Tsp 65 Form

What is the TSP 65 Form

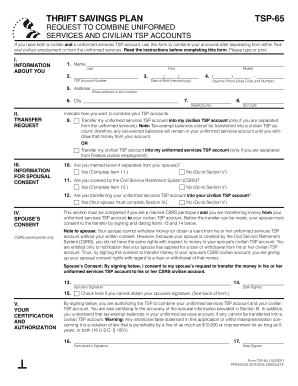

The TSP 65 form, also known as the "Request to Withdraw from the Thrift Savings Plan," is a crucial document for federal employees and members of the uniformed services who wish to withdraw funds from their Thrift Savings Plan account. This form enables participants to request a distribution of their retirement savings, which can be essential for financial planning during retirement or other life events. Understanding the purpose and implications of the TSP 65 form is vital for making informed decisions about retirement savings.

How to Use the TSP 65 Form

Using the TSP 65 form involves several steps to ensure proper completion and submission. First, participants must gather necessary information, such as their TSP account number and personal identification details. The form requires specific choices regarding the type of withdrawal, whether a partial or full withdrawal, and the method of payment. After filling out the form accurately, participants must submit it according to the provided instructions, ensuring they comply with any deadlines or requirements set by the TSP. Proper use of the TSP 65 form can facilitate a smooth withdrawal process.

Steps to Complete the TSP 65 Form

Completing the TSP 65 form involves a systematic approach to ensure accuracy and compliance. Here are the essential steps:

- Gather personal information, including your TSP account number and Social Security number.

- Choose the type of withdrawal you wish to make, such as a full or partial withdrawal.

- Provide details on how you would like to receive your funds, whether through a check or direct deposit.

- Review the form for any errors or omissions before signing.

- Submit the completed form via the specified method, ensuring it reaches the TSP office on time.

Legal Use of the TSP 65 Form

The TSP 65 form holds legal significance as it serves as an official request for withdrawal from a retirement account. To be legally binding, the form must be completed accurately and submitted in accordance with TSP regulations. Compliance with federal laws governing retirement savings is essential to avoid potential penalties or delays in processing the withdrawal. Understanding the legal implications of the TSP 65 form can help participants navigate their retirement options effectively.

Key Elements of the TSP 65 Form

Several key elements are essential when completing the TSP 65 form. These include:

- Personal Information: Accurate identification details, including name, address, and TSP account number.

- Withdrawal Type: Selection between full or partial withdrawal.

- Payment Method: Indication of how the funds should be distributed.

- Signature: A signature is required to validate the request and confirm the participant's intent.

Form Submission Methods

Participants can submit the TSP 65 form through various methods, ensuring flexibility and convenience. The available submission methods typically include:

- Online Submission: Using the TSP website to submit the form electronically.

- Mail: Sending the completed form via postal service to the designated TSP address.

- In-Person: Delivering the form directly to a TSP office, if available.

Quick guide on how to complete tsp 65 form

Complete Tsp 65 Form effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly without any delays. Handle Tsp 65 Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Tsp 65 Form effortlessly

- Obtain Tsp 65 Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to preserve your changes.

- Select how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid files, tiresome form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Tsp 65 Form and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tsp 65 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form tsp 65 and how can it be used with airSlate SignNow?

The form tsp 65 is a critical document required for TSP (Thrift Savings Plan) participants when making specific transactions. With airSlate SignNow, users can easily fill out, sign, and send the form tsp 65 in a secure environment, streamlining the process and ensuring compliance with TSP regulations.

-

How does airSlate SignNow simplify the process of completing form tsp 65?

airSlate SignNow simplifies the completion of form tsp 65 by offering intuitive templates and an easy-to-use interface. Users can quickly input the required information, sign electronically, and store the document securely, making it accessible at any time throughout the transaction process.

-

Is there a cost associated with using airSlate SignNow for form tsp 65?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. While there are subscription costs, the platform provides a cost-effective solution for managing forms like tsp 65 and signNowly reduces the time and resources spent on document handling.

-

What features of airSlate SignNow enhance the use of form tsp 65?

airSlate SignNow provides several features that enhance the use of form tsp 65, including customizable templates, advanced security measures, and real-time tracking of document status. These features ensure that your forms are completed accurately and efficiently while maintaining confidentiality and compliance.

-

Can I integrate airSlate SignNow with other software to manage form tsp 65?

Yes, airSlate SignNow offers seamless integrations with various software applications and platforms. This allows users to manage form tsp 65 alongside other tools they already use, enhancing workflow and improving document management efficiency.

-

What are the benefits of using airSlate SignNow for form tsp 65?

Using airSlate SignNow for form tsp 65 offers multiple benefits, including faster processing times, improved accuracy, and reduced paper waste. By digitizing the signing and submission process, users can enjoy a more environmentally friendly approach that also saves on printing and mailing costs.

-

How secure is airSlate SignNow for handling forms like tsp 65?

airSlate SignNow prioritizes security and compliance, utilizing industry-standard encryption and secure data storage practices. Users can trust that their form tsp 65 and other documents are protected from unauthorized access while being managed on the platform.

Get more for Tsp 65 Form

- Ast amp ust form navajo epa navajonationepa

- Unitransfer online form

- Prequalification mortgage paper form

- Low income rental application knik tribal council form

- Dataformfillcom

- Cpt recertification application nasm form

- Cigna eap claims form

- Pre qualification questionnaire intake form builders of hope cdc

Find out other Tsp 65 Form

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now