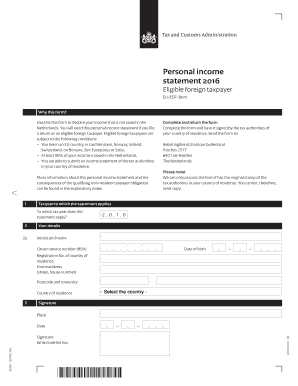

Personal Income Statement Eligible Foreign Taxpayer Eu Eer Form

What is the Personal Income Statement Eligible Foreign Taxpayer Eu Eer Form

The Personal Income Statement Eligible Foreign Taxpayer EU EER Form is a crucial document for individuals who need to report their income for tax purposes while residing outside the United States. This form is specifically designed for foreign taxpayers who meet certain eligibility criteria, allowing them to declare their income accurately. It serves as a means for the IRS to assess the tax obligations of these individuals, ensuring compliance with U.S. tax laws.

How to use the Personal Income Statement Eligible Foreign Taxpayer Eu Eer Form

Using the Personal Income Statement Eligible Foreign Taxpayer EU EER Form involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including income statements and any relevant tax documents. Next, fill out the form with precise information regarding your income sources, deductions, and any applicable credits. Ensure that all entries are clear and legible, as inaccuracies can lead to processing delays or penalties. Finally, review the completed form for errors before submission.

Steps to complete the Personal Income Statement Eligible Foreign Taxpayer Eu Eer Form

Completing the Personal Income Statement Eligible Foreign Taxpayer EU EER Form requires careful attention to detail. Follow these steps:

- Begin by entering your personal information, including your name, address, and taxpayer identification number.

- Report your income from various sources, such as wages, dividends, and interest.

- Include any deductions you are eligible for, which may reduce your taxable income.

- Double-check all figures for accuracy and ensure that you have included all necessary attachments.

- Sign and date the form to validate your submission.

Legal use of the Personal Income Statement Eligible Foreign Taxpayer Eu Eer Form

The legal use of the Personal Income Statement Eligible Foreign Taxpayer EU EER Form is governed by U.S. tax laws. It must be completed and submitted in accordance with IRS regulations to ensure that it is recognized as a valid document. This includes adhering to deadlines and ensuring that all information provided is truthful and complete. Failure to comply with these legal requirements can result in penalties or legal action.

Key elements of the Personal Income Statement Eligible Foreign Taxpayer Eu Eer Form

Several key elements are essential for the completion of the Personal Income Statement Eligible Foreign Taxpayer EU EER Form. These include:

- Personal Information: Accurate identification details of the taxpayer.

- Income Reporting: Comprehensive disclosure of all income sources.

- Deductions and Credits: Identification of eligible deductions that can lower taxable income.

- Signature: Required to validate the authenticity of the form.

Filing Deadlines / Important Dates

It is vital to be aware of the filing deadlines associated with the Personal Income Statement Eligible Foreign Taxpayer EU EER Form. Typically, the form must be submitted by the tax deadline, which is usually April 15 for most taxpayers. However, foreign taxpayers may qualify for extensions, so it is important to check the IRS guidelines for specific dates relevant to your situation. Missing these deadlines can lead to penalties and interest on unpaid taxes.

Quick guide on how to complete personal income statement eligible foreign taxpayer eu eer form

Complete Personal Income Statement Eligible Foreign Taxpayer Eu Eer Form seamlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the utilities required to create, modify, and eSign your documents quickly and efficiently. Manage Personal Income Statement Eligible Foreign Taxpayer Eu Eer Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest way to modify and eSign Personal Income Statement Eligible Foreign Taxpayer Eu Eer Form effortlessly

- Obtain Personal Income Statement Eligible Foreign Taxpayer Eu Eer Form and click on Get Form to begin.

- Utilize the features we offer to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your preference. Modify and eSign Personal Income Statement Eligible Foreign Taxpayer Eu Eer Form to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the personal income statement eligible foreign taxpayer eu eer form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an EER format PDF and how is it used?

An EER format PDF is a document that encapsulates electronic business processes, ensuring information is securely exchanged. It is commonly used for regulatory compliance and documentation in various industries. Utilizing an EER format PDF can streamline your operations and enhance data accuracy.

-

How does airSlate SignNow support EER format PDFs?

airSlate SignNow seamlessly integrates with EER format PDFs, enabling users to eSign and manage these documents effortlessly. Our platform ensures that EER format PDFs retain their integrity during the signing process. This feature is crucial for businesses that rely on maintaining compliance and professional standards.

-

Can I convert my documents into EER format PDF using airSlate SignNow?

Yes, airSlate SignNow allows you to convert your documents into EER format PDF easily. The intuitive interface makes this process straightforward, enabling businesses to create the necessary documents quickly. This capability is beneficial for organizations looking to comply with industry standards while saving time.

-

What are the benefits of using airSlate SignNow for EER format PDFs?

Using airSlate SignNow for EER format PDFs offers numerous benefits, including enhanced security, compliance, and ease of use. The platform is designed to simplify document management, making it easier for businesses to handle complex signing processes. Additionally, it helps reduce errors and ensures a smooth workflow.

-

Is airSlate SignNow cost-effective for handling EER format PDFs?

Absolutely! airSlate SignNow provides a cost-effective solution for handling EER format PDFs, making it accessible for businesses of all sizes. With competitive pricing plans and no hidden fees, organizations can manage their documents economically while benefiting from top-notch features. This allows companies to efficiently allocate resources and reduce overhead costs.

-

What features does airSlate SignNow offer for EER format PDF management?

airSlate SignNow includes features such as customizable templates, bulk sending, and real-time tracking specifically for EER format PDFs. These functionalities enhance document management efficiency and oversight. Furthermore, users can easily manage and secure their EER format PDFs from a single platform.

-

Does airSlate SignNow integrate with other applications for EER format PDFs?

Yes, airSlate SignNow offers multiple integrations with popular business applications, making it easy to manage EER format PDFs alongside your existing workflows. These integrations facilitate seamless data transfer and enhance overall productivity. This interconnectedness is essential for maintaining efficiency in document management.

Get more for Personal Income Statement Eligible Foreign Taxpayer Eu Eer Form

Find out other Personal Income Statement Eligible Foreign Taxpayer Eu Eer Form

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy