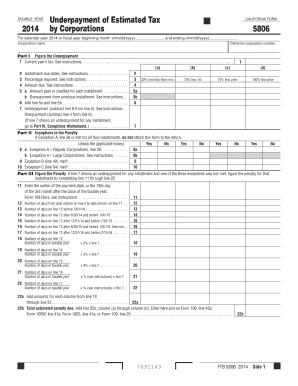

California Form 5806

What is the California Form 5806

The California Form 5806 is a tax form used to report the California source income of non-residents and part-year residents. It is essential for individuals who earn income in California but do not reside in the state for the entire year. This form helps ensure that the appropriate taxes are collected on income earned within California's jurisdiction. Completing the form accurately is crucial for compliance with state tax laws.

How to use the California Form 5806

To use the California Form 5806, begin by gathering all necessary information regarding your income earned in California. This includes wages, salaries, and other sources of income. Fill out the form by providing your personal details, including your name, address, and taxpayer identification number. Ensure that you report all California-source income accurately, as this will affect your tax liability. Once completed, the form can be submitted according to the specified guidelines.

Steps to complete the California Form 5806

Completing the California Form 5806 involves several key steps:

- Gather all required documents, including W-2s and 1099s that report your California income.

- Fill in your personal information, such as your name, address, and Social Security number.

- Report your California-source income accurately in the designated sections of the form.

- Calculate your total tax liability based on the income reported.

- Review the form for accuracy and completeness before submission.

Legal use of the California Form 5806

The California Form 5806 is legally binding when completed and submitted according to state regulations. It must be filed by the due date to avoid penalties. The form serves as a declaration of your income earned in California and is subject to review by the California Franchise Tax Board. Ensuring that the form is filled out correctly is vital for compliance with California tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the California Form 5806 are typically aligned with the federal tax filing deadlines. Generally, the form must be submitted by April 15 of the year following the tax year in question. However, if you are unable to meet this deadline, it is advisable to check for any extensions or specific guidelines provided by the California Franchise Tax Board. Keeping track of these dates is essential to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The California Form 5806 can be submitted through various methods. Taxpayers have the option to file online through the California Franchise Tax Board's website, which provides a convenient and efficient way to submit the form. Alternatively, the form can be mailed to the appropriate address listed on the form itself. For those who prefer in-person submission, visiting a local Franchise Tax Board office is also an option. Each method has its advantages, so choose the one that best fits your needs.

Quick guide on how to complete california form 5806

Effortlessly Prepare California Form 5806 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly option compared to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Manage California Form 5806 on any platform with airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The Easiest Way to Edit and eSign California Form 5806 Effortlessly

- Locate California Form 5806 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign California Form 5806 and guarantee outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california form 5806

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2014 California form 5806?

The 2014 California form 5806 is a tax form used by certain partnerships to report partnerships' income and other tax-related information to the state of California. It is essential for ensuring compliance with state tax requirements and is often necessary for accurate tax filings.

-

How can I complete the 2014 California form 5806 using airSlate SignNow?

You can easily complete the 2014 California form 5806 using airSlate SignNow's intuitive platform. Simply upload the form, fill in the required details, and leverage our handy eSigning feature to finalize the document quickly and securely.

-

What are the benefits of using airSlate SignNow for the 2014 California form 5806?

Using airSlate SignNow for the 2014 California form 5806 offers signNow advantages, such as a user-friendly interface, efficient processing time, and enhanced security. This ensures that your sensitive tax information remains confidential while facilitating a smooth signing process.

-

Is there a cost associated with using airSlate SignNow for submitting the 2014 California form 5806?

Yes, airSlate SignNow offers various pricing plans suited to different needs, including affordable options for individuals and businesses wanting to submit the 2014 California form 5806 efficiently. Our plans are designed to provide value while ensuring you have all the necessary features for seamless document management.

-

Can I save my progress while filling out the 2014 California form 5806 on airSlate SignNow?

Absolutely! airSlate SignNow allows you to save your progress while filling out the 2014 California form 5806. This feature ensures you can complete the form at your convenience without worrying about losing your inputs.

-

Does airSlate SignNow integrate with other software for managing the 2014 California form 5806?

Yes, airSlate SignNow boasts robust integrations with various accounting and tax software, providing a seamless experience for managing the 2014 California form 5806. This capability allows you to consolidate your tax reporting processes more efficiently.

-

Is airSlate SignNow compliant with California state regulations for the 2014 form 5806?

Yes, airSlate SignNow is designed to comply with California state regulations, ensuring that your use of the 2014 California form 5806 is secure and legally sound. Our platform stays updated with any changes to state laws, providing peace of mind for users.

Get more for California Form 5806

- Www titusville comview2238gateway to nature ampamp space application for right of way row form

- New york application assurancewireless com form

- Rut25 e fleet exemption schedule form

- Sisseton wahpeton oyate enrollment application form

- Standard recommended practice in line inspection of pipelines form

- School field trip registration form

- Application to keep chickens form

- Zoning permit application form

Find out other California Form 5806

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template