Truliant Dispute Charge Form

Understanding the Truliant Dispute Charge

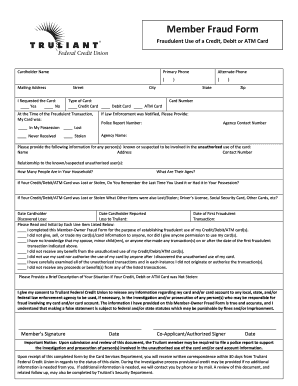

The Truliant Dispute Charge is a formal process that allows members of Truliant Federal Credit Union to contest unauthorized transactions or billing errors on their accounts. This charge is essential for safeguarding consumer rights and ensuring that members can address discrepancies effectively. It is important to understand the circumstances under which a dispute can be filed, as well as the necessary steps to initiate the process.

Steps to Complete the Truliant Dispute Charge

To successfully complete the Truliant Dispute Charge, follow these steps:

- Gather all relevant documentation, including transaction details and any correspondence related to the dispute.

- Access the Truliant online banking portal or visit a local branch to obtain the dispute form.

- Fill out the form accurately, providing all necessary information about the transaction in question.

- Submit the completed form along with any supporting documents either online, by mail, or in person at a Truliant branch.

- Keep a copy of the submitted form and any correspondence for your records.

Legal Use of the Truliant Dispute Charge

The legal framework surrounding the Truliant Dispute Charge is designed to protect consumers under the Fair Credit Billing Act (FCBA). This act allows consumers to dispute charges that they believe are incorrect or unauthorized. It is crucial for members to be aware of their rights and the legal obligations of Truliant in processing these disputes. Members should ensure that their disputes are filed within the required time frame to maintain compliance with legal standards.

Key Elements of the Truliant Dispute Charge

When filing a dispute, certain key elements must be included to ensure the process is effective:

- Transaction Date: The exact date when the disputed transaction occurred.

- Transaction Amount: The amount charged that is being contested.

- Description of the Dispute: A clear explanation of why the charge is being disputed.

- Supporting Documentation: Any evidence that supports the claim, such as receipts or correspondence.

Examples of Using the Truliant Dispute Charge

Common scenarios for utilizing the Truliant Dispute Charge include:

- Unauthorized transactions resulting from fraud or identity theft.

- Billing errors where the amount charged differs from the agreed-upon amount.

- Charges for goods or services that were not received or were defective.

Form Submission Methods for the Truliant Dispute Charge

Members can submit the Truliant Dispute Charge form through various methods, ensuring flexibility and convenience:

- Online: Through the Truliant online banking portal.

- By Mail: Sending the completed form and documents to the designated Truliant address.

- In-Person: Visiting a local Truliant branch to submit the form directly.

Quick guide on how to complete truliant dispute charge

Complete Truliant Dispute Charge effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without hassle. Manage Truliant Dispute Charge on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest way to modify and electronically sign Truliant Dispute Charge with ease

- Obtain Truliant Dispute Charge and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes just a few seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Select your preferred method to send your form via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or missing documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Truliant Dispute Charge and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the truliant dispute charge

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Does Truliant have Zelle for money transfers?

Yes, Truliant does have Zelle, allowing its members to easily send and receive money directly from their banking app. This feature enhances convenience for users who need quick and easy money transfers without dealing with cash or checks.

-

How do I set up Zelle with my Truliant account?

To set up Zelle with your Truliant account, simply log into your online banking or mobile app and follow the prompts for Zelle integration. It’s a straightforward process that quickly connects your bank account to Zelle, letting you start transferring money.

-

Are there any fees for using Zelle at Truliant?

No, Truliant does not charge any fees for using Zelle to send or receive money. This makes it a cost-effective option for members who want to transact without incurring additional costs.

-

What are the limits for Zelle transactions at Truliant?

Truliant allows a daily limit on Zelle transactions, which can vary based on your account type. It's advisable to check your account details or contact customer service for specific limits regarding Zelle transactions.

-

Can I use Zelle for business payments with Truliant?

Yes, Truliant supports Zelle for business payments, making it an excellent tool for small business owners to facilitate quick and easy transactions. Keep in mind that some limitations might apply depending on your account type.

-

What features make using Zelle with Truliant beneficial?

Using Zelle with Truliant offers benefits such as instant money transfers, no fees, and seamless integration within the banking app. These features streamline transactions, enhancing both individual and business cash flow.

-

Are there any alternatives to Zelle offered by Truliant?

Yes, Truliant also provides other money transfer services if Zelle doesn’t meet your needs. Options may include bank transfers or other digital payment methods.

Get more for Truliant Dispute Charge

- Declaration of trade name declaration of trade name form

- Ascension parish sales and use tax exemption certificate form

- Aaa safety patrol certificate of commendation lieutenant aaacom form

- Condominium resale certificate williams amp williams real estate form

- Greater hartford association of realtors inc rental application form

- Lf305 04 form

- Pnp pds form

- State of michigan certificate of no fault insurance yellowhammer form

Find out other Truliant Dispute Charge

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed