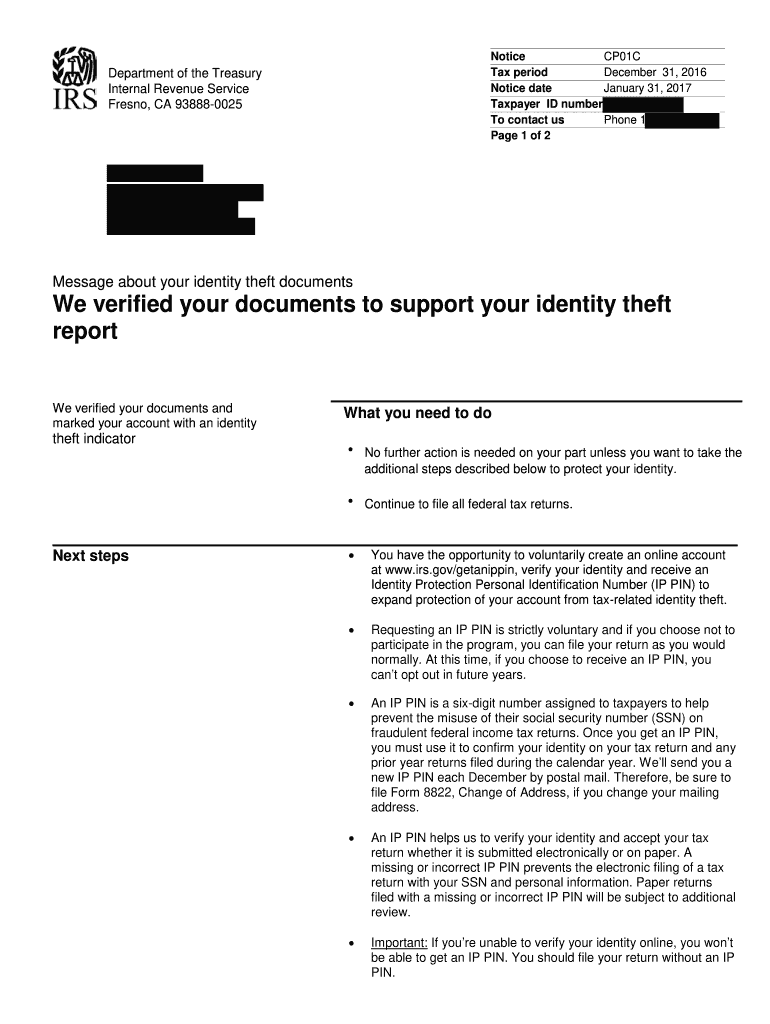

We Verified Your Documents to Support Your Identity Theft IRS Gov Form

What is the IRS verification form?

The IRS verification form is a document used by the Internal Revenue Service to confirm an individual's identity, particularly in cases of potential identity theft. This form is often associated with the 5071C letter, which the IRS sends to taxpayers when there is a concern about the authenticity of their tax return. The verification process helps ensure that the correct taxpayer receives any refunds or credits, protecting both the taxpayer and the IRS from fraudulent claims.

How to use the IRS verification form

To use the IRS verification form, individuals must follow a series of steps to confirm their identity. When a taxpayer receives a 5071C letter, they should carefully read the instructions provided. The form typically requires personal information, such as Social Security numbers and filing status. After filling out the form, taxpayers can submit it electronically through the IRS website or by mail, depending on the instructions provided in the letter.

Steps to complete the IRS verification form

Completing the IRS verification form involves several key steps:

- Review the 5071C letter for specific instructions.

- Gather necessary personal information, including your Social Security number and details from your tax return.

- Fill out the verification form accurately, ensuring all information matches what the IRS has on file.

- Submit the completed form as directed—either online or via mail.

- Keep a copy of the submitted form for your records.

Legal use of the IRS verification form

The IRS verification form serves a crucial legal function in protecting taxpayers from identity theft. When filled out and submitted correctly, it acts as a legally binding document that verifies an individual's identity. Compliance with IRS guidelines ensures that the form is accepted, and it is essential for safeguarding personal information during the verification process.

Required documents for the IRS verification form

When completing the IRS verification form, certain documents may be required to support your identity. These typically include:

- A copy of your most recent tax return.

- Your Social Security card or a document containing your Social Security number.

- Any correspondence from the IRS, such as the 5071C letter.

Having these documents ready can streamline the verification process and help ensure that your identity is confirmed without delays.

Filing deadlines for the IRS verification form

Filing deadlines for the IRS verification form can vary depending on the specific circumstances surrounding the 5071C letter. Generally, it is advisable to respond as soon as possible to avoid delays in processing your tax return or receiving any refunds. The IRS typically provides a timeline in the 5071C letter, and adhering to this timeline is essential for compliance.

IRS guidelines for the verification process

The IRS has established guidelines to ensure the verification process is secure and efficient. These guidelines include:

- Providing accurate and complete information on the verification form.

- Submitting the form within the timeframe specified in the 5071C letter.

- Using secure methods for submitting personal information, such as the IRS website.

Following these guidelines helps protect your identity and ensures that the IRS can effectively verify your information.

Quick guide on how to complete we verified your documents to support your identity theft irs gov

Complete We Verified Your Documents To Support Your Identity Theft IRS gov seamlessly on any device

Digital document management has gained immense traction among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents promptly without any holdups. Manage We Verified Your Documents To Support Your Identity Theft IRS gov on any device using airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign We Verified Your Documents To Support Your Identity Theft IRS gov effortlessly

- Acquire We Verified Your Documents To Support Your Identity Theft IRS gov and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent portions of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Verify all information and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign We Verified Your Documents To Support Your Identity Theft IRS gov to ensure superior communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the we verified your documents to support your identity theft irs gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS verification form and why is it important?

The IRS verification form is a document used to confirm your identity and verify your tax information with the IRS. It is crucial for maintaining compliance with tax regulations and safeguarding personal information during tax-related transactions.

-

How does airSlate SignNow simplify the process of completing the IRS verification form?

airSlate SignNow streamlines the process of filling out the IRS verification form by providing easy-to-use templates and electronic signature capabilities. This allows users to complete the form quickly, securely, and without the hassle of printing and scanning.

-

Are there any fees associated with using airSlate SignNow for the IRS verification form?

airSlate SignNow offers various pricing plans, including affordable options for small businesses and individuals. You can send and eSign your IRS verification form without high costs while benefiting from a reliable and efficient document management system.

-

What features does airSlate SignNow provide for managing IRS verification forms?

AirSlate SignNow includes features like customizable templates, real-time tracking, and secure cloud storage, all designed to improve the management of IRS verification forms. These features enhance workflow efficiency and ensure you can access your documents anytime.

-

Can I integrate airSlate SignNow with other applications for IRS verification forms?

Yes, airSlate SignNow offers integrations with various applications such as CRM systems, project management tools, and cloud storage providers. This allows for seamless handling of your IRS verification form alongside other important business processes.

-

Is airSlate SignNow compliant with security regulations for IRS verification forms?

Absolutely! airSlate SignNow adheres to stringent security protocols and compliance standards, ensuring that your IRS verification form and any sensitive information are protected. With features like encryption and secure access controls, you can trust in the safety of your documents.

-

How can airSlate SignNow improve the turnaround time for IRS verification forms?

By utilizing airSlate SignNow’s electronic signature capabilities and efficient workflow management features, businesses can signNowly reduce the turnaround time for IRS verification forms. This ensures that tax-related tasks are completed promptly and without unnecessary delays.

Get more for We Verified Your Documents To Support Your Identity Theft IRS gov

- The value of relationships form

- Trav retirement perspectives qualified plans form

- On the future metlife form

- Agenda louisiana state boxing and wrestling commission form

- Application form for registration the government of

- Sale agent contract template form

- Sale business contract template form

- Sale by owner contract template form

Find out other We Verified Your Documents To Support Your Identity Theft IRS gov

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer