Form 941

What is the Form 941

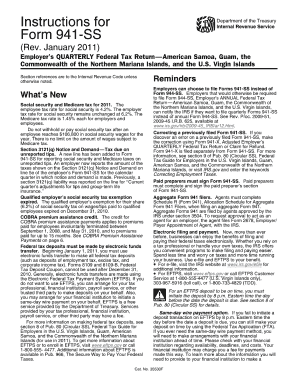

The 941 form for 2011 is a crucial document used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is filed quarterly and provides the Internal Revenue Service (IRS) with essential information regarding payroll taxes. Employers must accurately complete and submit this form to ensure compliance with federal tax regulations.

Steps to complete the Form 941

Completing the 941 form for 2011 involves several key steps:

- Gather necessary information about your business, including the Employer Identification Number (EIN).

- Collect payroll data for the quarter, including total wages paid, tips reported, and the amount of federal income tax withheld.

- Calculate the total taxes owed, including Social Security and Medicare taxes.

- Complete each section of the form accurately, ensuring that all figures are correct and reflect your payroll records.

- Review the form for any errors before submission.

How to obtain the Form 941

The 941 form for 2011 can be obtained directly from the IRS website or through various tax preparation software. Employers can download a printable version of the form, ensuring they have the correct version for the year. It is important to use the specific form for 2011 to avoid any discrepancies in reporting.

Legal use of the Form 941

The 941 form is legally binding when completed and submitted in compliance with IRS regulations. Employers must ensure that the information provided is accurate and truthful, as any false statements can lead to penalties. Utilizing digital tools for eSigning the form can enhance its legality, provided that electronic signature laws are followed.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the 941 form. For 2011, the form is due on the last day of the month following the end of each quarter. Specifically, the deadlines are:

- First quarter: April 30

- Second quarter: July 31

- Third quarter: October 31

- Fourth quarter: January 31 of the following year

Form Submission Methods (Online / Mail / In-Person)

The 941 form for 2011 can be submitted through various methods. Employers have the option to file electronically using IRS-approved e-file services or to mail a paper copy of the form to the appropriate IRS address. In-person submission is not typically available for this form, as it is primarily processed through mail or electronic means.

Quick guide on how to complete form 941 55729

Effortlessly prepare Form 941 on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and without delays. Manage Form 941 on any device using the airSlate SignNow applications for Android or iOS, and streamline any document-related process today.

How to modify and electronically sign Form 941 effortlessly

- Acquire Form 941 and click on Get Form to begin.

- Use the tools at your disposal to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using the tools airSlate SignNow provides for that purpose.

- Create your signature with the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your changes.

- Select your preferred method of delivering your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Form 941 and ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 941 55729

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 941 form 2011, and why is it important for businesses?

The 941 form 2011 is a quarterly tax return used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. It provides the IRS with essential information regarding your business's employment tax liabilities. Properly filing the 941 form 2011 can help ensure compliance and avoid potential penalties.

-

How can airSlate SignNow help with submitting the 941 form 2011?

airSlate SignNow simplifies the process of completing and submitting the 941 form 2011 by enabling users to fill out the form electronically and securely eSign it. Our service provides templates and easy navigation to ensure all sections of the form are correctly filled out. This streamlines your tax preparation process while ensuring that all documents are submitted on time.

-

What features does airSlate SignNow offer for managing the 941 form 2011?

With airSlate SignNow, you can access a range of features including customizable templates for the 941 form 2011, real-time document tracking, and automatic reminders for important deadlines. Additionally, our solution allows for team collaboration, making it easy to gather necessary information from multiple stakeholders. This enhances efficiency and minimizes the risk of errors.

-

Is airSlate SignNow cost-effective for small businesses needing to file the 941 form 2011?

Yes, airSlate SignNow offers competitive pricing plans that cater to small businesses looking to handle their 941 form 2011 filing efficiently. The platform provides a cost-effective solution that eliminates the need for costly paper processes and reduces overhead associated with traditional filing methods. You can choose a plan that best fits your budget and needs.

-

How does airSlate SignNow ensure the security of my 941 form 2011 documents?

Security is a top priority at airSlate SignNow. When handling your 941 form 2011 documents, we use industry-standard encryption protocols and secure servers to protect your sensitive information. Regular security audits are conducted to ensure compliance with regulations and maintain the highest standards of data protection.

-

Can I integrate airSlate SignNow with other software for my 941 form 2011?

Absolutely! airSlate SignNow provides seamless integration with various accounting and productivity tools. This means you can easily import or export data related to the 941 form 2011, enhancing your workflow and ensuring data consistency across your platforms. Integrations help improve efficiency and streamline the overall filing process.

-

What are the benefits of using airSlate SignNow for the 941 form 2011?

Using airSlate SignNow for filing the 941 form 2011 offers numerous benefits, including improved accuracy, time savings, and enhanced workflow efficiency. Our user-friendly interface allows for quick completion and electronic signing, reducing paperwork and administrative burdens. This ensures your business remains compliant without the hassle of traditional filing methods.

Get more for Form 941

- Printable baseball registration form

- Adu income certification form rental fairfax county government fairfaxcounty

- Fire alarm form

- Fairfax motions form

- Parking tabulation form

- Probate information form ccr j 20 fairfax county government fairfaxcounty

- Cc 1471 form

- Employment verification form fairfax county government fairfaxcounty

Find out other Form 941

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer