Form 2 Revised Intuit Benefits

What is the Form 2 Revised Intuit Benefits

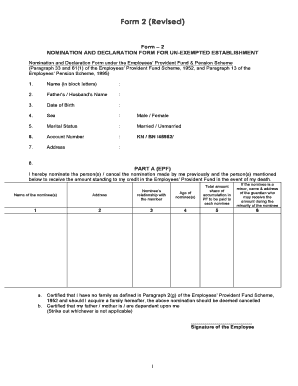

The Form 2 Revised Intuit Benefits is a document designed to provide individuals and businesses with a clear outline of the benefits associated with using Intuit products. This form is essential for understanding various advantages, including tax deductions, software compatibility, and enhanced financial management capabilities. It serves as a resource for users to navigate their options effectively, ensuring they can maximize their benefits while using Intuit's services.

How to use the Form 2 Revised Intuit Benefits

Using the Form 2 Revised Intuit Benefits involves several straightforward steps. First, ensure you have the most recent version of the form, which can be obtained from official sources. Next, carefully read through the sections detailing the benefits provided. Fill out the required information accurately, as this will help in identifying the specific advantages applicable to your situation. Finally, keep a copy for your records and consult with a financial advisor if needed to understand the implications of the benefits listed.

Steps to complete the Form 2 Revised Intuit Benefits

Completing the Form 2 Revised Intuit Benefits requires attention to detail. Follow these steps:

- Obtain the latest version of the form from a reliable source.

- Review the instructions carefully to understand what information is required.

- Fill in your personal or business details as prompted.

- Provide any necessary documentation that supports your claims for benefits.

- Double-check all entries for accuracy before submission.

Legal use of the Form 2 Revised Intuit Benefits

The legal use of the Form 2 Revised Intuit Benefits is governed by various regulations that ensure its validity. To be legally binding, the form must be filled out in compliance with applicable laws, including tax regulations. It is crucial to ensure that all information provided is truthful and accurate to avoid any legal repercussions. Consulting with a legal professional can provide additional assurance that the form meets all necessary legal standards.

Key elements of the Form 2 Revised Intuit Benefits

Key elements of the Form 2 Revised Intuit Benefits include:

- Identification of the user, whether an individual or business entity.

- A detailed list of benefits associated with Intuit products.

- Instructions for claiming these benefits effectively.

- Any required documentation to substantiate claims.

- Contact information for further assistance or clarification.

Examples of using the Form 2 Revised Intuit Benefits

Examples of using the Form 2 Revised Intuit Benefits can vary based on individual or business needs. For instance, a self-employed individual might use the form to identify tax deductions related to software expenses. A small business could leverage the form to outline the benefits of using Intuit's accounting software, helping them streamline their financial processes. Each example highlights the practical application of the form in real-world scenarios.

Quick guide on how to complete form 2 revised intuit benefits

Effortlessly Prepare Form 2 Revised Intuit Benefits on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides all the resources you need to create, edit, and electronically sign your documents quickly and smoothly. Manage Form 2 Revised Intuit Benefits on any device using the airSlate SignNow apps for Android or iOS, and streamline your document-related tasks today.

The Easiest Way to Edit and eSign Form 2 Revised Intuit Benefits with Minimal Effort

- Obtain Form 2 Revised Intuit Benefits and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or conceal sensitive information using specific tools that airSlate SignNow provides for this purpose.

- Create your eSignature with the Sign feature, which only takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 2 Revised Intuit Benefits to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2 revised intuit benefits

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key intuit benefits of using airSlate SignNow?

The key intuit benefits of using airSlate SignNow include streamlined document management, enhanced security, and improved workflow efficiency. This platform allows businesses to quickly eSign documents and manage them all in one place, making it easier for teams to collaborate and track their progress.

-

How does airSlate SignNow's pricing structure work?

airSlate SignNow offers a variety of pricing plans to cater to different business needs, ensuring you can find an option that aligns with your budget. With affordable monthly and annual subscriptions, the intuit benefits include access to all essential features without hidden costs, allowing businesses to maximize their investment.

-

What features does airSlate SignNow offer that highlight intuit benefits?

airSlate SignNow provides a range of features that showcase intuit benefits, such as customizable templates, in-person signing options, and robust API integrations. These features ensure that businesses can create efficient workflows, save time, and enhance customer satisfaction.

-

Can airSlate SignNow integrate with other software platforms?

Yes, airSlate SignNow can seamlessly integrate with various software platforms, amplifying its intuit benefits. This capability allows businesses to streamline their processes, synchronize data, and improve overall productivity by connecting with tools like CRM systems and cloud storage services.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely, airSlate SignNow prioritizes security and offers advanced measures such as encryption and secure access controls. These intuit benefits ensure that sensitive documents are safely handled, providing peace of mind to businesses concerned about data protection.

-

What types of businesses can benefit from airSlate SignNow?

airSlate SignNow caters to a diverse range of businesses, from startups to large enterprises, providing various intuit benefits suitable for any size. Whether you need to streamline contracts, onboarding documents, or approvals, SignNow can enhance efficiency across different sectors.

-

How can airSlate SignNow improve team collaboration?

With features that allow multiple users to access, comment on, and sign documents concurrently, airSlate SignNow signNowly enhances team collaboration. The intuit benefits of this approach include reduced delays in decision-making and improved workflow transparency, leading to faster project completion.

Get more for Form 2 Revised Intuit Benefits

- Plainfield fire protection district state of illinois form

- Calpers ca gov forms

- Www alpinefire org files 4a4835c93invites applications for firefighteremt application period form

- City services and departments city of piedmont form

- Sonoma valley 630 2 street west fire ampamp rescue authority form

- Application for employment pala band of mission indians form

- Personnel office schell vista fire protection district use form

- Contact us tiburon fire protection district form

Find out other Form 2 Revised Intuit Benefits

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online