W 3n Form

What is the W-3N?

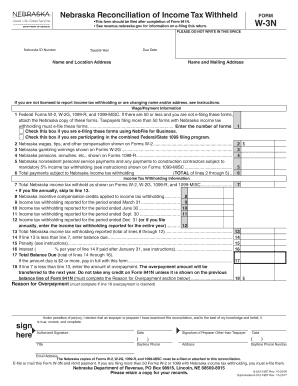

The W-3N is a form used by employers in Nebraska to report wages paid to employees and the associated state income tax withheld. This form is essential for ensuring compliance with state tax regulations. It serves as a summary of all W-2 forms issued by an employer during the tax year. The Nebraska Department of Revenue requires this form to facilitate the accurate reporting of income and tax withholdings to the state.

How to use the W-3N

To use the W-3N effectively, employers must first complete the individual W-2 forms for each employee. Once all W-2 forms are finalized, the information is aggregated on the W-3N. This includes total wages, tips, and other compensation, as well as the total state income tax withheld. The completed W-3N is then submitted to the Nebraska Department of Revenue, along with copies of the W-2 forms. This process ensures that the state has accurate records of employee earnings and withholdings.

Steps to complete the W-3N

Completing the W-3N involves several key steps:

- Gather all W-2 forms for your employees for the tax year.

- Calculate the total wages, tips, and other compensation for all employees.

- Determine the total state income tax withheld for the same period.

- Fill out the W-3N form with the aggregated data from the W-2 forms.

- Review the form for accuracy and ensure all required information is included.

- Submit the completed W-3N along with the W-2 forms to the Nebraska Department of Revenue by the specified deadline.

Legal use of the W-3N

The W-3N must be used in accordance with Nebraska state law. It is legally binding when filled out accurately and submitted on time. Employers are responsible for ensuring that all information provided is correct to avoid penalties or legal issues. The form must be filed annually, and failure to do so can result in fines or other consequences from the Nebraska Department of Revenue.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines for filing the W-3N. Typically, the form is due by January thirty-first of the year following the tax year being reported. It is crucial to submit the W-3N and accompanying W-2 forms on time to avoid penalties. Employers should also keep track of any changes in deadlines announced by the Nebraska Department of Revenue, as these can vary from year to year.

Form Submission Methods (Online / Mail / In-Person)

The W-3N can be submitted to the Nebraska Department of Revenue through various methods. Employers may choose to file the form online via the department's e-filing system, which is often the fastest and most efficient method. Alternatively, the form can be mailed to the designated address provided by the department. In-person submissions may also be possible at local offices, but it is advisable to check ahead for specific requirements and hours of operation.

Quick guide on how to complete w 3n 462486136

Fill out W 3n effortlessly on any device

Digital document management has gained signNow traction among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, edit, and electronically sign your documents quickly and efficiently. Manage W 3n on any device using the airSlate SignNow Android or iOS applications and enhance your document-related workflows today.

How to amend and electronically sign W 3n without any hassle

- Locate W 3n and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as an ink signature.

- Review all the details and then click on the Done button to retain your changes.

- Select your preferred method for sending your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow manages all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign W 3n to ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w 3n 462486136

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nebraska Department of Revenue fill in W 3N form?

The Nebraska Department of Revenue fill in W 3N form is a tax reporting document that employers use to summarize annual wage information. It’s essential for accurate income reporting to ensure compliance with state tax regulations. Using airSlate SignNow, you can easily fill in and eSign this form digitally, streamlining the process.

-

How can airSlate SignNow help with filling out the Nebraska Department of Revenue W 3N?

airSlate SignNow simplifies the process of filling out the Nebraska Department of Revenue W 3N form by providing an intuitive interface for entering data. With our eSignature feature, you can quickly sign and submit the form electronically, ensuring you meet deadlines while maintaining compliance.

-

Is airSlate SignNow cost-effective for businesses needing to fill in the W 3N form?

Yes, airSlate SignNow offers cost-effective solutions for businesses that need to fill in the W 3N form. Our tiered pricing plans cater to businesses of all sizes, allowing you to select a plan that fits your budget while benefiting from an efficient document management system.

-

What features does airSlate SignNow provide to assist with tax document management?

airSlate SignNow includes features like templates for the Nebraska Department of Revenue fill in W 3N form, eSignature capabilities, and secure cloud storage. These features streamline your document workflow, saving you time and reducing the risk of errors in tax submissions.

-

Can I integrate airSlate SignNow with other applications for tax processing?

Yes, airSlate SignNow allows seamless integrations with various applications like accounting software, CRM systems, and more. This integration capability means you can manage the entire process of preparing the Nebraska Department of Revenue fill in W 3N form alongside other financial operations in one platform.

-

How does airSlate SignNow ensure the security of documents like the W 3N form?

With airSlate SignNow, security is a top priority. Our platform employs end-to-end encryption and ensures that sensitive documents, including the Nebraska Department of Revenue fill in W 3N form, are stored securely and only accessible to authorized users.

-

What are the benefits of using airSlate SignNow for tax-related forms?

Using airSlate SignNow for tax-related forms like the Nebraska Department of Revenue fill in W 3N can greatly enhance your productivity. The platform allows for quick edits, easy sharing, and electronic signing, all of which reduce turnaround time and improve accuracy in your tax submissions.

Get more for W 3n

Find out other W 3n

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed