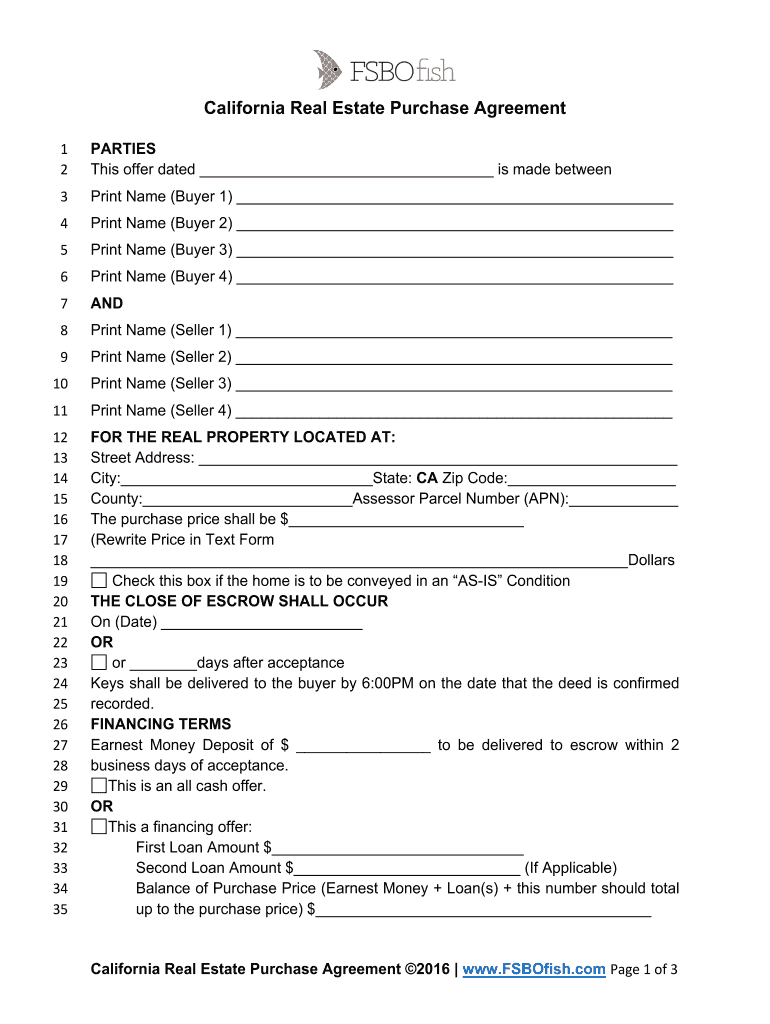

California Real Estate Sale Agreement Fsbofish Com Form

Key elements of the California Real Estate Sale Agreement

The California Real Estate Sale Agreement, often utilized in for sale by owner transactions, includes several essential components that ensure clarity and legal validity. Key elements typically encompass:

- Parties Involved: Clearly identify the seller and buyer, including their legal names and contact information.

- Property Description: Provide a detailed description of the property, including the address, legal description, and any included fixtures or personal property.

- Purchase Price: State the agreed-upon purchase price and any deposit amounts, along with the payment method.

- Contingencies: Outline any conditions that must be met for the sale to proceed, such as financing, inspections, or the sale of another property.

- Closing Date: Specify the date when the transaction will be finalized and ownership transferred.

- Signatures: Ensure all parties sign and date the agreement to validate it legally.

Steps to complete the California Real Estate Sale Agreement

Completing the California Real Estate Sale Agreement involves several straightforward steps to ensure that all necessary information is accurately captured. Follow these steps for a smooth process:

- Gather Information: Collect all relevant details about the property, including legal descriptions and any disclosures required by California law.

- Fill Out the Agreement: Complete the form with the necessary information about the buyer, seller, and property details.

- Review Contingencies: Discuss and include any contingencies that may affect the sale, ensuring both parties are in agreement.

- Negotiate Terms: If necessary, negotiate terms such as the purchase price and closing date to reach a mutual agreement.

- Sign the Agreement: Both parties should sign and date the document, ensuring that it is legally binding.

Legal use of the California Real Estate Sale Agreement

The California Real Estate Sale Agreement serves as a legally binding contract between the buyer and seller. For it to be enforceable, certain legal requirements must be met:

- Written Agreement: California law requires real estate contracts to be in writing to be enforceable.

- Capacity: Both parties must have the legal capacity to enter into a contract, meaning they are of legal age and sound mind.

- Consideration: There must be an exchange of value, typically the purchase price, for the agreement to be valid.

- Mutual Consent: Both parties must agree to the terms without coercion or undue influence.

Disclosure Requirements

In California, sellers are required to provide specific disclosures to buyers under state law. These disclosures help protect both parties and ensure transparency in the transaction. Key disclosures include:

- Transfer Disclosure Statement (TDS): A form that outlines the condition of the property and any known issues.

- Natural Hazard Disclosure (NHD): Information regarding the property's location in relation to natural hazards such as floods, earthquakes, or wildfires.

- Lead-Based Paint Disclosure: Required for homes built before 1978, informing buyers of potential lead hazards.

Examples of using the California Real Estate Sale Agreement

The California Real Estate Sale Agreement can be utilized in various scenarios, particularly in for sale by owner transactions. Examples include:

- Direct Sales: Homeowners selling their property directly to buyers without a real estate agent.

- Investment Properties: Investors purchasing residential or commercial properties directly from sellers.

- Family Transfers: Family members selling property to each other, where a formal agreement helps clarify terms and conditions.

Quick guide on how to complete california real estate sale agreement fsbofishcom

Effortlessly Prepare California Real Estate Sale Agreement Fsbofish com on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and efficiently. Handle California Real Estate Sale Agreement Fsbofish com on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Edit and Electronically Sign California Real Estate Sale Agreement Fsbofish com Without Any Hassle

- Find California Real Estate Sale Agreement Fsbofish com and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Leave behind concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign California Real Estate Sale Agreement Fsbofish com and guarantee effective communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How come real estate sales went from their older forms to the organized profession it is now?

It's different from every country, but the main denominator is money.To make more money, the old forms for selling had to be organized.Real estate involves huge sums of money for all parties included in a particular transaction. From the main players (buyers, seller, brokers, agents) to the support players (mortgage firms, construction companies, pest control, maintenance, etc) down to the government agencies (taxes bureaus, local permits, etc).The old ways of selling had to be organized to realize more profit, keep the transaction secure and make the tax man happy.Listings and documentations had to be digitalised, real estate brokers and agents had to be professionalized and all financial transactions tracked and monitored.Anything that makes money in this world would always be organized (whether it be through laissez faire or its opposite, these things will organize themselves in one form or another). That's how things work.

-

How hard is it to get out of a real estate listing agreement if you believe your realtor isn’t doing a good job?

Despite what the person said below It is not easy at all! It’s called a contract for a reason. If it were that easy to break, what would the point be of having a contract?So in order for you to be able to get out of the real estate contract, the other party has to let you out unless there is specific language that addresses your ability to escape.Most contracts are not set up that way. If the real estate agent/company is smart, however, they will not keep someone in a contract who is unhappy.The company could do more harm to themselves if you speak negatively about them than just being amenable to let you out.Here are some tips on how to fire a real estate agent that should prove helpful. Like Jay mentioned below, the contract is with the company and not the agent.

-

How much tax do I need to pay for rent out my real estate in California when I am a foreigner?

Sure, I can address. Here, I am assuming you rent out your house as a rental property as a full time rental. And, I am assuming you you do not spend substantial time in the US, and you do not have green card. So, you represent a non resident alien (“NRA”) for tax purposes under Section 7701(b)(1)(B).Under Section 871(b), a non resident person pays tax at graduated rates on his/her effectively connected income from a United States Trade or Business (“USTB”). For passive types of income a non resident pays a 30% withholding rate.Given the above, a NRA may have his/her rents (before any expenses) taxed at 30%. Or, Treasury provides an election where the rental real estate represents a USTB with effectively connected income under Section 871(d)(1)(A). By making this election, NRA can reduce rents by expenses and NRA gets taxed on rental profits only. We would make this election for clients by providing specific documentation as required by Treasury Regulation Section 1.871-10(a).If NRA sells the rental property at a later date, any gain on sales gets included in NRA’s taxable income under Section 897(a).NRA files a 1040 Non Resident tax return each year as required by Treasury Regulation Section 1.6012-1(b)(1)(i). In addition, NRA requires an Individual Tax Identification Number (“ITIN”) — we obtain this ITIN requiring proof of identity as part of filing the return.As a final note, we apply tax requirements first as we did above. Then, we look for any bilateral tax treaty between the US and NRA’s specific home country which may mitigate the tax results.However, treaties do not change the above results (Article 6, 7, and 13).And, NRA files a California income tax return and pays tax on the real estate profits and gain from a sale. As California taxes all non residents on his/her California source income of which the property represents such.I have included the above tax analysis based on the fact situation, if the fact change in any way, the tax results may change materially. www.rst.tax

-

How did the Federal Reserve move the bubble from dot com startups in California to real estates in Arizona during the 2000-06 period?

This is probably off target, but it is my opinion. Dot coma bubble burst leaving one less lucrative investment in the picture, so if the fed lowered interest rates to ease financial woes of those with big losses from the burst, (and I don't recall if they did lower the interest then...just guessing that they did) then it became easy to borrow. What better to use low interest borrowed funds for than houses...Investment houses that cost more than most can afford because people were approved for more mortgage than they could afford, and they wanted the biggest and best they could get. Since they were in reality over-extended, they began defaulting en mass. Thus, the burst real estate bubble. If the fed stayed out of the whole thing from the outset, and just let people take their lumps, the second bubble may have not formed and; consequently, not burst. I think quantitative easing is the manipulative tool we should blame. It artificially supports overspending growing the various bubbles in our economy until they signNow levels that are unsustainable and burst.

-

Can I pay an out of state real estate agent for a referral in California? If so, how much and does their broker have to be notified?

Referrals, like all payments are broker to broker, not agent to agent. This may sound like a technicality but it is the way it is.It really doesn’t matter if you are licensed in California and the referring broker is in California or in another state, the way it works is the same. The referring agent completes the referral agreement and gets it signed by his broker. He then sends it over to you. You will need to have your broker sign it before you can receive any payment.

Create this form in 5 minutes!

How to create an eSignature for the california real estate sale agreement fsbofishcom

How to make an electronic signature for your California Real Estate Sale Agreement Fsbofishcom in the online mode

How to make an electronic signature for your California Real Estate Sale Agreement Fsbofishcom in Google Chrome

How to make an electronic signature for signing the California Real Estate Sale Agreement Fsbofishcom in Gmail

How to create an electronic signature for the California Real Estate Sale Agreement Fsbofishcom straight from your mobile device

How to make an electronic signature for the California Real Estate Sale Agreement Fsbofishcom on iOS

How to make an electronic signature for the California Real Estate Sale Agreement Fsbofishcom on Android devices

People also ask

-

What is the paperwork for selling a house by owner?

The paperwork for selling a house by owner typically includes the sales agreement, disclosure forms, and other legal documents that outline the terms of the sale. These documents ensure that both parties understand their legal rights and responsibilities. Using airSlate SignNow can help you manage these documents electronically, making the signing process easier.

-

How can airSlate SignNow simplify the paperwork for selling a house by owner?

airSlate SignNow simplifies the paperwork for selling a house by owner by allowing you to create, send, and eSign documents online. This not only saves time but also reduces the risk of errors and ensures that all parties receive copies of signed documents instantly. With a user-friendly interface, you can efficiently manage your paperwork throughout the selling process.

-

What are the pricing plans for using airSlate SignNow for my paperwork?

airSlate SignNow offers various pricing plans designed to cater to different needs and budgets when dealing with paperwork for selling a house by owner. Plans typically include features like unlimited document signing, templates, and integration with other software. You can choose a plan that best fits your requirements without overspending.

-

Does airSlate SignNow offer template options for selling a house?

Yes, airSlate SignNow provides customizable templates specifically designed for the paperwork involved in selling a house by owner. These templates streamline the document creation process, allowing you to input essential information quickly. Having a structured template ensures that you cover all necessary legal elements, saving time and effort.

-

Are the documents created with airSlate SignNow legally binding?

Absolutely, documents signed through airSlate SignNow are legally binding. The platform complies with eSignature laws, ensuring that your paperwork for selling a house by owner holds up in court. It's essential to meet all legal requirements, and airSlate SignNow guarantees that your documents are valid and enforceable.

-

Can I integrate airSlate SignNow with other tools I use?

Yes, airSlate SignNow offers integrations with various applications to enhance your workflow when managing paperwork for selling a house by owner. Whether you use CRM systems, cloud storage services, or other business tools, these integrations ensure a seamless experience. This connectivity helps you maintain organized records and efficiently manage your transactions.

-

How secure is my paperwork when using airSlate SignNow?

The security of your paperwork for selling a house by owner is a top priority for airSlate SignNow. The platform employs advanced encryption and secure access protocols to protect your sensitive information. Regular security audits and compliance with data protection regulations further enhance the safety of your documents.

Get more for California Real Estate Sale Agreement Fsbofish com

Find out other California Real Estate Sale Agreement Fsbofish com

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document