Form as 2915 1 a SALES and USE TAX MONTHLY RETURN Hacienda Pr

What is the Form AS 2915 1 A Sales and Use Tax Monthly Return?

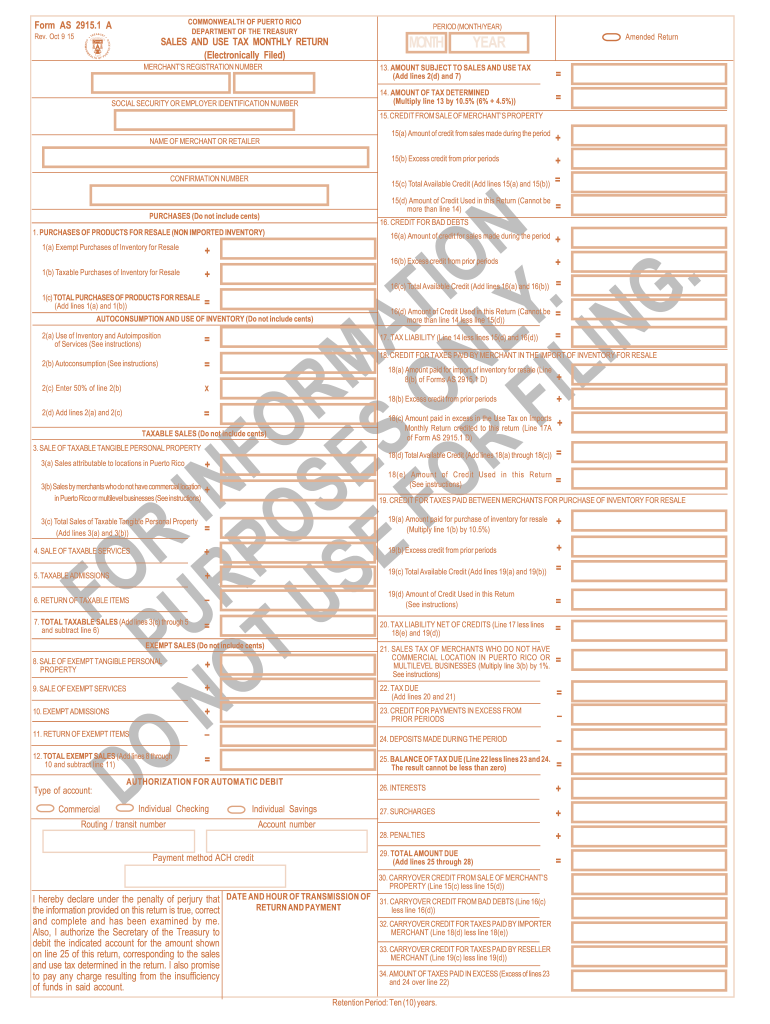

The Form AS 2915 1, also known as the Sales and Use Tax Monthly Return, is a crucial document used by businesses in Puerto Rico to report and pay sales and use taxes to the Hacienda. This form is essential for ensuring compliance with the local tax regulations and is typically required to be submitted on a monthly basis. It captures various details, including total sales, taxable sales, and the amount of tax owed. Understanding the purpose and requirements of this form is vital for any business operating in Puerto Rico.

Steps to Complete the Form AS 2915 1 A Sales and Use Tax Monthly Return

Completing the Form AS 2915 1 involves several key steps to ensure accuracy and compliance. First, gather all relevant sales data for the reporting period, including total sales and any exempt sales. Next, accurately calculate the total taxable sales and the corresponding tax owed based on the applicable rates. Fill out the form with these figures, ensuring that all sections are completed thoroughly. Finally, review the form for any errors before submitting it to the Hacienda, either electronically or via mail, depending on your preference.

How to Use the Form AS 2915 1 A Sales and Use Tax Monthly Return

The Form AS 2915 1 serves as a tool for businesses to report their sales and use tax obligations to the Hacienda. To use this form effectively, businesses should first familiarize themselves with the required information, including sales figures and tax rates. The form must be filled out accurately to reflect the business's sales activities for the month. Once completed, it can be submitted online or through traditional mail, ensuring that all deadlines are met to avoid penalties. Proper use of this form helps maintain compliance with tax laws in Puerto Rico.

Key Elements of the Form AS 2915 1 A Sales and Use Tax Monthly Return

The Form AS 2915 1 includes several key elements that are critical for accurate reporting. These elements encompass the business's identification information, such as the taxpayer's name and identification number, as well as detailed sections for reporting total sales, taxable sales, and the amount of sales tax collected. Additionally, the form may require information about any exemptions claimed during the reporting period. Understanding these elements is essential for ensuring that the form is filled out correctly and submitted on time.

Legal Use of the Form AS 2915 1 A Sales and Use Tax Monthly Return

The legal use of the Form AS 2915 1 is governed by the tax laws of Puerto Rico. This form must be submitted to the Hacienda to fulfill the legal obligation of reporting sales and use taxes. Failure to submit the form accurately and on time can result in penalties and interest charges. It is important for businesses to ensure that they follow all legal requirements associated with this form to avoid potential legal issues and maintain good standing with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Form AS 2915 1 are typically set on a monthly basis. Businesses must submit their returns by the end of the month following the reporting period. For example, the return for January must be filed by the end of February. It is crucial to keep track of these deadlines to avoid late fees and penalties. Additionally, businesses should be aware of any changes in deadlines that may occur due to holidays or other factors.

Quick guide on how to complete form as 29151 a sales and use tax monthly return hacienda pr

Effortlessly Prepare Form AS 2915 1 A SALES AND USE TAX MONTHLY RETURN Hacienda Pr on Any Device

Managing documents online has become increasingly popular among companies and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed forms, allowing you to access the appropriate template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Form AS 2915 1 A SALES AND USE TAX MONTHLY RETURN Hacienda Pr on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-related process today.

Effortless Modification and eSigning of Form AS 2915 1 A SALES AND USE TAX MONTHLY RETURN Hacienda Pr

- Obtain Form AS 2915 1 A SALES AND USE TAX MONTHLY RETURN Hacienda Pr and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device. Modify and eSign Form AS 2915 1 A SALES AND USE TAX MONTHLY RETURN Hacienda Pr and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Do I need a tax lawyer if I received a CP2000 letter for my state tax return, and will I need to fill out a 1040X for my federal as I used TaxAct during 2015?

Whether you need a tax attorney or not depends on the content of the CP2000 letter. Most of the time, the reason for the letter is for failure to report an income form on your return (W-2, 1099, etc.) or something similar, usually not something severe enough to pay an attorney. If you filed the return yourself online, you may want to contact a CPA firm or other tax prep firm that has Enrolled Agents (EAs) who are qualified and certified to practice and represent clients before the IRS in the event the letter ends up being severe enough that you’ll be audited by the IRS. However, most tax professionals in these types of firms will have seen these types of letters before, will be able to understand them and know what you need to do to respond. Depending on the company, they may or may not charge you for this advice, so I would call ahead to be sure.Generally, with a CP2000 letter the IRS generally does not want you to file a 1040X form to amend your return for that year.Here’s a link to help you with understanding the letter you received:Understanding Your CP2000 Notice

-

A man buys a condo and rents it out for 1 year, then he lives in it with his girlfriend for the next year as his primary residence. He sells after 2 years of ownership, 1 of which is deemed "non-qualifying use". Assuming a $200K profit on sale, how would any tax exclusion be calculated?

It depends. The simple answer is none, the IRS has 2 tests to qualify for the exclusion: the ownership test - you must own the home for 2 years; and the use test - you must live in the home as your primary residence for 2 years (not 3 as Mark stated).However, there are some exceptions that allow for a reduced exemption. The acceptable reasons for exceptions include a change in place of employment, health issues, and unforseen circumstances.See the following IRS publications for details: Publication 523 (2013), Selling Your Home

-

How does US immigration know when you overstay your visit in the US? I just left the US on a visit, and I was not stamped out as it used to be in other countries. Not even a form filled. Does the UK not stamp you out too?

You now see an extension of a principle tenet of US law applied to immigration: You are presumed innocent until proven guilty. In this case, the US assumes you will leave when your visa expires. Unless you are picked up for some other reason (like breaking the law somewhere) and found to be overstaying your visa, the US assumes you are honest. Most times, you will get away with it unless you cause trouble somewhere. Merely overstaying your visa is not something so serious that anyone will track you down to confirm that you have left.This sort of thing applies to ALL law enforcement in the USA. Robbers and thieves get away with their crime about 90% of the time. But such people tend to keep doing bad things and eventually get caught and convicted. 10% conviction rate is enough to deter most such crimes. People break the law by all the time by speeding, and might only be caught once every few years. The conviction rate is probably a fraction of a percent. At the other end of the spectrum, more serious crimes are pursued more rigorously.. we don’t want murderers running loose.

-

How could I be able to view a copy of my USPS change of address form? It’s been months since I filled it out, and I forgot whether I checked the box on the form as a “temporary” or “permanent” move. Silly question, but I honestly forgot.

To inquire about your change of address, contact a post office. You will not be able to view a copy of the form you filled out, but the information is entered into a database. They can tell you if it is temporary or permanent.

Create this form in 5 minutes!

How to create an eSignature for the form as 29151 a sales and use tax monthly return hacienda pr

How to generate an electronic signature for your Form As 29151 A Sales And Use Tax Monthly Return Hacienda Pr in the online mode

How to make an electronic signature for the Form As 29151 A Sales And Use Tax Monthly Return Hacienda Pr in Chrome

How to generate an electronic signature for signing the Form As 29151 A Sales And Use Tax Monthly Return Hacienda Pr in Gmail

How to create an eSignature for the Form As 29151 A Sales And Use Tax Monthly Return Hacienda Pr right from your smartphone

How to make an eSignature for the Form As 29151 A Sales And Use Tax Monthly Return Hacienda Pr on iOS

How to generate an eSignature for the Form As 29151 A Sales And Use Tax Monthly Return Hacienda Pr on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to wwwhaciendagob pr com?

airSlate SignNow is an innovative platform that empowers businesses to send and eSign documents efficiently. By using wwwhaciendagob pr com, you gain access to a cost-effective solution designed for seamless document management and electronic signatures.

-

What features does airSlate SignNow offer for wwwhaciendagob pr com users?

For users accessed via wwwhaciendagob pr com, airSlate SignNow provides features such as document templates, team collaboration tools, and automated workflows. These features are tailored to enhance productivity and simplify the eSigning experience.

-

What are the pricing options for airSlate SignNow through wwwhaciendagob pr com?

airSlate SignNow offers various pricing plans suitable for businesses of all sizes. Visiting wwwhaciendagob pr com allows you to explore flexible subscription options that align with your budget and needs.

-

How can airSlate SignNow improve business productivity via wwwhaciendagob pr com?

By leveraging airSlate SignNow through wwwhaciendagob pr com, businesses can signNowly streamline document workflows. This leads to faster turnaround times and reduces administrative overhead, allowing teams to focus on core activities.

-

Is airSlate SignNow secure for eSignature transactions via wwwhaciendagob pr com?

Yes, airSlate SignNow prioritizes security for all eSignature transactions initiated from wwwhaciendagob pr com. The platform complies with industry standards, ensuring that your documents and signatures are protected against unauthorized access.

-

What integrations are available with airSlate SignNow and wwwhaciendagob pr com?

airSlate SignNow offers seamless integrations with various third-party applications, enhancing its functionality. By using wwwhaciendagob pr com, you can easily connect with tools like Google Drive, Salesforce, and more to optimize your document management.

-

Can I customize the airSlate SignNow templates on wwwhaciendagob pr com?

Absolutely! Users accessing airSlate SignNow through wwwhaciendagob pr com can fully customize document templates. This feature allows businesses to maintain brand consistency and meet specific client or compliance requirements.

Get more for Form AS 2915 1 A SALES AND USE TAX MONTHLY RETURN Hacienda Pr

- Loan service request emirates nbd form

- Isr buds sheet form

- Rtrockets form

- Medco change of ownership form

- Bishop mclaughlin catholic high school application form

- Permit application acknowledgement southwest ranches florida southwestranches form

- Special event permit application city of pensacola form

- Mis 5185 on off campus school activity form

Find out other Form AS 2915 1 A SALES AND USE TAX MONTHLY RETURN Hacienda Pr

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online