Uniform Sales & Use Tax Resale Certificate Multijurisdiction Form 2020-2026

What is the Uniform Sales & Use Tax Resale Certificate Multijurisdiction Form

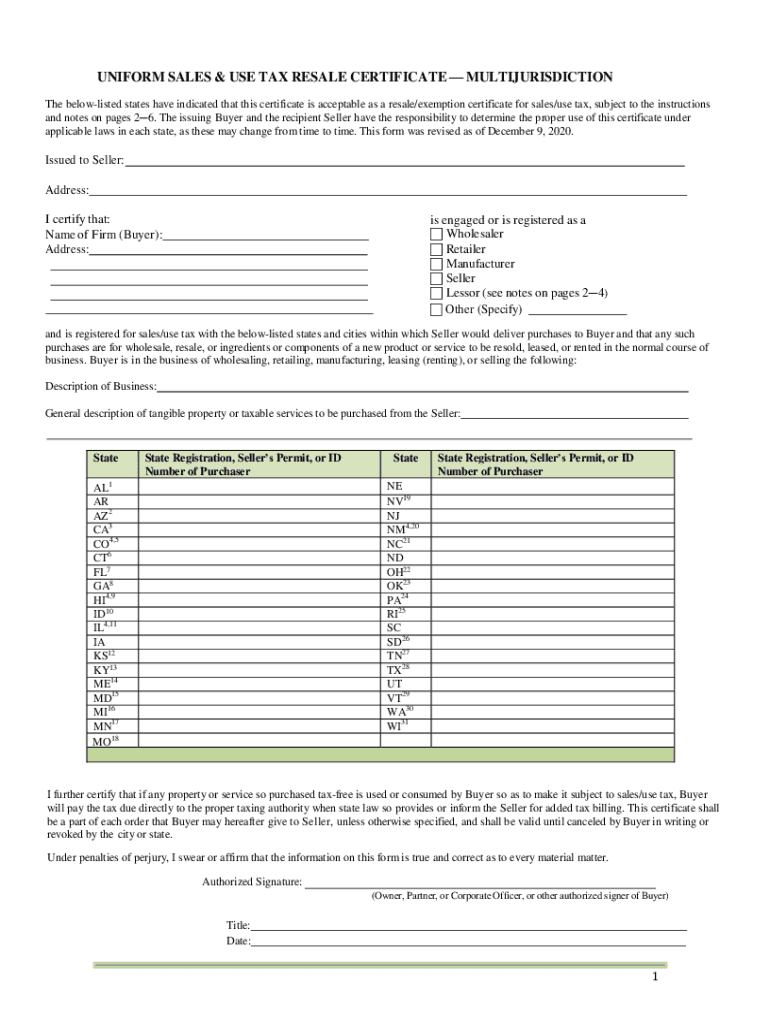

The Uniform Sales & Use Tax Resale Certificate Multijurisdiction Form is a standardized document used across multiple states in the United States. It allows businesses to purchase goods without paying sales tax, provided the items are intended for resale. This form simplifies the process of tax exemption for retailers, enabling them to streamline their purchasing procedures while complying with state tax regulations. By utilizing this form, businesses can ensure they are following the necessary legal guidelines for tax exemption, which can vary from state to state.

Steps to Complete the Uniform Sales & Use Tax Resale Certificate Multijurisdiction Form

Completing the Uniform Sales & Use Tax Resale Certificate Multijurisdiction Form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the seller's and buyer's details, such as names, addresses, and tax identification numbers. Next, indicate the type of property being purchased for resale. It is essential to provide accurate descriptions to avoid potential issues with tax authorities. After filling out the form, both parties should sign and date it to validate the transaction. Finally, retain a copy for your records and provide the original to the seller to facilitate tax-exempt purchases.

Legal Use of the Uniform Sales & Use Tax Resale Certificate Multijurisdiction Form

The legal use of the Uniform Sales & Use Tax Resale Certificate Multijurisdiction Form hinges on compliance with state laws and regulations. Businesses must ensure that the form is completed accurately and used solely for purchasing items intended for resale. Misuse of the form, such as using it for personal purchases, can lead to penalties and legal repercussions. Each state has its own guidelines regarding the use of resale certificates, so it is crucial to consult state-specific regulations to ensure adherence to legal requirements.

Eligibility Criteria for the Uniform Sales & Use Tax Resale Certificate Multijurisdiction Form

To be eligible to use the Uniform Sales & Use Tax Resale Certificate Multijurisdiction Form, a business must be registered and possess a valid sales tax permit in the state where it operates. This certification verifies that the business is authorized to collect sales tax and engage in sales transactions. Additionally, the items purchased using this form must be intended for resale in the regular course of business. Individuals or businesses that do not meet these criteria should not use the resale certificate, as it could result in tax liabilities and penalties.

State-Specific Rules for the Uniform Sales & Use Tax Resale Certificate Multijurisdiction Form

Each state has its own rules and regulations regarding the use of the Uniform Sales & Use Tax Resale Certificate Multijurisdiction Form. While the form is designed to be uniform, businesses must be aware of specific state requirements that may apply. For instance, some states may require additional documentation or have particular guidelines on how the form should be filled out. It is essential for businesses to familiarize themselves with their state's regulations to ensure compliance and avoid potential issues with tax authorities.

Examples of Using the Uniform Sales & Use Tax Resale Certificate Multijurisdiction Form

Examples of using the Uniform Sales & Use Tax Resale Certificate Multijurisdiction Form include a retailer purchasing inventory from a wholesaler or a contractor acquiring materials for a project intended for resale. In these scenarios, the buyer presents the completed resale certificate to the seller, allowing them to purchase goods without incurring sales tax. This practice not only facilitates smoother transactions but also helps businesses manage their cash flow effectively by reducing upfront costs associated with sales tax payments.

Quick guide on how to complete uniform sales amp use tax resale certificate multijurisdiction form

Finish Uniform Sales & Use Tax Resale Certificate Multijurisdiction Form effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed paperwork, as you can easily locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents quickly and without holdups. Manage Uniform Sales & Use Tax Resale Certificate Multijurisdiction Form on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to edit and electronically sign Uniform Sales & Use Tax Resale Certificate Multijurisdiction Form without any hassle

- Find Uniform Sales & Use Tax Resale Certificate Multijurisdiction Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to finalize your changes.

- Choose how you wish to send your form—via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and electronically sign Uniform Sales & Use Tax Resale Certificate Multijurisdiction Form and guarantee outstanding communication at every stage of your form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct uniform sales amp use tax resale certificate multijurisdiction form

Create this form in 5 minutes!

How to create an eSignature for the uniform sales amp use tax resale certificate multijurisdiction form

The best way to create an e-signature for your PDF document online

The best way to create an e-signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to make an e-signature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The way to make an e-signature for a PDF file on Android OS

People also ask

-

What is a multistate tax commission exemption certificate?

A multistate tax commission exemption certificate is a document that allows businesses to exempt certain purchases from sales tax across multiple states. This certificate simplifies tax compliance for companies that operate in multiple jurisdictions, ensuring they adhere to varying state tax laws without incurring additional costs.

-

How can airSlate SignNow help with multistate tax commission exemption certificates?

airSlate SignNow provides a streamlined solution for managing multistate tax commission exemption certificates by allowing businesses to easily create, send, and eSign these documents. Our platform ensures secure and efficient handling of tax-related paperwork, reducing the time spent on tax compliance.

-

Is there a cost associated with using airSlate SignNow for managing exemption certificates?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Our plans are cost-effective and flexible, allowing you to manage multistate tax commission exemption certificates and other eSigning requirements without breaking your budget.

-

What features does airSlate SignNow offer for handling multistate tax commission exemption certificates?

airSlate SignNow includes features like customizable templates, document tracking, and automated workflows, making it easier to create and manage multistate tax commission exemption certificates. These tools help enhance productivity and ensure that important documents are processed promptly.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax management software. By using our platform to handle multistate tax commission exemption certificates, you can synchronize your documents with existing systems, improving your overall workflow.

-

What are the benefits of using airSlate SignNow for tax exemption documentation?

Using airSlate SignNow for managing multistate tax commission exemption certificates offers numerous benefits, including enhanced efficiency, reduced paperwork, and simplified compliance. Our eSigning solution ensures that your documents are securely signed and stored, allowing for easy retrieval when needed.

-

How secure is the information shared in multistate tax commission exemption certificates with airSlate SignNow?

Security is a top priority at airSlate SignNow. We employ advanced encryption technology to protect the information shared within multistate tax commission exemption certificates, ensuring that sensitive data remains confidential and secure throughout the signing process.

Get more for Uniform Sales & Use Tax Resale Certificate Multijurisdiction Form

- In the superior court of the state of washington in and form

- Texas legal form titles legal documentsus legal forms

- Texas deed forms general warranty quit claim ampamp special

- Request for civil no contact order polk county iowa form

- Justia affidavit motion and order for court forms

- 85 7 433 forms interim waiver and release justia law

- Form 207 limited partnership texas secretary of state

- Certified mail return receipt requested epa form

Find out other Uniform Sales & Use Tax Resale Certificate Multijurisdiction Form

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter