4506t Ez Rev January Form

What is the 4506t Ez Rev January Form

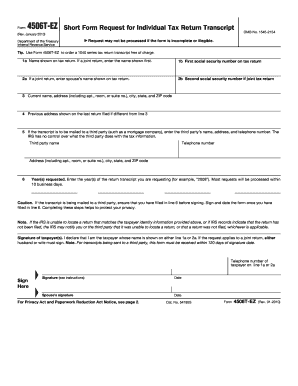

The 4506-T EZ Rev January Form is a simplified version of the IRS form used by taxpayers to request a transcript of their tax return information. This form is particularly useful for individuals who need to provide proof of income or tax filing status for various purposes, such as applying for loans or financial aid. The EZ version streamlines the process, making it easier for taxpayers to obtain their information without the complexities of the standard 4506-T form.

How to use the 4506t Ez Rev January Form

Using the 4506-T EZ Rev January Form involves several straightforward steps. First, download the form from the IRS website or obtain a copy from a tax professional. Next, fill in your personal information, including your name, Social Security number, and address. Indicate the type of transcript you are requesting and the tax years needed. Finally, sign and date the form before submitting it to the IRS, either by mail or electronically, depending on the submission methods available.

Steps to complete the 4506t Ez Rev January Form

Completing the 4506-T EZ Rev January Form requires attention to detail. Follow these steps for accurate completion:

- Download the form from the IRS website.

- Provide your full name, Social Security number, and address in the designated fields.

- Select the type of transcript you need, such as a tax return transcript or account transcript.

- Specify the tax years for which you are requesting transcripts.

- Sign and date the form, confirming that the information provided is accurate.

- Submit the form via your chosen method, ensuring it reaches the IRS in a timely manner.

Legal use of the 4506t Ez Rev January Form

The 4506-T EZ Rev January Form is legally recognized for obtaining tax transcripts, which can be essential for various legal and financial transactions. It is crucial to complete the form accurately and submit it through proper channels to ensure compliance with IRS regulations. Misuse of the form or providing false information can lead to penalties, including fines or legal action.

IRS Guidelines

The IRS provides specific guidelines for using the 4506-T EZ Rev January Form. Taxpayers should ensure they are using the most current version of the form and follow all instructions carefully. The IRS recommends checking the status of your request after submission, as processing times can vary. Understanding these guidelines helps ensure that requests are handled efficiently and correctly.

Required Documents

When submitting the 4506-T EZ Rev January Form, certain documents may be required to verify your identity. Typically, you will need to provide a valid form of identification, such as a driver's license or state ID. Additionally, if you are requesting transcripts for a business, you may need to include documentation proving your relationship to the business, such as a partnership agreement or corporate resolution.

Quick guide on how to complete 4506t ez rev january form

Complete 4506t Ez Rev January Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Handle 4506t Ez Rev January Form on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-focused process today.

The easiest way to edit and eSign 4506t Ez Rev January Form without hassle

- Obtain 4506t Ez Rev January Form and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools offered by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as an old-fashioned wet ink signature.

- Review the details and then click the Done button to save your edits.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any preferred device. Edit and eSign 4506t Ez Rev January Form and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 4506t ez rev january form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 4506t Ez Rev January Form?

The 4506t Ez Rev January Form is a simplified version of the 4506-T form, allowing users to request a transcript of their tax return information from the IRS. It is specifically designed to streamline the process for businesses needing quick access to tax data for loan or verification purposes. Understanding how to utilize this form effectively can enhance your workflow and efficiency.

-

How can airSlate SignNow help with the 4506t Ez Rev January Form?

airSlate SignNow simplifies the process of sending and eSigning documents like the 4506t Ez Rev January Form. By utilizing our platform, businesses can easily manage this form digitally, reducing paper usage and improving document turnaround times. Our intuitive interface ensures that signing and sending this form is both efficient and secure.

-

Is there a cost associated with using the 4506t Ez Rev January Form on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, including features for handling the 4506t Ez Rev January Form. Our plans are designed to be cost-effective, offering flexibility based on the volume of documents processed. Evaluate our pricing tiers to find the one that best suits your organization.

-

What features does airSlate SignNow offer for the 4506t Ez Rev January Form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for forms like the 4506t Ez Rev January Form. These tools enhance user experience, ensuring that you can manage your tax transcript requests smoothly. Automating these processes can save time and reduce errors.

-

How does eSigning the 4506t Ez Rev January Form ensure security?

eSigning the 4506t Ez Rev January Form through airSlate SignNow employs advanced encryption methods and complies with legal standards for electronic signatures. This ensures that your documents are secure and verifiable upon submission. By using our platform, you can have peace of mind knowing your sensitive information is protected.

-

Can I integrate airSlate SignNow with other applications for handling the 4506t Ez Rev January Form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing seamless workflows when managing the 4506t Ez Rev January Form. This capability enhances productivity as you can connect our eSigning solution with your favorite CRM, document management, and accounting systems.

-

What are the benefits of using airSlate SignNow for the 4506t Ez Rev January Form?

Using airSlate SignNow for the 4506t Ez Rev January Form enhances efficiency, reduces costs, and improves document management. Our platform simplifies the process of obtaining required tax information, ensuring you have the right data when needed. This results in quicker processing times and better overall customer satisfaction.

Get more for 4506t Ez Rev January Form

Find out other 4506t Ez Rev January Form

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation