. Optimize your tax administration with advanced PDF editing, eSigning, and seamless sharing.

Follow the instructions below to finalize your Indiana State Business Report Forms in just a few minutes:

- Establish your account and start editing PDFs in no time.

- Utilize our directory to find any IRS tax document; explore various versions and schedules.

- Click Retrieve form to access your Indiana State Business Report Forms in our editor.

- Complete the necessary fillable fields with your information (text, figures, checkmarks).

- Employ the Signature Tool to append your legally-binding eSignature (if required).

- Examine your file and correct any mistakes.

- Preserve changes, print your version, send it to your intended recipient, and save it to your device.

Leverage this manual to submit your taxes electronically using airSlate SignNow. Remember that filing by paper can lead to increased return errors and delayed refunds. It’s important to check the IRS website for submission regulations specific to your state before e-filing your taxes.

Create this form in 5 minutes or less

FAQs

-

How do I fill out Form 30 for ownership transfer?

Form 30 for ownership transfer is a very simple self-explanatory document that can filled out easily. You can download this form from the official website of the Regional Transport Office of a concerned state. Once you have downloaded this, you can take a printout of this form and fill out the request details.Part I: This section can be used by the transferor to declare about the sale of his/her vehicle to another party. This section must have details about the transferor’s name, residential address, and the time and date of the ownership transfer. This section must be signed by the transferor.Part II: This section is for the transferee to acknowledge the receipt of the vehicle on the concerned date and time. A section for hypothecation is also provided alongside in case a financier is involved in this transaction.Official Endorsement: This section will be filled by the RTO acknowledging the transfer of vehicle ownership. The transfer of ownership will be registered at the RTO and copies will be provided to the seller as well as the buyer.Once the vehicle ownership transfer is complete, the seller will be free of any responsibilities with regard to the vehicle.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do I fill a form which is PDF?

You can try out Fill which had a free forever plan and requires no download. You simply upload your PDF and then fill it in within the browser:UploadFillDownloadIf the fields are live, as in the example above, simply fill them in. If the fields are not live you can drag on the fields to complete it quickly. Once you have completed the form click the download icon in the toolbar to download a copy of the finished PDF. Or send it for signing.Open a free account on Fill here

-

What are some tips to fill out the kvpy self appraisal form?

You should not lie in the self-appraisal form. Professors generally do not ask anything from the self appraisal form. But if they find out some extraordinary stuffs in your form, they may ask you about those topics. And if you do not know those topics properly, you will have higher chance of NOT getting selected for the fellowship. So, DO NOT write anything that you are not sure about.If I remember properly, in the form they ask, “What is your favorite subject?” and I mentioned Biology there. Head of the interview panel saw that and asked me about my favorite field of biology. When I told genetics, two professors started asking question from genetics and did not ask anything from any other fields at all (except exactly 2 chemistry questions as I mentioned chemistry as my 2nd favorite subject). But they did not check other answers in self-appraisal form (at least in my presence).Do mention about science camps if you have attended any. Again, do not lie.All the best for interview round. :)

-

Is there any research on the topic of how people fill out forms?

There are a number of places online to look for peer-reviewed published HCI studies. Here are several good ones for usability of web forms: HCI Bibliography : Human-Computer Interaction Resources ACM Digital LibraryWebSM.org - Web Survey MethodologyA quick search resulted in these research studies measuring response rates of online forms. It seems like in addition to eye-tracking you can also use keystrokes to measure user behavior: Denscombe, Martyn. 2006. Web-Based Questionnaires and the Mode Effect. Soc. Sci. Comput. Rev. 24, 2 (May 2006), 246-254. DOI=10.1177/0894439305284522 Healey, B.: Drop Downs and Scrollmice: The Effect of Response Option Format and Input Mechanism Employed on Data Quality in Web Surveys. Social Science Computer Review 25(1), 111–128 (2007) Hogg, A., Masztal, J.J.: Drop-down, Radio Buttons, or Fill-in-the-blank? Effects of Attribute Rating Scale Type on Web Survey Responses. In: Proceedings ESOMAR 2001 (2001)Nikolaos Karousos, Christos Katsanos, Nikolaos Tselios, and Michalis Xenos. 2013. Effortless tool-based evaluation of web form filling tasks using keystroke level model and fitts law. In CHI '13 Extended Abstracts on Human Factors in Computing Systems (CHI EA '13). ACM, New York, NY, USA, 1851-1856. DOI=10.1145/2468356.2468688 Mirjam Seckler, Silvia Heinz, Javier A. Bargas-Avila, Klaus Opwis, and Alexandre N. Tuch. 2013. Empirical evaluation of 20 web form optimization guidelines. In CHI '13 Extended Abstracts on Human Factors in Computing Systems (CHI EA '13). ACM, New York, NY, USA, 1893-1898. DOI=10.1145/2468356.2468695 Vicente, P., & Reis, E. (2010). Using questionnaire design to fight nonresponse bias in web surveys. Social Science Computer Review, 28(2), 251-267.As for what the user actually does in regards to scan first or fill first, it depends on other factors beyond the design such as personal styles and cognitive styles. One approach to overcome the uncertainty of the answer to your question is by placing one question on a page at a time.

-

How can a job ask you to fill out forms but then tell you that you didn't get the job?

By managing your expectations; that is, by informing you that filling out the forms does not guarantee that you will be chosen for the job. Companies should further manage expectations by describing the actual selection process in more detail and including a time line for the final selection. Armed with this information you can decide whether you wish to spend the time required to fill out the forms.

Create this form in 5 minutes!

How to create an eSignature for the forms in

How to generate an electronic signature for your Forms In online

How to create an electronic signature for the Forms In in Chrome

How to create an eSignature for putting it on the Forms In in Gmail

How to create an eSignature for the Forms In right from your smart phone

How to generate an eSignature for the Forms In on iOS devices

How to make an eSignature for the Forms In on Android OS

People also ask

-

What are Indiana State Business Report Forms?

Indiana State Business Report Forms are essential documents that businesses in Indiana must file to maintain their legal status and comply with state regulations. These forms typically include information about the business's financial status, ownership, and operational changes. Completing these forms accurately is crucial for avoiding penalties and ensuring your business remains in good standing.

-

How can airSlate SignNow help with Indiana State Business Report Forms?

airSlate SignNow simplifies the process of completing and eSigning Indiana State Business Report Forms. With its user-friendly interface, you can easily fill out, sign, and send these forms digitally, reducing paperwork and streamlining your compliance process. This efficient solution ensures that you meet deadlines without the hassle of printing and mailing.

-

What is the cost of using airSlate SignNow for Indiana State Business Report Forms?

airSlate SignNow offers competitive pricing plans tailored to fit various business needs, making it a cost-effective solution for managing Indiana State Business Report Forms. The pricing depends on the features you choose, but you can expect transparent costs with no hidden fees. Sign up for a free trial to explore all the functionalities before committing.

-

Are there any specific features for managing Indiana State Business Report Forms with airSlate SignNow?

Yes, airSlate SignNow includes several features designed for managing Indiana State Business Report Forms efficiently. These features include customizable templates, automated reminders for submission deadlines, and secure cloud storage for easy access. Additionally, the platform supports real-time collaboration, allowing team members to work together seamlessly.

-

Can I integrate airSlate SignNow with other tools for Indiana State Business Report Forms?

Absolutely! airSlate SignNow offers integration capabilities with various business tools, enhancing your workflow for managing Indiana State Business Report Forms. You can connect it with popular applications like Google Drive, Dropbox, and CRM systems to streamline document management and ensure all your business operations are interconnected.

-

Is airSlate SignNow legally compliant for Indiana State Business Report Forms?

Yes, airSlate SignNow is legally compliant for eSigning Indiana State Business Report Forms. The platform adheres to the eSign Act and UETA, ensuring that your electronic signatures are valid and legally binding. This compliance provides peace of mind, knowing that your submitted forms will meet all legal requirements.

-

What are the benefits of using airSlate SignNow for Indiana State Business Report Forms?

Using airSlate SignNow for Indiana State Business Report Forms offers numerous benefits, including time savings, improved accuracy, and enhanced security. Digital signing eliminates the need for physical paperwork, reducing errors and delays in the filing process. Additionally, the platform provides secure storage, ensuring that your important documents are protected.

Get more for Indiana State Business Report Forms

Find out other Indiana State Business Report Forms

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online