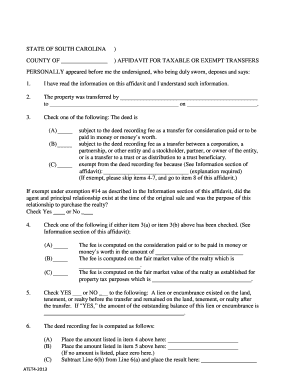

Affidavit for Taxable or Exempt Transfers Form

What is the affidavit for taxable or exempt transfers?

The affidavit for taxable or exempt transfers is a legal document used to declare the nature of a transfer of property or assets, indicating whether it is subject to taxation or qualifies for an exemption. This form is often required in real estate transactions, inheritance cases, or other financial transfers where tax implications may arise. By completing this affidavit, individuals or entities affirm their understanding of the tax obligations associated with the transfer, ensuring compliance with local and federal regulations.

How to use the affidavit for taxable or exempt transfers

Using the affidavit for taxable or exempt transfers involves several steps. First, identify the specific circumstances under which the transfer is taking place. Next, gather all necessary information, including details about the property or assets being transferred, the parties involved, and any relevant tax identification numbers. Once the information is compiled, fill out the affidavit accurately, ensuring all declarations are truthful and complete. Finally, submit the completed affidavit to the appropriate authority, which may include local tax offices or other regulatory bodies.

Steps to complete the affidavit for taxable or exempt transfers

Completing the affidavit for taxable or exempt transfers requires careful attention to detail. Follow these steps for successful completion:

- Obtain the correct form from a reliable source.

- Provide your personal information, including name, address, and contact details.

- Clearly describe the property or assets being transferred.

- Indicate whether the transfer is taxable or exempt, providing reasons for any exemptions claimed.

- Sign and date the affidavit, ensuring all parties involved do the same if required.

- Submit the affidavit to the relevant authority, keeping a copy for your records.

Key elements of the affidavit for taxable or exempt transfers

Several key elements must be included in the affidavit for taxable or exempt transfers to ensure its validity. These elements typically include:

- The full names and addresses of the parties involved in the transfer.

- A detailed description of the property or assets being transferred.

- A clear statement regarding the tax status of the transfer, including any exemptions claimed.

- The signature of the person completing the affidavit, along with the date of signing.

- Any additional documentation that may support the claims made in the affidavit.

Legal use of the affidavit for taxable or exempt transfers

The legal use of the affidavit for taxable or exempt transfers is crucial for compliance with tax laws. This document serves as a formal declaration that can be used in legal proceedings or tax assessments. When properly executed, it provides evidence of the transfer's nature and the parties' intentions, helping to prevent disputes or misunderstandings regarding tax liabilities. It is important to ensure that the affidavit meets all legal requirements specific to the jurisdiction in which it is filed.

State-specific rules for the affidavit for taxable or exempt transfers

Each state in the United States may have its own rules and regulations governing the affidavit for taxable or exempt transfers. These rules can vary significantly, affecting the required information, submission processes, and deadlines. It is essential to consult state-specific guidelines to ensure compliance. Local tax offices or legal resources can provide valuable information regarding any unique requirements or considerations that must be addressed when completing the affidavit in a particular state.

Quick guide on how to complete affidavit for taxable or exempt transfers

Effortlessly Prepare Affidavit For Taxable Or Exempt Transfers on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers a perfect eco-friendly substitute for conventional printed and signed documents, as you can access the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents rapidly without any hold-ups. Manage Affidavit For Taxable Or Exempt Transfers on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Affidavit For Taxable Or Exempt Transfers seamlessly

- Find Affidavit For Taxable Or Exempt Transfers and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive content using tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method for delivering your form, via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Modify and eSign Affidavit For Taxable Or Exempt Transfers and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the affidavit for taxable or exempt transfers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an affidavit for taxable or exempt transfers?

An affidavit for taxable or exempt transfers is a legal document that certifies the transfer of property and clarifies whether the transfer is subject to taxes. This affidavit is essential for ensuring proper compliance with tax laws and regulations. Using airSlate SignNow, you can easily create and sign such affidavits electronically.

-

How does airSlate SignNow simplify the process of creating an affidavit for taxable or exempt transfers?

airSlate SignNow provides an intuitive platform for creating an affidavit for taxable or exempt transfers with customizable templates. It allows you to fill out, edit, and eSign the document in a secure environment. This streamlines the entire process, making it easier for users to manage their documents without legal hassles.

-

What are the benefits of using airSlate SignNow for affidavits?

Using airSlate SignNow for your affidavit for taxable or exempt transfers offers signNow advantages, including reduced turnaround times and improved document security. The eSigning feature ensures that all parties sign the affidavit quickly and securely. Additionally, the platform's tracking capabilities allow you to monitor the status of each document.

-

Is there any cost associated with using airSlate SignNow for affidavits?

Yes, airSlate SignNow offers various pricing plans that accommodate different business needs when it comes to affidavits for taxable or exempt transfers. Plans are designed to be cost-effective, providing users with a range of features at competitive prices. You can choose a plan that best suits your document management needs.

-

Can I integrate airSlate SignNow with other applications for managing affidavits?

Absolutely! airSlate SignNow seamlessly integrates with numerous applications, making it easy to manage your affidavit for taxable or exempt transfers along with other business processes. Integrations with CRM and document management systems streamline workflows and enhance productivity, allowing for a more efficient document handling experience.

-

What security features does airSlate SignNow provide for affidavits?

airSlate SignNow prioritizes the security of your documents, including affidavits for taxable or exempt transfers, with advanced encryption and authentication protocols. This ensures that sensitive information remains confidential and protected from unauthorized access. Users can rely on airSlate SignNow for secure document management.

-

How can I ensure the legality of my affidavit for taxable or exempt transfers when using airSlate SignNow?

To ensure the legality of your affidavit for taxable or exempt transfers, airSlate SignNow complies with all eSignature laws and regulations. The platform also provides templates that are crafted to meet legal standards. Additionally, having all signers authenticate their identity reinforces the document's legitimacy.

Get more for Affidavit For Taxable Or Exempt Transfers

- Fillable online ccg n645 01 04 10 cook county clerk of form

- 12th judicial circuit courtcourt servicesfamily gal form

- Illinois statewide forms approved dissolution of marriagecivil union divorce no children

- 12 08 27 norway supreme court review of oslo district form

- Personal guarantee of rental agreement legalformsorg

- New occupant statement 425574239 form

- River bend ranch fay ranches form

- Asset manager property inspection report 4 property address form

Find out other Affidavit For Taxable Or Exempt Transfers

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template