Sales Tax Form

What is the Sales Tax Form

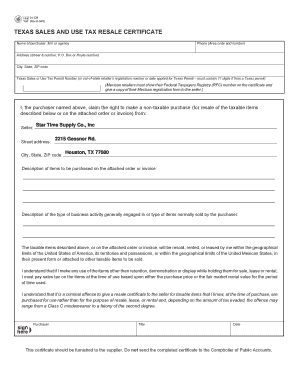

The sales tax form in Texas is a crucial document used by businesses to report and remit sales tax collected from customers. This form is essential for compliance with state tax regulations and helps ensure that businesses fulfill their tax obligations. The Texas sales tax form typically includes information about the total sales made, the amount of tax collected, and any deductions or exemptions that may apply.

How to Obtain the Sales Tax Form

Businesses can obtain the sales tax form in Texas through the Texas Comptroller of Public Accounts website. The form is available for download in a printable format, allowing businesses to fill it out manually or electronically. Additionally, businesses can request a physical copy by contacting the Comptroller's office directly. It is important to ensure that you are using the most current version of the form to comply with state regulations.

Steps to Complete the Sales Tax Form

Completing the sales tax form involves several key steps:

- Gather all necessary sales records, including invoices and receipts.

- Calculate the total sales amount for the reporting period.

- Determine the total sales tax collected based on applicable rates.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions before submission.

Legal Use of the Sales Tax Form

The sales tax form must be used in accordance with Texas state laws to ensure its legal validity. This includes accurate reporting of sales and tax amounts, as well as adherence to deadlines for submission. Failure to comply with these regulations can result in penalties or fines. It is advisable for businesses to maintain thorough records and consult with a tax professional if they have questions about legal compliance.

Form Submission Methods

Businesses can submit the sales tax form in Texas through various methods:

- Online submission through the Texas Comptroller's eSystems, which allows for quick processing.

- Mailing a physical copy of the completed form to the designated address provided by the Comptroller's office.

- In-person submission at local Comptroller offices, if preferred.

Penalties for Non-Compliance

Failure to file the sales tax form or remit the correct amount of tax can lead to significant penalties. These may include:

- Late fees based on the amount of tax owed.

- Interest charges on unpaid tax amounts.

- Potential legal action for persistent non-compliance.

It is essential for businesses to stay informed about their filing requirements and deadlines to avoid these consequences.

Quick guide on how to complete sales tax form 84376983

Effortlessly Prepare Sales Tax Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal sustainable alternative to conventional printed and signed documents, allowing you to easily locate the appropriate form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Sales Tax Form on any device using airSlate SignNow mobile applications for Android or iOS, and streamline any document-related task today.

The simplest way to edit and electronically sign Sales Tax Form effortlessly

- Obtain Sales Tax Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Sales Tax Form to ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales tax form 84376983

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sales tax form Texas, and why is it important?

A sales tax form Texas is a document used by businesses to report and pay sales tax collected from customers to the state of Texas. It is important for compliance with state tax laws and helps ensure businesses avoid penalties for non-compliance.

-

How can airSlate SignNow help with sales tax form Texas submissions?

airSlate SignNow streamlines the signing and submission of your sales tax form Texas. With features like eSignature and document management, businesses can easily prepare and send their forms securely and efficiently.

-

Is airSlate SignNow affordable for small businesses needing to file a sales tax form Texas?

Yes, airSlate SignNow offers a cost-effective solution perfect for small businesses. Our pricing plans are designed to fit various budgets, ensuring that filing your sales tax form Texas doesn’t break the bank.

-

What features does airSlate SignNow offer for handling sales tax form Texas?

airSlate SignNow includes features such as customizable templates, secure eSigning, and automated reminders, specifically tailored for managing your sales tax form Texas efficiently. These tools simplify the process, ensuring accuracy and timely submissions.

-

Can airSlate SignNow integrate with other software for sales tax form Texas management?

Absolutely! airSlate SignNow offers integrations with various accounting and business management software, enabling seamless workflow when handling your sales tax form Texas. This connectivity helps keep your financial data organized and easily accessible.

-

How secure is airSlate SignNow for sending sales tax form Texas?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and authentication measures, ensuring your sales tax form Texas is sent and stored securely, protecting sensitive information from unauthorized access.

-

How can I track the status of my sales tax form Texas using airSlate SignNow?

With airSlate SignNow, you can easily track the status of your sales tax form Texas submissions through our user-friendly dashboard. You'll receive notifications once documents are signed, helping you stay updated on the submission process.

Get more for Sales Tax Form

- Tow authorization form

- Motion to set aside default judgment nmsupremecourt nmcourts form

- 4a 204 new mexico supreme court nmsupremecourt nmcourts form

- Petetion 4a 103 new mexico form

- Dld60 form

- Seasonal influenza attestationdeclination form broward health browardhealth

- Emacs psychiatry referral form regions hospital

- Volunteer hours form

Find out other Sales Tax Form

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile