Cb10 Form 2013-2026

What is the Cb10 Form

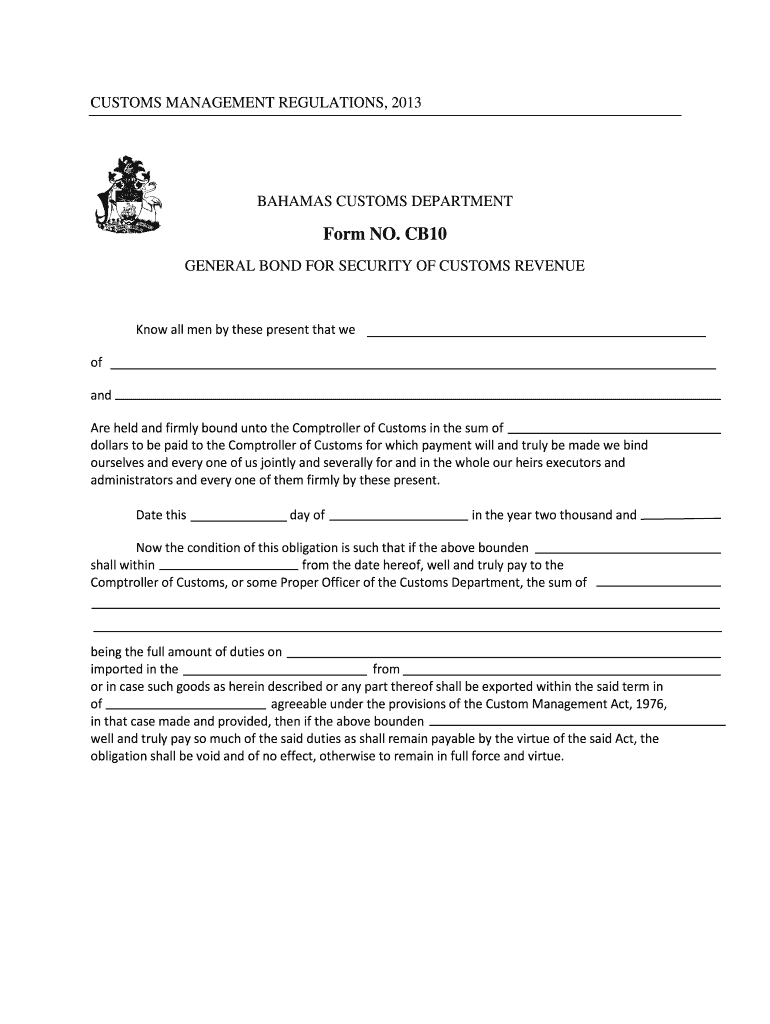

The Cb10 form, commonly referred to as the Bahamas customs Cb10 form, is a crucial document used for customs declarations in the Bahamas. It is primarily utilized by individuals and businesses to report goods being imported into the country. This form ensures that all necessary customs duties and taxes are accurately assessed and paid. Understanding the purpose and requirements of the Cb10 form is essential for compliance with Bahamian customs regulations.

Steps to Complete the Cb10 Form

Completing the Cb10 form involves several key steps:

- Gather all necessary information regarding the goods being imported, including descriptions, quantities, and values.

- Obtain the Cb10 form from the appropriate customs authority or download it from a reliable source.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the customs office along with any required documentation and payment for duties.

Legal Use of the Cb10 Form

The Cb10 form holds legal significance as it serves as an official declaration to customs authorities. Properly completing and submitting this form is essential for ensuring compliance with Bahamian customs laws. Failure to adhere to the requirements can result in penalties or delays in the clearance of goods. It is important to understand the legal implications associated with inaccuracies or omissions on the Cb10 form.

Required Documents

When submitting the Cb10 form, several supporting documents may be required to facilitate the customs process. These documents typically include:

- Invoices detailing the goods being imported.

- Shipping documents, such as bills of lading.

- Proof of payment for any applicable duties or taxes.

- Any additional permits or licenses required for specific goods.

Form Submission Methods

The Cb10 form can be submitted through various methods, depending on the customs authority's regulations. Common submission methods include:

- Online submission through the customs authority's official portal.

- Mailing the completed form to the designated customs office.

- In-person submission at the customs office during business hours.

Who Issues the Form

The Cb10 form is issued by the Bahamas Customs Department, which is responsible for regulating and facilitating the importation of goods into the country. This department provides the necessary guidelines and resources for individuals and businesses to ensure compliance with customs regulations.

Penalties for Non-Compliance

Non-compliance with the requirements associated with the Cb10 form can lead to significant penalties. These may include:

- Fines for late submission or inaccuracies in the declaration.

- Delays in the clearance of goods, resulting in additional storage fees.

- Potential legal action for repeated violations or fraudulent declarations.

Quick guide on how to complete vat form no cb10 general bond for security revenue cb 10 form inlandrevenue finance gov

Discover how to effortlessly navigate the Cb10 Form completion with this simple manual

Online filing and form completion are becoming increasingly favored and the primary choice for many users. It offers numerous advantages over outdated printed documents, such as convenience, time savings, enhanced precision, and security.

With tools like airSlate SignNow, you can find, modify, sign, and improve and dispatch your Cb10 Form without getting bogged down in endless printing and scanning. Adhere to this brief manual to begin and complete your form.

Follow these steps to obtain and complete Cb10 Form

- Begin by clicking the Get Form button to access your document in our editor.

- Observe the green label on the left indicating required fields so you don’t overlook them.

- Utilize our advanced features to comment, modify, sign, secure, and enhance your document.

- Safeguard your file or convert it into a fillable form using the tools on the right panel.

- Review the document and verify it for errors or inconsistencies.

- Select DONE to complete the editing process.

- Rename your form or leave it as is.

- Choose the storage solution where you wish to keep your document, send it via USPS, or click the Download Now button to save your file.

If Cb10 Form isn’t what you were seeking, you can explore our vast collection of pre-loaded templates that you can complete with minimal effort. Check out our platform today!

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat form no cb10 general bond for security revenue cb 10 form inlandrevenue finance gov

How to make an electronic signature for the Vat Form No Cb10 General Bond For Security Revenue Cb 10 Form Inlandrevenue Finance Gov online

How to make an electronic signature for your Vat Form No Cb10 General Bond For Security Revenue Cb 10 Form Inlandrevenue Finance Gov in Chrome

How to generate an eSignature for signing the Vat Form No Cb10 General Bond For Security Revenue Cb 10 Form Inlandrevenue Finance Gov in Gmail

How to create an electronic signature for the Vat Form No Cb10 General Bond For Security Revenue Cb 10 Form Inlandrevenue Finance Gov straight from your smartphone

How to create an eSignature for the Vat Form No Cb10 General Bond For Security Revenue Cb 10 Form Inlandrevenue Finance Gov on iOS devices

How to make an eSignature for the Vat Form No Cb10 General Bond For Security Revenue Cb 10 Form Inlandrevenue Finance Gov on Android

People also ask

-

What is the c44 form Bahamas?

The c44 form Bahamas is an essential document for businesses operating in the Bahamas, often required for various legal and financial transactions. airSlate SignNow simplifies the process of filling out and signing this form, ensuring compliance with local regulations while saving time.

-

How does airSlate SignNow help with the c44 form Bahamas?

airSlate SignNow provides a user-friendly platform that allows you to easily fill out, sign, and manage the c44 form Bahamas online. Our solution streamlines the document workflow, making it easier for businesses to handle important paperwork efficiently.

-

Is there a cost to use airSlate SignNow for the c44 form Bahamas?

Yes, airSlate SignNow offers affordable pricing plans tailored to meet the needs of businesses featuring the c44 form Bahamas. Our pricing is competitive and provides great value, especially considering the convenience and security of our eSigning solutions.

-

What features does airSlate SignNow offer for the c44 form Bahamas?

With airSlate SignNow, you can enjoy features such as customizable templates for the c44 form Bahamas, multi-party signing, and secure cloud storage. Additionally, you can track the status of your documents and get notifications for completed actions.

-

Can I integrate airSlate SignNow with other software for handling the c44 form Bahamas?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications, enhancing your ability to manage documents like the c44 form Bahamas. This allows for a smoother workflow and better data management within your existing systems.

-

What are the benefits of using airSlate SignNow for the c44 form Bahamas?

Using airSlate SignNow for the c44 form Bahamas enhances efficiency, reduces paper usage, and ensures secure transactions. Our platform also provides a digital trail of your documents, making it easier to stay organized and compliant with legal requirements.

-

Is airSlate SignNow secure for handling the c44 form Bahamas?

Yes, security is a top priority at airSlate SignNow. Our platform uses advanced encryption and strict compliance measures to ensure that your information related to the c44 form Bahamas remains protected throughout the signing process.

Get more for Cb10 Form

Find out other Cb10 Form

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself