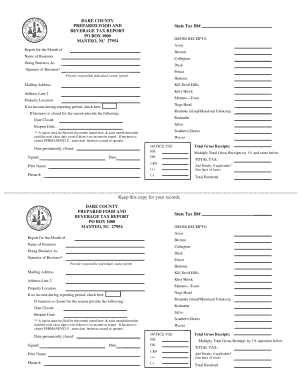

Dare County Prepared Food Tax Form

What is the Dare County Prepared Food Tax Form

The Dare County Prepared Food Tax Form is a document used by businesses in Dare County, North Carolina, to report and remit taxes collected on prepared food sales. This form ensures compliance with local tax regulations and helps maintain accurate records for both the business and the local government. It is essential for restaurants, caterers, and any food service providers who sell prepared food to understand their obligations regarding this tax.

How to use the Dare County Prepared Food Tax Form

Using the Dare County Prepared Food Tax Form involves several key steps. First, businesses must accurately calculate the total sales of prepared food during the reporting period. Next, they should complete the form by entering the necessary information, including sales figures and tax collected. After filling out the form, it must be submitted to the appropriate local tax authority, either electronically or via mail, depending on the specific submission guidelines provided by Dare County.

Steps to complete the Dare County Prepared Food Tax Form

To complete the Dare County Prepared Food Tax Form, follow these steps:

- Gather all sales records for prepared food during the reporting period.

- Calculate the total amount of prepared food sold.

- Determine the total tax collected based on the applicable tax rate.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for accuracy before submission.

- Submit the form either online or by mailing it to the designated tax office.

Legal use of the Dare County Prepared Food Tax Form

The legal use of the Dare County Prepared Food Tax Form is crucial for businesses to avoid penalties and ensure compliance with local tax laws. This form serves as an official record of tax obligations and must be filed within the specified deadlines. Failure to submit the form or inaccuracies in reporting can lead to fines or other legal repercussions. Understanding the legal framework surrounding this form helps businesses operate within the law.

Filing Deadlines / Important Dates

It is important for businesses to be aware of the filing deadlines for the Dare County Prepared Food Tax Form. Typically, forms are due on a quarterly basis, with specific dates set by the local tax authority. Missing these deadlines can result in penalties or interest charges on unpaid taxes. Keeping a calendar of important dates related to the form can help ensure timely compliance.

Form Submission Methods (Online / Mail / In-Person)

Businesses have several options for submitting the Dare County Prepared Food Tax Form. The form can be submitted online through the Dare County tax office website, which often provides a more efficient and faster processing method. Alternatively, businesses may choose to mail the completed form directly to the tax office or deliver it in person. Each method has its own advantages, and businesses should select the one that best fits their needs.

Quick guide on how to complete dare county prepared food tax form

Set Up Dare County Prepared Food Tax Form effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, edit, and eSign your documents quickly and without issues. Manage Dare County Prepared Food Tax Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Dare County Prepared Food Tax Form without hassle

- Locate Dare County Prepared Food Tax Form and then click Get Form to commence.

- Employ the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to store your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your requirements in document management within a few clicks from any device of your choice. Edit and eSign Dare County Prepared Food Tax Form while ensuring outstanding communication throughout every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dare county prepared food tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dare county prepared food tax form?

The dare county prepared food tax form is a document required by the local government that helps track prepared food sales in Dare County. This form ensures that businesses comply with local tax regulations. By using the airSlate SignNow platform, you can easily fill out and submit this form digitally.

-

How do I complete the dare county prepared food tax form using airSlate SignNow?

To complete the dare county prepared food tax form with airSlate SignNow, simply upload the document to our platform and fill in the required fields. You can also use our templates for a quicker process. Once completed, you can eSign and submit it right from the platform.

-

Is there a fee associated with filing the dare county prepared food tax form?

Filing the dare county prepared food tax form may have associated fees determined by local government regulations. However, utilizing airSlate SignNow to prepare and submit the form can save you time and potential errors, which ultimately reduces costs. It's advisable to check with your local tax authority for specific fees.

-

What features does airSlate SignNow offer for managing the dare county prepared food tax form?

AirSlate SignNow offers a range of features to streamline the management of the dare county prepared food tax form. You can digitally fill out, sign, and store the form within our secure platform. Additionally, our audit trails and document tracking features help ensure compliance throughout the filing process.

-

Can I integrate airSlate SignNow with other systems for handling the dare county prepared food tax form?

Yes, airSlate SignNow offers seamless integrations with various software applications, such as accounting and CRM systems. This means you can easily manage and automate your dare county prepared food tax form processes across different platforms. Check our integrations page for more details.

-

What benefits does eSigning the dare county prepared food tax form provide?

eSigning the dare county prepared food tax form through airSlate SignNow offers several benefits, including faster processing times and enhanced security. Digital signatures are legally binding and reduce the risk of lost paperwork. This modern approach ensures you stay compliant while saving time.

-

How can airSlate SignNow assist businesses in streamlining the dare county prepared food tax form submission?

AirSlate SignNow assists businesses by providing a user-friendly platform to create, manage, and submit the dare county prepared food tax form efficiently. With built-in templates and automated workflows, businesses can minimize errors and enhance productivity. This ensures timely submissions and compliance with local regulations.

Get more for Dare County Prepared Food Tax Form

Find out other Dare County Prepared Food Tax Form

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter