1040x Fillable Form

What is the 1040x Fillable

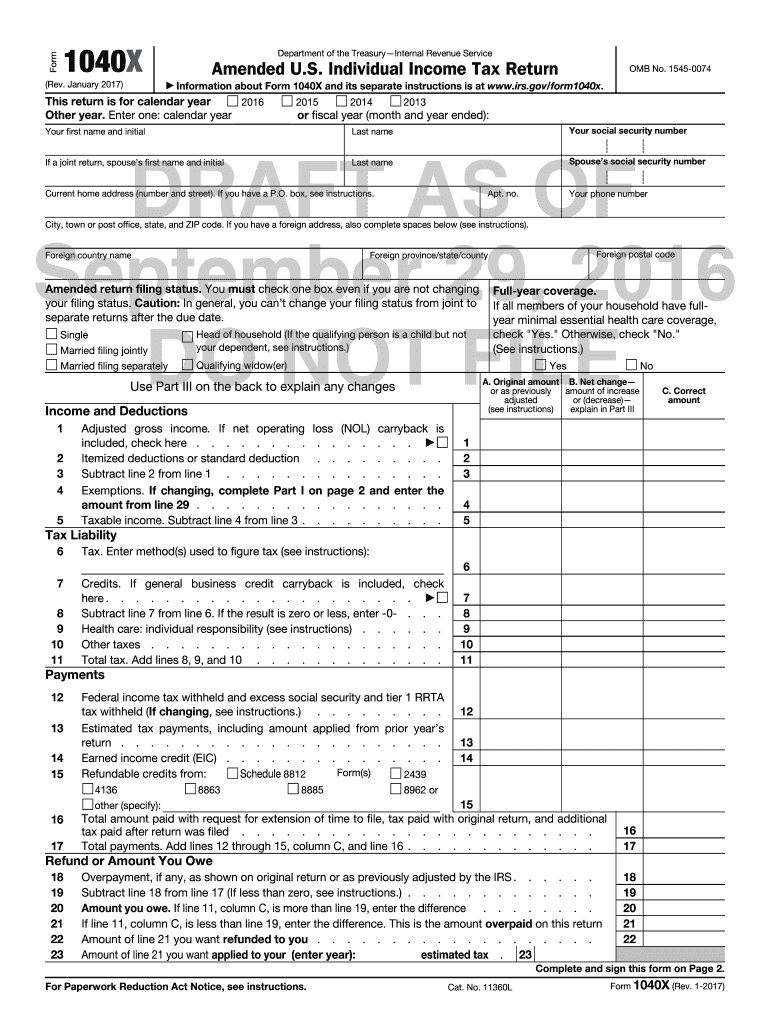

The 1040x fillable form is an amended U.S. individual income tax return used to correct errors on a previously filed Form 1040, 1040A, or 1040EZ. This form allows taxpayers to make adjustments to their income, deductions, or credits, ensuring their tax filings are accurate. It is essential for anyone who needs to rectify mistakes or claim additional deductions or credits that were not included in the original return.

How to use the 1040x Fillable

Using the 1040x fillable form is straightforward. Taxpayers can complete the form electronically, which simplifies the process. They should first download the fillable PDF version from the IRS website or a trusted source. After opening the form, users can enter their information directly into the fields provided. It's important to follow the instructions carefully, ensuring that all necessary sections are completed accurately. Once filled out, the form can be printed for submission or saved for electronic filing, depending on the requirements.

Steps to complete the 1040x Fillable

Completing the 1040x fillable form involves several key steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate the tax year you are amending, which in this case is 2017.

- Provide the original amounts from your previously filed return in the appropriate columns.

- Enter the corrected amounts in the designated areas, explaining each change in the space provided.

- Sign and date the form, ensuring that all information is accurate before submission.

Legal use of the 1040x Fillable

The 1040x fillable form is legally recognized as a valid method for amending tax returns in the United States. To ensure its legal standing, taxpayers must adhere to IRS guidelines regarding the completion and submission of the form. This includes providing accurate information and ensuring that the form is signed. Additionally, electronic signatures are accepted if the form is filed online, provided that the eSignature complies with relevant laws such as ESIGN and UETA.

Filing Deadlines / Important Dates

When amending a tax return using the 1040x fillable form, it is crucial to be aware of filing deadlines. Generally, taxpayers have three years from the original filing date to submit an amended return. For the 2017 tax year, this means that the deadline for filing the 1040x is typically April 15, 2021. However, if you are claiming a refund, it is advisable to file as soon as possible to ensure you receive any eligible amounts promptly.

Form Submission Methods (Online / Mail / In-Person)

The 1040x fillable form can be submitted in various ways, depending on how it is completed. If filled out electronically, taxpayers can e-file the form through IRS-approved software. Alternatively, if the form is printed after completion, it can be mailed to the appropriate IRS address based on the taxpayer's location. In-person submission is generally not available for amended returns, as the IRS encourages electronic filing for efficiency and accuracy.

Quick guide on how to complete form 1040x rev january 2017 amended us individual income tax return ftp irs

Easily Prepare 1040x Fillable on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage 1040x Fillable on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to Modify and eSign 1040x Fillable Effortlessly

- Find 1040x Fillable and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, and errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign 1040x Fillable and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Is the filing of Individual Income tax returns mandatory to claim Relief u/s 89(1) of the income tax act? Suppose I received arrears of 2014-15 in 2017-18, is ITR mandatory for 2014-15? Or is relief allowed by filing form 10E?

Its not mandatory to file ITR for 2014–15. However you need to consider the income of 2014–15, to calculate the relief u.s 89(1), basically the calculation is to consider the fact that had the amount been received in 2014–15, what would be tax liablity, and its not appropriate to pay the tax liablity on arrears received, considering it completely in 2017–18.For any further information you can ping me at sfstaxsolutions17@gmail.com

Create this form in 5 minutes!

How to create an eSignature for the form 1040x rev january 2017 amended us individual income tax return ftp irs

How to make an eSignature for your Form 1040x Rev January 2017 Amended Us Individual Income Tax Return Ftp Irs in the online mode

How to create an electronic signature for the Form 1040x Rev January 2017 Amended Us Individual Income Tax Return Ftp Irs in Chrome

How to make an eSignature for putting it on the Form 1040x Rev January 2017 Amended Us Individual Income Tax Return Ftp Irs in Gmail

How to create an electronic signature for the Form 1040x Rev January 2017 Amended Us Individual Income Tax Return Ftp Irs from your mobile device

How to generate an electronic signature for the Form 1040x Rev January 2017 Amended Us Individual Income Tax Return Ftp Irs on iOS

How to generate an electronic signature for the Form 1040x Rev January 2017 Amended Us Individual Income Tax Return Ftp Irs on Android devices

People also ask

-

What is a 1040x pdf and why do I need it?

A 1040x pdf is a form used to amend your individual income tax return. It allows you to correct mistakes or make changes to your original 1040 form. Utilizing a 1040x pdf is essential for ensuring that your tax information is accurate and up-to-date, which can prevent potential issues with the IRS.

-

How can airSlate SignNow assist with filling out a 1040x pdf?

airSlate SignNow simplifies the process of completing a 1040x pdf by providing intuitive document editing tools. Users can easily input their data, sign the document, and send it securely, all within a user-friendly interface. This streamlines the process of amending tax returns and ensures that your documents are completed accurately.

-

Is there a pricing option for using airSlate SignNow to handle 1040x pdf documents?

Yes, airSlate SignNow offers various pricing plans designed to meet different user needs, including those who require handling 1040x pdf documents. Our competitive pricing allows individuals and businesses to choose a plan that best suits their requirements without breaking the bank. You can check our pricing page for detailed options.

-

What features does airSlate SignNow offer for managing 1040x pdf files?

airSlate SignNow comes with features like eSignature capabilities, document templates, and secure sharing options that are particularly useful for managing 1040x pdf files. Additionally, our platform allows for real-time tracking of document status, ensuring you know exactly when your amendments are signed and submitted. These features enhance productivity and efficiency.

-

Can I integrate airSlate SignNow with other software when working with 1040x pdf?

Absolutely! airSlate SignNow offers seamless integrations with various software systems, making it easier to work with your 1040x pdf files. Whether you use accounting software or customer relationship management tools, our integration options enhance your overall workflow and ensure that all your documents are synchronized efficiently.

-

What are the benefits of using airSlate SignNow for 1040x pdf management?

Using airSlate SignNow for 1040x pdf management provides users with signNow benefits such as ease of use, time savings, and enhanced security. With our platform, you can quickly fill out, sign, and send your amendments without physical paperwork. Additionally, built-in encryption safeguards your personal information throughout the process.

-

Is electronic signing of the 1040x pdf legally recognized?

Yes, electronic signing of the 1040x pdf is legally recognized in the United States, provided that certain conditions are met. airSlate SignNow complies with all applicable federal and state laws regarding electronic signatures, ensuring that your signed 1040x pdf is valid and enforceable. This legal compliance facilitates a smoother amendment process.

Get more for 1040x Fillable

Find out other 1040x Fillable

- eSign Maryland Rental Invoice Template Now

- eSignature Utah Warranty Deed Free

- eSign Louisiana Assignment of intellectual property Fast

- eSign Utah Commercial Lease Agreement Template Online

- eSign California Sublease Agreement Template Safe

- How To eSign Colorado Sublease Agreement Template

- How Do I eSign Colorado Sublease Agreement Template

- eSign Florida Sublease Agreement Template Free

- How Do I eSign Hawaii Lodger Agreement Template

- eSign Arkansas Storage Rental Agreement Now

- How Can I eSign Texas Sublease Agreement Template

- eSign Texas Lodger Agreement Template Free

- eSign Utah Lodger Agreement Template Online

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template

- eSignature Illinois Postnuptial Agreement Template Easy

- eSignature Kentucky Postnuptial Agreement Template Computer

- How To eSign California Home Loan Application