Form 8866 2017-2026

What is the Form 8866

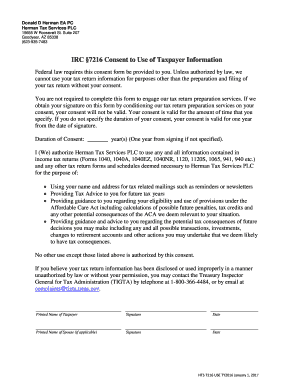

The Form 8866, also known as the taxpayer consent form, is a document used by taxpayers to provide consent for certain disclosures related to their tax information. This form is particularly relevant for those who need to authorize the release of their tax data to third parties, such as financial institutions or tax professionals. It ensures that the taxpayer's information is handled in compliance with privacy regulations while allowing necessary access for processing tax-related matters.

How to obtain the Form 8866

To obtain the Form 8866, taxpayers can visit the official IRS website, where the form is available for download in PDF format. Additionally, taxpayers may request a physical copy of the form by contacting the IRS directly or by visiting a local IRS office. It is important to ensure that you are using the most current version of the form to avoid any issues during submission.

Steps to complete the Form 8866

Completing the Form 8866 involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Clearly indicate the purpose of the consent by specifying the third party to whom the information will be disclosed.

- Provide any additional details required, such as the specific tax years or types of information being authorized for release.

- Sign and date the form to validate your consent.

Ensure that all information is accurate to prevent delays in processing.

Legal use of the Form 8866

The Form 8866 is legally binding and must be used in accordance with IRS guidelines. Taxpayers should only provide consent for disclosures that are necessary and relevant to their tax situation. Misuse of this form, such as providing consent for unauthorized parties or for purposes outside of tax processing, can lead to legal repercussions. It is advisable to consult with a tax professional if there are any uncertainties regarding the use of this form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8866 may vary depending on the specific circumstances of the taxpayer. Generally, it is advisable to submit the form as soon as the need for disclosure arises. Taxpayers should be aware of the annual tax filing deadlines, as any delays in submitting the form could impact their ability to authorize disclosures in a timely manner. Keeping track of important dates ensures compliance with IRS regulations.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Form 8866 can result in significant penalties. Taxpayers who do not obtain proper consent before disclosing tax information may face fines or legal action. Additionally, unauthorized disclosures can lead to complications in tax processing, potentially resulting in audits or other enforcement actions by the IRS. It is crucial to adhere strictly to the guidelines provided with the form.

Quick guide on how to complete form 8866

Complete Form 8866 seamlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Form 8866 on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The simplest way to modify and eSign Form 8866 effortlessly

- Locate Form 8866 and click on Get Form to start.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to save your changes.

- Select how you wish to share your form: via email, SMS, a link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from your preferred device. Modify and eSign Form 8866 and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8866

Create this form in 5 minutes!

How to create an eSignature for the form 8866

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is irc 7216 and how does it relate to airSlate SignNow?

irc 7216 is a standard that outlines the best practices for electronic signatures. airSlate SignNow complies with irc 7216, ensuring that your eSigning process is secure, legally binding, and efficient. By adhering to this standard, we provide our users with peace of mind when sending and signing documents.

-

How much does airSlate SignNow cost for businesses looking to implement irc 7216?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses of all sizes. Our plans are designed to be cost-effective while ensuring compliance with irc 7216. You can choose a plan that fits your budget and requirements, with options for monthly or annual billing.

-

What features does airSlate SignNow offer that support irc 7216 compliance?

airSlate SignNow includes features such as secure document storage, audit trails, and customizable templates that align with irc 7216 standards. These features enhance the security and efficiency of your eSigning process, making it easier to manage documents while ensuring compliance with industry regulations.

-

What are the benefits of using airSlate SignNow for irc 7216 compliant eSigning?

Using airSlate SignNow for irc 7216 compliant eSigning streamlines your document workflow, reduces turnaround times, and enhances security. Our platform is user-friendly, allowing you to send and sign documents quickly while ensuring that all signatures are legally binding and compliant with irc 7216.

-

Can airSlate SignNow integrate with other software while maintaining irc 7216 compliance?

Yes, airSlate SignNow offers seamless integrations with various software applications, ensuring that your eSigning process remains compliant with irc 7216. Whether you use CRM systems, project management tools, or cloud storage services, our integrations help you maintain a smooth workflow without compromising on compliance.

-

Is airSlate SignNow suitable for small businesses needing irc 7216 compliance?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses that require irc 7216 compliance. Our affordable pricing plans and user-friendly interface make it easy for small businesses to implement secure eSigning solutions without the need for extensive resources.

-

How does airSlate SignNow ensure the security of documents signed under irc 7216?

airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect documents signed under irc 7216. Our platform ensures that all data is stored securely and that only authorized users can access sensitive information, providing a safe environment for your eSigning needs.

Get more for Form 8866

Find out other Form 8866

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe