Hedge Fund Alert Top 200 Form

What is the Hedge Fund Alert Top 200

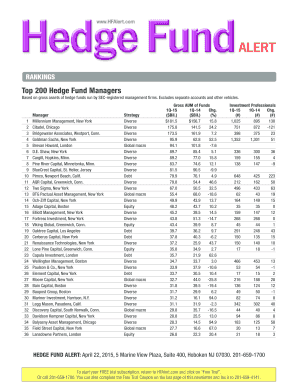

The Hedge Fund Alert Top 200 is a comprehensive list that ranks the largest hedge funds based on their assets under management (AUM). This list serves as a valuable resource for investors, financial analysts, and industry professionals who seek insights into the hedge fund landscape. By identifying the top 200 hedge funds, stakeholders can better understand market trends, investment strategies, and the overall performance of leading funds in the industry.

How to use the Hedge Fund Alert Top 200

Utilizing the Hedge Fund Alert Top 200 involves several steps that can enhance investment decision-making. First, review the rankings to identify funds that align with your investment goals. Next, examine the performance metrics and strategies of these funds to assess their suitability. Additionally, consider the fund managers' track records and their approach to risk management. This information can guide you in making informed investment choices and help you diversify your portfolio effectively.

Steps to complete the Hedge Fund Alert Top 200

Completing the Hedge Fund Alert Top 200 requires a systematic approach. Start by gathering relevant data on hedge funds, including their AUM, investment strategies, and historical performance. Next, categorize the funds based on specific criteria, such as asset class or geographical focus. Once the data is organized, analyze the results to identify trends and insights. Finally, compile the findings into a comprehensive report that highlights key takeaways and recommendations for potential investors.

Legal use of the Hedge Fund Alert Top 200

Understanding the legal implications of using the Hedge Fund Alert Top 200 is crucial for compliance and ethical considerations. The information within this list is typically considered public data; however, using it for investment decisions must adhere to relevant regulations. Ensure that any analysis or distribution of the list complies with the Securities and Exchange Commission (SEC) guidelines and other applicable laws. This diligence helps maintain transparency and integrity in the investment process.

Key elements of the Hedge Fund Alert Top 200

The Hedge Fund Alert Top 200 comprises several key elements that provide valuable insights into the hedge fund industry. These elements include the fund's name, ranking based on AUM, performance metrics, investment strategies, and management team details. Each component plays a vital role in assessing the fund's viability and potential for returns. By focusing on these key elements, investors can make more informed decisions regarding their investment strategies.

Examples of using the Hedge Fund Alert Top 200

Examples of utilizing the Hedge Fund Alert Top 200 can illustrate its practical applications. For instance, an investor may use the list to identify top-performing funds in a specific asset class, such as equities or fixed income. Another example could involve a financial advisor recommending funds from the list to clients based on their risk tolerance and investment objectives. These examples highlight how the Hedge Fund Alert Top 200 can serve as a strategic tool for various stakeholders in the financial industry.

Quick guide on how to complete hedge fund alert top 200

Effortlessly Handle Hedge Fund Alert Top 200 on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents quickly and efficiently. Manage Hedge Fund Alert Top 200 on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to Edit and Electronically Sign Hedge Fund Alert Top 200 with Ease

- Locate Hedge Fund Alert Top 200 and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to store your modifications.

- Choose your preferred method for sending your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Hedge Fund Alert Top 200 while ensuring exceptional communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hedge fund alert top 200

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a hedge fund alert and how does it work?

A hedge fund alert is a notification system that keeps you updated on important trends and changes in the hedge fund industry. With airSlate SignNow, users can easily receive these alerts to stay informed about market movements, ensuring they make timely decisions in their investments.

-

What features does airSlate SignNow offer for hedge fund alerts?

airSlate SignNow offers features such as real-time notifications, customizable alerts, and detailed analytics. These features allow users to track their investments closely and receive hedge fund alerts tailored to their specific interests and needs.

-

How much does airSlate SignNow cost for hedge fund alert users?

The pricing for using airSlate SignNow varies based on the plan selected. Users can choose from different tiers that best fit their needs for hedge fund alert services, making it a cost-effective solution for both individual and institutional investors.

-

Can I integrate airSlate SignNow with other tools for hedge fund alerts?

Yes, airSlate SignNow offers seamless integrations with various financial tools and platforms, enhancing its utility for hedge fund alerts. This integration capability allows users to streamline their workflows and make data-driven decisions quickly.

-

What benefits can I expect from using airSlate SignNow for hedge fund alerts?

Using airSlate SignNow for hedge fund alerts provides numerous benefits, including timely information, enhanced decision-making capabilities, and increased productivity. Users can react quickly to market changes, which is crucial for maximizing investment potential.

-

How reliable are the hedge fund alerts from airSlate SignNow?

The hedge fund alerts from airSlate SignNow are highly reliable, as they are based on real-time data and insights from reputable sources. Users can trust these alerts to inform their investment strategies and stay ahead of market fluctuations.

-

Is it easy to set up hedge fund alerts with airSlate SignNow?

Absolutely! Setting up hedge fund alerts with airSlate SignNow is very user-friendly. The intuitive interface allows users to customize their alert settings with ease, ensuring they receive only the information that matters to them.

Get more for Hedge Fund Alert Top 200

- Pomona valley hospital medical center professional legal form

- Medical record request form east alabama medical center

- 1 888 955 6000 form

- Annual review form non institutional programs

- Application for an affidavit of emissions extension form

- Form i 485 application to register permanent residence application to register permanent residence or adjust status

- Illinois new secretary of state promises to improve vehicle form

- Grand jury touches on issues with vehicle seizures form

Find out other Hedge Fund Alert Top 200

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile