Cobb County Property Records Form

Understanding Cobb County Property Records

Cobb County property records are official documents that provide detailed information about properties located within the county. These records include data on property ownership, assessed values, property descriptions, and tax information. They serve as essential resources for various stakeholders, including property owners, potential buyers, and real estate professionals. Accessing these records can help individuals make informed decisions regarding property transactions and tax obligations.

How to Access Cobb County Property Records

To obtain Cobb County property records, individuals can visit the Cobb County Tax Assessor's office or access the records online through the county's official website. The online portal allows users to search for properties using various criteria such as owner name, address, or parcel number. This digital access simplifies the process, enabling users to retrieve the necessary information efficiently without the need for in-person visits.

Steps to Complete the Cobb County Business Personal Property Tax Return Form

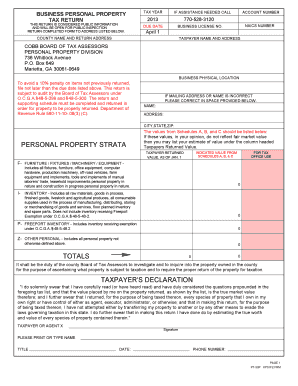

Filling out the Cobb County business personal property tax return form involves several key steps:

- Gather necessary documentation, including previous tax returns and inventory lists.

- Complete the form, ensuring all sections are filled out accurately, including business details and property descriptions.

- Review the completed form for any errors or omissions.

- Submit the form by the specified deadline, either online or via mail, to the Cobb County Tax Assessor's office.

Legal Use of Cobb County Property Records

Cobb County property records are legally recognized documents that can be used in various legal contexts. They can serve as evidence in property disputes, tax assessments, and real estate transactions. Understanding the legal implications of these records is crucial for property owners and potential buyers, as inaccuracies or disputes can lead to significant financial consequences.

Required Documents for Filing

When filing the Cobb County business personal property tax return form, specific documents are required to support the information provided. These may include:

- Previous year's tax return.

- Inventory lists detailing business personal property.

- Proof of business ownership, such as articles of incorporation or partnership agreements.

Penalties for Non-Compliance

Failure to file the Cobb County business personal property tax return form by the deadline can result in penalties. These penalties may include fines or increased tax assessments. It is essential for business owners to be aware of these consequences and ensure timely submission to avoid unnecessary costs.

Quick guide on how to complete cobb county property records

Effortlessly Prepare Cobb County Property Records on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly and without interruptions. Manage Cobb County Property Records on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

Efficiently Modify and Electronically Sign Cobb County Property Records with Ease

- Locate Cobb County Property Records and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature with the Sign tool, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any chosen device. Edit and eSign Cobb County Property Records and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cobb county property records

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the cobb county business personal property tax return form?

The Cobb County business personal property tax return form is a document that businesses must complete to declare their personal property for tax purposes. This form helps ensure compliance with local tax regulations and accurately reflects the value of the business's assets for tax assessments.

-

How do I fill out the cobb county business personal property tax return form?

To fill out the Cobb County business personal property tax return form, you will need to gather details about your business assets, including equipment, furniture, and other personal property. Accurate valuation and thorough completion of all sections are crucial for proper submission.

-

Where can I download the cobb county business personal property tax return form?

The Cobb County business personal property tax return form can typically be downloaded from the official Cobb County tax assessor's website. Ensure you have the most current version of the form to avoid any compliance issues.

-

What are the consequences of not filing the cobb county business personal property tax return form?

Failing to file the Cobb County business personal property tax return form can lead to penalties, interest on unpaid taxes, and potential legal issues. It is crucial for businesses to fulfill this requirement to maintain compliance with local laws.

-

What features does airSlate SignNow offer for completing the cobb county business personal property tax return form?

airSlate SignNow provides an intuitive platform for digitally signing and sending documents, including the Cobb County business personal property tax return form. Its features promote ease of use, compliance, and streamlined document management for businesses of all sizes.

-

Is there a cost associated with using airSlate SignNow for the cobb county business personal property tax return form?

airSlate SignNow offers a variety of pricing plans designed to accommodate different needs, making it a cost-effective solution for businesses. Check the pricing page for details on the specific features available with each plan, especially for managing tax documents like the Cobb County business personal property tax return form.

-

Can airSlate SignNow integrate with other software for managing the cobb county business personal property tax return form?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow when managing documents such as the Cobb County business personal property tax return form. This interoperability ensures that businesses can efficiently handle their documentation and tax filings.

Get more for Cobb County Property Records

- Limited power of attorney tennessee form

- Nd bill of sale form

- Fulling out quit claim new mexico form

- West virginia fiduciary deed for use by executors trustees trustors administrators and other fiduciaries form

- Hawaii quitclaim deed from individual to husband and wife form

- Ar 05a 09 form

- Michigan articles of incorporation for domestic nonprofit corporation form

- Oregon heirship form

Find out other Cobb County Property Records

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile