IRC 7216 Consent to Use of Taxpayer Information 2015

What is the IRC 7216 Consent to Use of Taxpayer Information

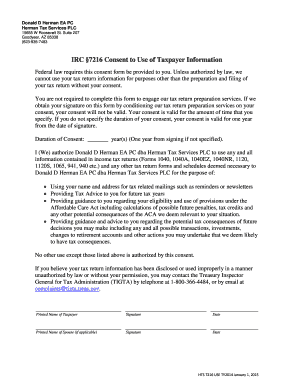

The IRC 7216 consent form is a legal document that allows tax preparers to use a taxpayer's information for purposes beyond the preparation of their tax return. This consent is essential for compliance with IRS regulations, ensuring that taxpayers are informed about how their personal data will be utilized. The form outlines the specific uses of taxpayer information, which can include sharing data with third parties or using it for marketing purposes. Understanding this consent is crucial for both taxpayers and tax professionals to maintain transparency and trust in the handling of sensitive information.

Steps to Complete the IRC 7216 Consent to Use of Taxpayer Information

Completing the IRC 7216 consent form involves several key steps to ensure that it is filled out correctly and complies with legal requirements. First, the taxpayer must review the consent form thoroughly to understand what information will be shared and for what purposes. Next, the taxpayer needs to provide their personal information, including their name, address, and Social Security number. After filling out the necessary details, the taxpayer should sign and date the form to indicate their consent. Finally, the completed form should be submitted to the tax preparer, who will keep it on file as required by law.

Legal Use of the IRC 7216 Consent to Use of Taxpayer Information

Legally, the IRC 7216 consent form must be used in accordance with IRS guidelines to protect taxpayer information. Tax preparers are required to obtain explicit consent before using taxpayer data for purposes not directly related to tax preparation. This legal framework ensures that taxpayers have control over their personal information and are aware of how it may be used. Non-compliance with these regulations can result in penalties for tax preparers, highlighting the importance of adhering to the legal requirements associated with the IRC 7216 consent.

Examples of Using the IRC 7216 Consent to Use of Taxpayer Information

There are various scenarios where the IRC 7216 consent form may be utilized. For instance, a tax preparer may seek consent to share a taxpayer's information with a financial institution for loan processing. Another example is when a tax preparer wants to use taxpayer data for marketing purposes, such as informing clients about new tax services or products. These examples illustrate the diverse applications of the consent form, emphasizing the need for clear communication between tax preparers and taxpayers regarding the use of sensitive information.

Filing Deadlines / Important Dates

Filing deadlines for the IRC 7216 consent form coincide with the tax preparation timeline. Taxpayers should ensure that the consent form is completed and submitted to their tax preparer well before the tax filing deadline, which is typically April fifteenth for individual tax returns. It is advisable to allow ample time for any necessary discussions about the use of taxpayer information. Keeping track of these important dates helps ensure compliance and facilitates a smoother tax preparation process.

Required Documents

To complete the IRC 7216 consent form, certain documents are typically required. Taxpayers should have their previous year's tax return, Social Security card, and any relevant financial documents on hand. These documents help ensure that the information provided on the consent form is accurate and complete. Having the necessary documentation readily available can streamline the process and reduce the likelihood of errors during tax preparation.

Quick guide on how to complete irc 7216 consent to use of taxpayer information

Complete IRC 7216 Consent To Use Of Taxpayer Information effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage IRC 7216 Consent To Use Of Taxpayer Information on any platform with airSlate SignNow's Android or iOS applications and enhance your document-centric operations today.

The easiest way to alter and eSign IRC 7216 Consent To Use Of Taxpayer Information with ease

- Locate IRC 7216 Consent To Use Of Taxpayer Information and click Get Form to begin.

- Use the tools we offer to complete your document.

- Identify important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your edits.

- Choose your preferred method to deliver your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign IRC 7216 Consent To Use Of Taxpayer Information and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irc 7216 consent to use of taxpayer information

Create this form in 5 minutes!

How to create an eSignature for the irc 7216 consent to use of taxpayer information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Form 7216 PDF and how is it used?

A Form 7216 PDF is a document utilized for consent to disclose tax return information. This form is particularly important for tax professionals who need authorization to share client tax details. Using airSlate SignNow, businesses can effortlessly create, send, and sign this form electronically.

-

How can I obtain a Form 7216 PDF?

You can easily download a Form 7216 PDF template from the IRS website or create one using airSlate SignNow's document templates. Our platform allows for customization, ensuring that your form meets all necessary requirements while maintaining compliance. This simplifies the process, making it accessible and straightforward.

-

What features does airSlate SignNow offer for handling Form 7216 PDF?

airSlate SignNow offers a variety of features tailored for managing Form 7216 PDF, including customizable templates, eSignature capabilities, and secure storage. With an intuitive interface, you can drag and drop signature fields, set signing orders, and track document status. These features enhance efficiency and streamline your workflow.

-

Is airSlate SignNow affordable for small businesses needing Form 7216 PDF?

Yes, airSlate SignNow provides cost-effective pricing plans suitable for small businesses that require the Form 7216 PDF. Our subscription options are flexible and ensure you only pay for the features you need. Additionally, the time and resources saved using our platform can lead to signNow cost savings in the long run.

-

Can I integrate airSlate SignNow with other software for Form 7216 PDF management?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions such as CRMs and document management systems, making it easy to incorporate Form 7216 PDF into your existing workflow. This integration optimizes your processes and reduces the need for switching between multiple applications.

-

What are the benefits of using airSlate SignNow for Form 7216 PDF?

Using airSlate SignNow for your Form 7216 PDF ensures a more efficient signing process and enhanced document security. With eSignatures, you signNowly reduce the turnaround time while maintaining compliance and accuracy. Additionally, our platform allows for tracking and reminders, keeping all parties informed.

-

Is it legal to use electronic signatures on Form 7216 PDF?

Yes, electronic signatures are legally recognized for Form 7216 PDF when used through a compliant eSignature platform like airSlate SignNow. Our service adheres to federal regulations ensuring your signed documents are valid and enforceable. Electronic signatures enhance convenience without compromising legality.

Get more for IRC 7216 Consent To Use Of Taxpayer Information

- Tacs request form osf saint francis medical center osfsaintfrancis

- Lafayette la birth announcements form

- Mckesson credit application pdf form

- Holy cross senior fit form

- Kernan hospital volunteer application form

- Medical release form johns hopkins medicine hopkinsmedicine

- Mwph therapeutic recreation application pdf form

- Physical sheet 2010 form

Find out other IRC 7216 Consent To Use Of Taxpayer Information

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation