Sc8857 2022

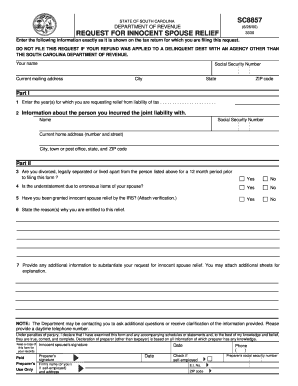

What is the SC8857?

The SC8857 is a specific form used in various administrative processes, often related to legal or regulatory requirements. Its primary purpose is to collect necessary information from individuals or entities to ensure compliance with established guidelines. Understanding the SC8857 is crucial for anyone required to submit it, as it serves as a formal declaration or application in specific contexts.

How to Use the SC8857

Using the SC8857 involves several steps to ensure accurate completion and submission. First, gather all relevant information and documents required for the form. Next, carefully fill out each section, ensuring all details are correct and complete. Once the form is filled out, review it for any errors before submission. Depending on the requirements, the SC8857 may need to be submitted online, by mail, or in person.

Steps to Complete the SC8857

Completing the SC8857 requires attention to detail. Follow these steps:

- Read the instructions carefully to understand the form's requirements.

- Collect all necessary documents, such as identification or supporting paperwork.

- Fill out the form accurately, ensuring all fields are completed.

- Double-check for any mistakes or missing information.

- Submit the form according to the specified method.

Legal Use of the SC8857

The SC8857 has legal implications, making it essential to understand its proper use. When completed correctly, the form can serve as a legally binding document in various contexts. Compliance with relevant laws and regulations is necessary to ensure that the information provided is accepted by authorities. It is advisable to familiarize oneself with the legal standards applicable to the SC8857 to avoid potential issues.

Required Documents

When preparing to submit the SC8857, certain documents may be required to support your application or declaration. Commonly needed documents include:

- Identification documents, such as a driver's license or passport.

- Proof of residency or business location, if applicable.

- Any additional forms or documentation specified in the SC8857 instructions.

Form Submission Methods

The SC8857 can be submitted through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online submission via a designated portal.

- Mailing the completed form to the appropriate address.

- In-person submission at a designated office or agency.

Penalties for Non-Compliance

Failing to comply with the requirements related to the SC8857 can result in various penalties. These may include fines, delays in processing, or denial of the application. It is important to ensure that the form is completed accurately and submitted on time to avoid such consequences.

Quick guide on how to complete sc8857 5450397

Complete Sc8857 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the required form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Sc8857 on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Sc8857 with ease

- Find Sc8857 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Sc8857 and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc8857 5450397

Create this form in 5 minutes!

How to create an eSignature for the sc8857 5450397

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the sc8857 solution offered by airSlate SignNow?

The sc8857 solution by airSlate SignNow is a powerful eSignature tool designed to simplify the signing process for documents. It offers an intuitive interface that streamlines the workflow of sending and signing documents, making it ideal for businesses of all sizes.

-

How much does the sc8857 solution cost?

The pricing for the sc8857 solution varies based on your chosen plan, ranging from basic to premium features. airSlate SignNow provides flexible pricing options that fit the budget of small businesses to large enterprises, ensuring you get the best value for your investment.

-

What features does the sc8857 solution include?

The sc8857 solution includes a comprehensive set of features such as document templates, real-time tracking, and secure cloud storage. It also supports multiple document formats, making it versatile for different signing scenarios.

-

How can the sc8857 solution benefit my business?

The sc8857 solution can enhance your business efficiency by signNowly reducing the time spent on obtaining signatures. This cost-effective solution not only speeds up the signing process but also improves overall workflow, allowing your team to focus on more critical tasks.

-

Does the sc8857 solution integrate with other applications?

Yes, the sc8857 solution seamlessly integrates with various business applications, including CRM systems and document management software. This connectivity ensures that you can manage your entire workflow in one place without any disruptions.

-

Is the sc8857 solution secure for sensitive documents?

Absolutely! The sc8857 solution employs advanced security measures, such as encryption and authentication, to protect sensitive documents. This commitment to security ensures that your information remains confidential throughout the signing process.

-

How do I get started with the sc8857 solution?

Getting started with the sc8857 solution is easy! Simply visit the airSlate SignNow website, choose your desired plan, and create an account. Once you’re set up, you can start sending documents for eSignature in just a few clicks.

Get more for Sc8857

- Credit one sheet form

- Personal declaration any individual with a disabil form

- Brandon patty st johns county clerk of the circui form

- Rule 9900 aformsnotice of appeal in the

- Form 1 997 civil cover sheet

- Memorandum of law sample florida form

- Eeop short form online

- This space for clerks recording permit no tax form

Find out other Sc8857

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo