Ascension Parish Sales Tax Form

What is the Ascension Parish Sales Tax Form

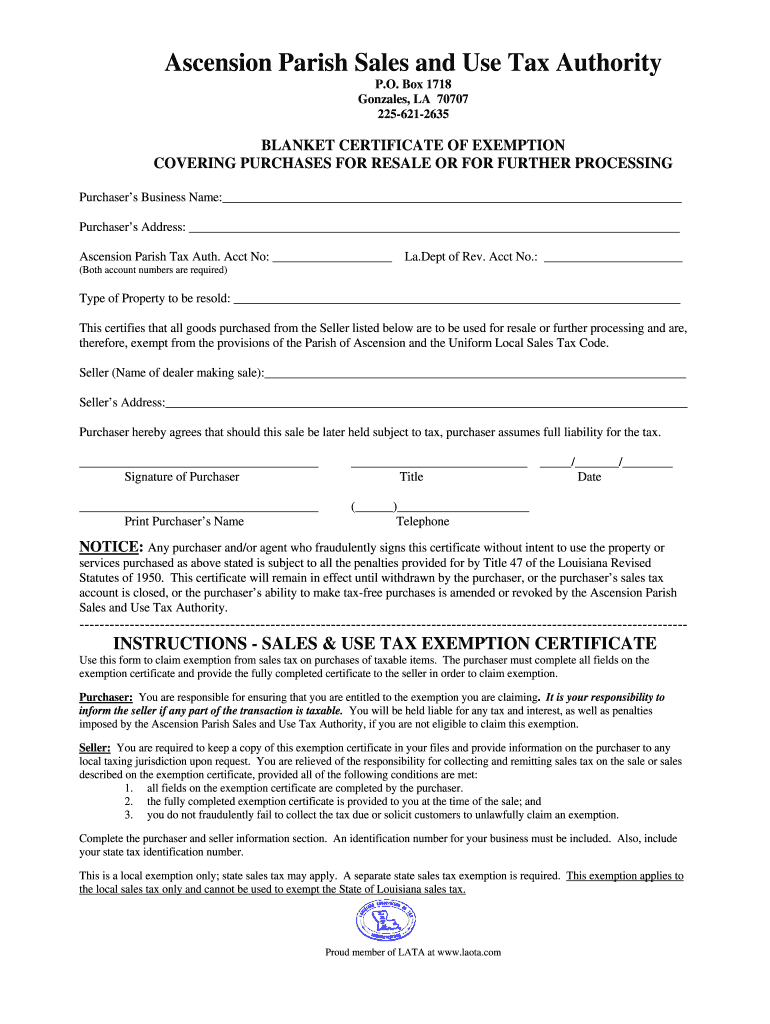

The Ascension Parish Sales Tax Form is a crucial document used by businesses and individuals to report and remit sales and use tax obligations to the Ascension Parish Sales Tax Authority. This form is essential for ensuring compliance with local tax regulations and helps maintain transparency in financial transactions. The form captures details about taxable sales, exemptions, and the applicable sales tax rate, which varies based on the nature of the goods or services sold.

How to use the Ascension Parish Sales Tax Form

Using the Ascension Parish Sales Tax Form involves several steps to ensure accurate reporting. First, gather all necessary sales records, including receipts and invoices. Next, complete the form by entering your business information, total sales amount, and any applicable exemptions. It is important to calculate the total sales tax due based on the current Ascension Parish sales tax rate. Finally, submit the completed form to the Ascension Parish Sales Tax Authority by the specified deadline.

Steps to complete the Ascension Parish Sales Tax Form

Completing the Ascension Parish Sales Tax Form requires careful attention to detail. Follow these steps:

- Gather all sales documentation for the reporting period.

- Provide your business name, address, and tax identification number on the form.

- Report total sales and any exempt sales clearly.

- Calculate the sales tax due by applying the appropriate tax rate.

- Review the form for accuracy before submission.

- Submit the form via the preferred method: online, by mail, or in person.

Legal use of the Ascension Parish Sales Tax Form

The legal use of the Ascension Parish Sales Tax Form is governed by state and local tax laws. This form must be filled out accurately to ensure compliance with the regulations set forth by the Ascension Parish Sales Tax Authority. Failing to properly complete and submit the form can result in penalties, including fines and interest on unpaid taxes. It is essential to retain copies of submitted forms for your records, as they may be required for audits or future reference.

Filing Deadlines / Important Dates

Filing deadlines for the Ascension Parish Sales Tax Form are typically set by the Ascension Parish Sales Tax Authority. Generally, forms are due on a monthly or quarterly basis, depending on the volume of sales. It is crucial to be aware of these deadlines to avoid late fees. Mark your calendar with important dates, such as the end of the reporting period and the due date for submission, to ensure timely compliance.

Form Submission Methods (Online / Mail / In-Person)

The Ascension Parish Sales Tax Form can be submitted through various methods to accommodate different preferences. You may choose to submit the form online via the Ascension Parish Sales Tax Authority's website, which often provides a streamlined process. Alternatively, you can mail the completed form to the designated address or deliver it in person to the tax office. Each method has its own processing time, so consider this when planning your submission.

Quick guide on how to complete ascension parish sales and use tax exemption certificate

Effortlessly Prepare Ascension Parish Sales Tax Form on Any Device

The management of online documents has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to generate, adjust, and eSign your documents swiftly without delays. Manage Ascension Parish Sales Tax Form on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and eSign Ascension Parish Sales Tax Form with Ease

- Find Ascension Parish Sales Tax Form and click Get Form to initiate the process.

- Make use of the tools at your disposal to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically designed for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Adjust and eSign Ascension Parish Sales Tax Form while ensuring outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

Why is it so hard to figure out how many exemptions and allowances one should claim on tax forms? Why isn't this specified clearly?

You should only filed the number of exemptions and/or allowances truly reflected in your household. If you are single, check Single, then it's one exemption, you. If you are Married filing Jointly, that is two exemptions(2 people) plus one exemption for each child). Or other person considered a dependent.Hope that helps. Exemptions are based on number of people in your household you can legally claim as dependents. Allowances are item that come off your taxable income for things like retirement places, childcare, etc.If you have further questions, it's best to contact a tax professional in your area. Most do free consultation, charging only for work we do for clients.

-

How illegal immigrants file taxes (presumably using ITIN) while paying taxes using fake SSN? How IRS accepts such forms as SSN used to pay tax and ITIN used for filling tax don't match?

Illegal immigrants are not authorized to work in the US and are not entitled to all the benefits of a citizen or legal resident, However, if they are here they are expected to pay taxes as any citizen would. If they choose to work, they are expected to pay income taxes.If they use a fake Social Security number to obtain work, it usually belongs to another person. This is illegal and could result in being ineligible to get a green card because any reported wages would be tracked to the account of the actual owner of the Social Security number along with any FICA/ Medicare taxes that the employer withholds.In order to isolate the tax reporting for the immigrant from that of the actual Social Security holder, the IRS issues an Individual Tax Identification Number (ITIN) to the immigrant under which he/she may report their earnings. When the copies of any W-2 or other withholding documents with fake SSN are included on the return, then the IRS now has the ability to segregate the wages that are incorrectly reported and notify Social Security Administration to segregate any reported FICA/ Medicare from the actual owner’s account.If the immigrant works “under the table” in either a cash-based transaction or self-employed status, it does not remove the obiligation to correctly report earnings. It just changes the forms required on the tax return and may incur penalties to worker and/or the employer.Disclaimer: Since you are not my client, the above message is not intended to constitute written tax advice,but general information for discussion purposes only. You should not, therefore, interpret the statements to be written tax advice or rely on the statements for any purpose.

-

How do I declare a short term capital gain tax in the ITR in India? I want to know about the ITR form number and where and what to fill in the details. This is my first time to pay a short term capital gain tax on an equity sale.

The selection of ITR form will depend upon the type of one's income.For Income from salary, house property, capital gains for ITR2 is suggestedHowever for income from above heads and business/profession ITR4 is suggestedIn both the forms under head CG, revenue from sale of equity shares are required to be mentioned along with purchase amount and expenses incurred on sale are also required to be mentioned.For short term and long term separate rows are there.Just fill up and it will take the net capital gain to respective cell in computation if income.

-

How do you use Quickbooks for dropshipping to keep your finances in check? How do I record all the sales and payments, keeping track of the finances and be ready to submit tax forms and all?

Hi Ricky,Drop shipping product affects how you would track inventory. Typically, one would invoice after the shipment is made. Do you produce inventory or just buy/sell/rep for products? If you produce the inventory yourself, you would want to capture the materials purchased, the assembly, the increase in inventory when built. Then when you ship, you can invoice and it decreases your inventory value and increases your Cost of Goods Sold.QuickBooks is a powerful tool to track all of the transactions that occur. From prepaying your vendor, customer deposits, receiving a vendor bill, invoicing your customer, receiving payments and making deposits. Can you tell I love my accounting software?

Create this form in 5 minutes!

How to create an eSignature for the ascension parish sales and use tax exemption certificate

How to make an eSignature for the Ascension Parish Sales And Use Tax Exemption Certificate in the online mode

How to make an eSignature for your Ascension Parish Sales And Use Tax Exemption Certificate in Google Chrome

How to make an eSignature for putting it on the Ascension Parish Sales And Use Tax Exemption Certificate in Gmail

How to create an electronic signature for the Ascension Parish Sales And Use Tax Exemption Certificate straight from your smart phone

How to make an eSignature for the Ascension Parish Sales And Use Tax Exemption Certificate on iOS

How to generate an eSignature for the Ascension Parish Sales And Use Tax Exemption Certificate on Android

People also ask

-

What is the role of the Ascension Parish Sales Tax Authority?

The Ascension Parish Sales Tax Authority is responsible for administering and collecting sales taxes within the parish. This includes ensuring compliance with tax regulations and providing necessary guidance to businesses regarding sales tax obligations. Understanding their role can help businesses better navigate tax requirements.

-

How can airSlate SignNow help businesses with Ascension Parish sales tax documentation?

airSlate SignNow streamlines the process of managing documents related to sales tax, such as tax exemption certificates and compliance forms. Our eSignature solution allows businesses to quickly sign and send necessary documents to the Ascension Parish Sales Tax Authority, ensuring timely submissions and better organization.

-

What pricing options does airSlate SignNow offer for teams addressing Ascension Parish sales tax concerns?

airSlate SignNow offers a variety of pricing plans designed to fit the needs of businesses dealing with Ascension Parish sales tax. Our plans are cost-effective and provide scalable features, allowing teams to choose the right solution based on their size and document management needs. Custom pricing is also available for larger enterprises.

-

What features does airSlate SignNow provide for handling Ascension Parish sales tax documents?

airSlate SignNow provides crucial features such as reusable templates, automated workflows, and mobile accessibility to manage Ascension Parish sales tax documents effectively. These features allow businesses to ensure compliance and maintain accurate records without cumbersome paperwork, helping them stay organized.

-

Can I integrate airSlate SignNow with other software for sales tax management?

Yes, airSlate SignNow seamlessly integrates with various accounting and financial software, which is essential for businesses managing Ascension Parish sales tax. This integration allows for synchronized data updates, reducing the risk of errors and improving overall efficiency in your tax processes.

-

What are the benefits of using airSlate SignNow for Ascension Parish sales tax processes?

Using airSlate SignNow signNowly reduces the time spent on paperwork and helps ensure better compliance with Ascension Parish sales tax regulations. Our user-friendly platform enables quick document execution and tracking, allowing businesses to focus more on growth and less on administrative tasks associated with tax compliance.

-

How does airSlate SignNow enhance the security of documents related to Ascension Parish sales tax?

airSlate SignNow prioritizes the security of all documents, including those related to Ascension Parish sales tax. Our platform incorporates encryption and advanced security measures to protect sensitive information, ensuring that your tax information remains confidential and secure during transmission and storage.

Get more for Ascension Parish Sales Tax Form

Find out other Ascension Parish Sales Tax Form

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract