Prime Contractors Exemption Certificate State Sd Form

What is the Prime Contractors Exemption Certificate State Sd

The Prime Contractors Exemption Certificate State Sd is a specific form used in South Dakota that allows contractors to purchase materials and supplies without paying sales tax. This exemption is particularly beneficial for contractors who are engaged in construction projects, as it helps reduce overall project costs. The certificate is issued to contractors who meet certain eligibility criteria, allowing them to claim exemption from sales tax on qualifying purchases directly related to their contracting work.

How to Obtain the Prime Contractors Exemption Certificate State Sd

To obtain the Prime Contractors Exemption Certificate State Sd, contractors must complete an application process that typically involves submitting specific documentation to the state tax authority. This may include proof of business registration, tax identification numbers, and any relevant licenses. Once the application is reviewed and approved, the contractor will receive the exemption certificate, which can then be used to make tax-exempt purchases.

Steps to Complete the Prime Contractors Exemption Certificate State Sd

Completing the Prime Contractors Exemption Certificate State Sd involves several key steps:

- Gather necessary information, including business details and tax identification numbers.

- Fill out the certificate form accurately, ensuring all required fields are completed.

- Sign and date the form to validate it.

- Submit the completed form to the appropriate vendor or supplier when making purchases.

Legal Use of the Prime Contractors Exemption Certificate State Sd

The legal use of the Prime Contractors Exemption Certificate State Sd is essential for ensuring compliance with state tax laws. Contractors must use the certificate only for eligible purchases related to their contracting work. Misuse of the exemption certificate, such as using it for personal purchases or non-qualifying items, can result in penalties, including fines and tax liabilities.

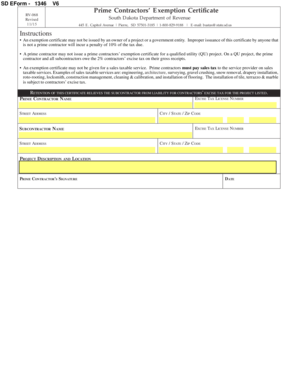

Key Elements of the Prime Contractors Exemption Certificate State Sd

Key elements of the Prime Contractors Exemption Certificate State Sd include:

- The contractor's name and business information.

- A statement declaring the intent to use the certificate for tax-exempt purchases.

- Details about the specific materials or supplies being purchased.

- Signature of the contractor or authorized representative.

State-Specific Rules for the Prime Contractors Exemption Certificate State Sd

State-specific rules for the Prime Contractors Exemption Certificate State Sd dictate how and when the certificate can be used. It is important for contractors to familiarize themselves with these regulations to avoid any compliance issues. This includes understanding which purchases qualify for exemption, the duration of the certificate's validity, and any reporting requirements that may apply.

Quick guide on how to complete prime contractors exemption certificate state sd

Prepare Prime Contractors Exemption Certificate State Sd effortlessly on any device

Online document management has become popular among organizations and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents swiftly without delays. Manage Prime Contractors Exemption Certificate State Sd on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Prime Contractors Exemption Certificate State Sd with ease

- Find Prime Contractors Exemption Certificate State Sd and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Prime Contractors Exemption Certificate State Sd and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the prime contractors exemption certificate state sd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Prime Contractors Exemption Certificate State Sd?

The Prime Contractors Exemption Certificate State Sd is a legal document that allows prime contractors in South Dakota to be exempt from sales tax on certain construction materials and services. It is essential for contractors to understand its usage to manage costs effectively on their projects. This certificate can signNowly reduce expenses, making it a crucial tool for state-contracted work.

-

How can I obtain a Prime Contractors Exemption Certificate State Sd?

To obtain a Prime Contractors Exemption Certificate State Sd, contractors need to apply through the South Dakota Department of Revenue. The application process may require details about your business operations and the projects you plan to use the exemption for. Once approved, it allows you to save on sales tax, boosting profit margins on your projects.

-

What are the benefits of using the Prime Contractors Exemption Certificate State Sd?

Using the Prime Contractors Exemption Certificate State Sd enables contractors to save on sales tax costs, which can substantially lower project expenses. This certificate improves cash flow by allowing contractors to allocate funds more efficiently. Additionally, it can enhance competitive positioning by offering lower bids to clients.

-

Is there a fee associated with the Prime Contractors Exemption Certificate State Sd?

There is typically no fee for obtaining the Prime Contractors Exemption Certificate State Sd itself, but there may be costs associated with the application process. Contractors should ensure they meet all requirements to avoid any delays or additional charges. Understanding this can help in budgeting for upcoming projects effectively.

-

How does the Prime Contractors Exemption Certificate State Sd affect eSigning documents?

The Prime Contractors Exemption Certificate State Sd does not directly impact the process of eSigning documents but is essential for documenting tax-exempt purchases. airSlate SignNow facilitates the seamless eSigning of all related documentation, helping contractors manage their compliance efficiently. This integration ensures that all records related to the exemption are easily accessible and properly executed.

-

Are there any limitations on using the Prime Contractors Exemption Certificate State Sd?

Yes, the Prime Contractors Exemption Certificate State Sd has specific limitations, typically applying only to construction materials and services directly related to projects. It is crucial for contractors to ensure compliance with state regulations to avoid penalties. Understanding these limitations can help in appropriately utilizing the certificate and planning project budgets.

-

Can I use the Prime Contractors Exemption Certificate State Sd in multiple projects?

Absolutely! The Prime Contractors Exemption Certificate State Sd can be utilized across multiple projects as long as the purchases meet the exemption criteria set by the state. This flexibility allows for better planning and cost management across all applicable projects. However, ensure that your documentation remains clear and compliant for each project undertaken.

Get more for Prime Contractors Exemption Certificate State Sd

- Alberta declaration of incorporationaffidavit of a religious society form

- Ffiec cybersecurity assessment tool overview for chief executive ffiec form

- Hand therapy initial assessment form

- How to complete your crest transfer form hargreaves lansdown

- Fl 324 declaration of supervised visitation provider editable and saveable california judicial council forms

- Collegeboard business farm supplement form

- Early decision agreement pdf vassar admissions denison form

- Office of student financial aid ampamp form

Find out other Prime Contractors Exemption Certificate State Sd

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer