Form 990N EPostcard Online View and Print Return 1 of 1 Httpsepostcard Losangeles Goldenrulelodge35ioof

Understanding the Form 990N ePostcard

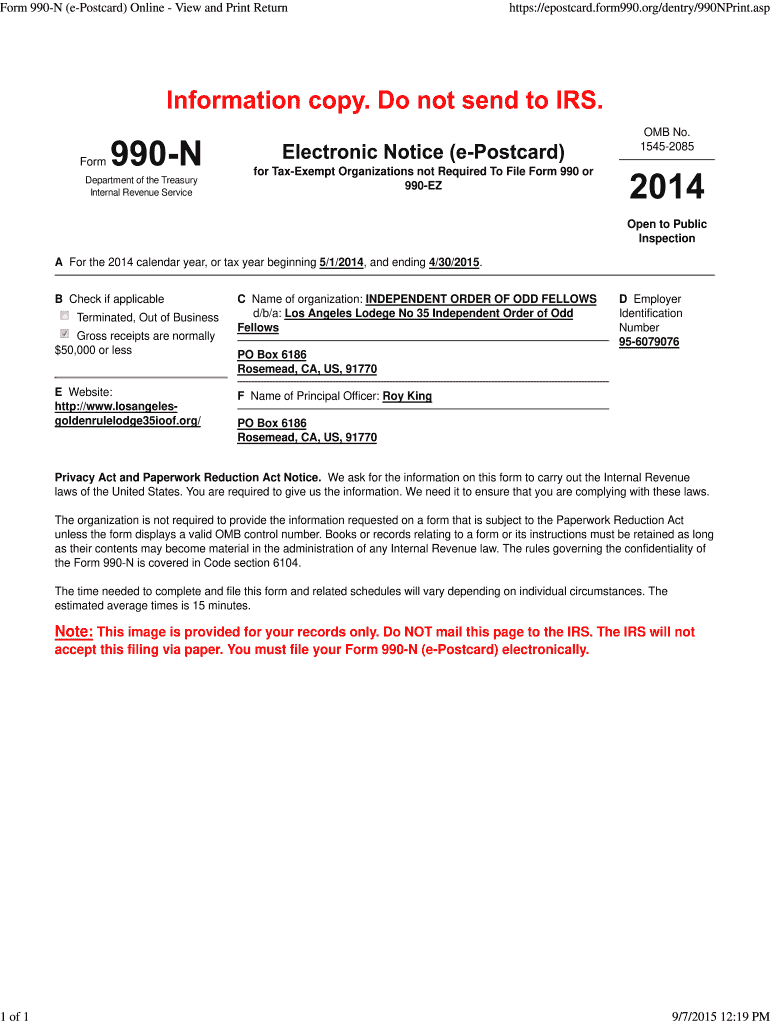

The Form 990N ePostcard is a simplified electronic filing option for small tax-exempt organizations in the United States. It is designed for organizations that normally have annual gross receipts of $50,000 or less. This form allows these organizations to meet their annual reporting requirements to the IRS without the need for a full Form 990 or Form 990EZ. The ePostcard is filed online, making it a convenient option for organizations that may not have the resources to handle more complex tax filings.

Steps to Complete the Form 990N ePostcard

Completing the Form 990N ePostcard is straightforward. Here are the steps to follow:

- Gather necessary information, including your organization's name, address, and Employer Identification Number (EIN).

- Access the IRS website or an authorized e-filing service to begin the submission process.

- Fill in the required fields, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the form electronically and save a copy for your records.

Legal Use of the Form 990N ePostcard

The Form 990N ePostcard is legally recognized as a valid method for tax-exempt organizations to report their financial activities. To ensure compliance, organizations must file the ePostcard annually if they meet the eligibility criteria. Failure to file can result in penalties, including the loss of tax-exempt status. It is important for organizations to understand the legal implications of their filings and maintain accurate records to support their compliance with IRS regulations.

Filing Deadlines for the Form 990N ePostcard

Organizations must file the Form 990N ePostcard by the 15th day of the fifth month after the end of their fiscal year. For most organizations operating on a calendar year, this means the deadline is May 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Being aware of these deadlines is crucial to avoid penalties and maintain good standing with the IRS.

Required Documents for Filing the Form 990N ePostcard

When preparing to file the Form 990N ePostcard, organizations should have the following documents and information ready:

- Employer Identification Number (EIN)

- Legal name of the organization

- Mailing address

- Website address (if applicable)

- Confirmation of gross receipts, ensuring they do not exceed $50,000

Examples of Using the Form 990N ePostcard

The Form 990N ePostcard is commonly used by various small tax-exempt organizations, including:

- Charitable organizations

- Religious institutions

- Educational institutions

- Social clubs

- Volunteer fire departments

These organizations utilize the ePostcard to fulfill their annual reporting requirements efficiently and effectively.

Quick guide on how to complete form 990n epostcard online view and print return 1 of 1 httpsepostcard losangeles goldenrulelodge35ioof

Complete Form 990N ePostcard Online View And Print Return 1 Of 1 Httpsepostcard Losangeles goldenrulelodge35ioof effortlessly on any gadget

Digital document management has gained signNow traction among enterprises and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed files, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without interruptions. Manage Form 990N ePostcard Online View And Print Return 1 Of 1 Httpsepostcard Losangeles goldenrulelodge35ioof on any gadget with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 990N ePostcard Online View And Print Return 1 Of 1 Httpsepostcard Losangeles goldenrulelodge35ioof with ease

- Locate Form 990N ePostcard Online View And Print Return 1 Of 1 Httpsepostcard Losangeles goldenrulelodge35ioof and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet-ink signature.

- Review all the information and then click the Done button to finalize your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or mislaid documents, tiring form searches, or mistakes requiring the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and eSign Form 990N ePostcard Online View And Print Return 1 Of 1 Httpsepostcard Losangeles goldenrulelodge35ioof and ensure effective communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 990n epostcard online view and print return 1 of 1 httpsepostcard losangeles goldenrulelodge35ioof

How to generate an eSignature for the Form 990n Epostcard Online View And Print Return 1 Of 1 Httpsepostcard Losangeles Goldenrulelodge35ioof in the online mode

How to create an eSignature for the Form 990n Epostcard Online View And Print Return 1 Of 1 Httpsepostcard Losangeles Goldenrulelodge35ioof in Google Chrome

How to make an eSignature for putting it on the Form 990n Epostcard Online View And Print Return 1 Of 1 Httpsepostcard Losangeles Goldenrulelodge35ioof in Gmail

How to make an eSignature for the Form 990n Epostcard Online View And Print Return 1 Of 1 Httpsepostcard Losangeles Goldenrulelodge35ioof from your smartphone

How to generate an eSignature for the Form 990n Epostcard Online View And Print Return 1 Of 1 Httpsepostcard Losangeles Goldenrulelodge35ioof on iOS

How to generate an eSignature for the Form 990n Epostcard Online View And Print Return 1 Of 1 Httpsepostcard Losangeles Goldenrulelodge35ioof on Android devices

People also ask

-

What is the fill n print feature of airSlate SignNow?

The fill n print feature of airSlate SignNow allows users to easily complete forms and documents online before printing them out. This tool streamlines the process for businesses, enabling them to fill out necessary paperwork quickly and efficiently. With an intuitive interface, users can fill n print their documents without any hassle.

-

How does airSlate SignNow ensure document security for fill n print?

airSlate SignNow prioritizes document security, especially for its fill n print feature. The platform employs advanced encryption methods to protect sensitive information as users fill out and print their documents. This ensures that confidential data remains safe during the entire process.

-

Is there a cost associated with using the fill n print feature on airSlate SignNow?

Yes, while airSlate SignNow offers a free trial, accessing the fill n print feature is part of their subscription plans. Pricing is competitive, providing great value for businesses looking to manage their document processes effectively. Visit our pricing page for more details.

-

Can I fill n print documents on mobile devices with airSlate SignNow?

Absolutely! airSlate SignNow's fill n print feature is fully optimized for mobile devices. Users can conveniently fill out and print documents directly from their smartphones or tablets while on the go, enhancing flexibility and productivity.

-

What types of documents can I fill n print using airSlate SignNow?

With airSlate SignNow, you can fill n print a wide range of documents, including contracts, forms, and agreements. This versatility makes it an ideal solution for businesses in various industries needing a reliable way to manage document workflows.

-

Does airSlate SignNow integrate with other software for fill n print processes?

Yes, airSlate SignNow offers seamless integrations with popular platforms such as Google Drive, Dropbox, and many CRM systems. This functionality enhances the fill n print process, allowing users to access and manage documents more efficiently within their preferred tools.

-

What are the benefits of using airSlate SignNow's fill n print feature for businesses?

The fill n print feature offers businesses signNow benefits, including time savings and increased accuracy in document handling. By simplifying the process of completing and printing forms, companies can improve operational efficiency and reduce the risk of errors in important paperwork.

Get more for Form 990N ePostcard Online View And Print Return 1 Of 1 Httpsepostcard Losangeles goldenrulelodge35ioof

- Kentucky map 24 to discharge form

- Mathlinks 7 answer key form

- Confined space rescue plan word template form

- Lash liftinglash tintingeyebrow tinting waiver and form

- Hpd affidavit in lieu of registration form

- Official 406 mhz epirb registration form

- Rapid strep osom training and competency record ltr9279 form

- Hb 4545 accelerated instruction plan template 428004478 form

Find out other Form 990N ePostcard Online View And Print Return 1 Of 1 Httpsepostcard Losangeles goldenrulelodge35ioof

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document