North Carolina Department of Revenue Application for Voluntary Dor State Nc Form

What is the North Carolina Department Of Revenue Application For Voluntary Dor State Nc

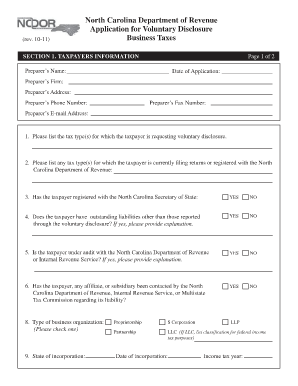

The North Carolina Department Of Revenue Application For Voluntary Dor State Nc is a formal document used by individuals or businesses seeking to voluntarily disclose tax-related information to the state. This application is essential for ensuring compliance with state tax laws and may help in mitigating potential penalties associated with non-disclosure. The form allows taxpayers to provide necessary details regarding their tax situation, facilitating a smoother resolution process with the Department of Revenue.

Steps to complete the North Carolina Department Of Revenue Application For Voluntary Dor State Nc

Completing the North Carolina Department Of Revenue Application For Voluntary Dor State Nc involves several key steps to ensure accuracy and compliance:

- Gather all relevant tax documents and financial records.

- Fill out the application form carefully, providing accurate information regarding your tax situation.

- Review the completed form for any errors or omissions before submission.

- Sign the form electronically or manually, depending on your submission method.

- Submit the form via the chosen method, ensuring you keep a copy for your records.

Legal use of the North Carolina Department Of Revenue Application For Voluntary Dor State Nc

The legal use of the North Carolina Department Of Revenue Application For Voluntary Dor State Nc is governed by state tax laws. This form must be completed accurately to be considered valid. Electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant laws. It is crucial to understand that submitting this application does not guarantee immunity from penalties; however, it can demonstrate a good faith effort to comply with tax obligations.

Eligibility Criteria

To be eligible to use the North Carolina Department Of Revenue Application For Voluntary Dor State Nc, taxpayers must meet specific criteria. Generally, this includes individuals or businesses that have undisclosed tax liabilities or have failed to file required tax returns. It is recommended to consult with a tax professional to determine eligibility and ensure that all necessary information is disclosed accurately in the application.

Form Submission Methods

The North Carolina Department Of Revenue Application For Voluntary Dor State Nc can be submitted through various methods, including:

- Online submission via the North Carolina Department of Revenue's secure portal.

- Mailing the completed form to the appropriate address provided by the Department.

- In-person submission at designated Department of Revenue offices.

Choosing the right submission method may depend on personal preference and the urgency of the application.

Required Documents

When filling out the North Carolina Department Of Revenue Application For Voluntary Dor State Nc, certain documents may be required to support your application. These typically include:

- Previous tax returns and supporting documentation.

- Financial statements detailing income and expenses.

- Any correspondence received from the Department of Revenue regarding your tax situation.

Having these documents ready can streamline the application process and ensure that all necessary information is provided.

Quick guide on how to complete north carolina department of revenue application for voluntary dor state nc

Complete North Carolina Department Of Revenue Application For Voluntary Dor State Nc effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage North Carolina Department Of Revenue Application For Voluntary Dor State Nc on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign North Carolina Department Of Revenue Application For Voluntary Dor State Nc with ease

- Locate North Carolina Department Of Revenue Application For Voluntary Dor State Nc and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign North Carolina Department Of Revenue Application For Voluntary Dor State Nc to maintain excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the north carolina department of revenue application for voluntary dor state nc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the North Carolina Department Of Revenue Application For Voluntary Dor State Nc?

The North Carolina Department Of Revenue Application For Voluntary Dor State Nc is a streamlined process for businesses seeking to comply with specific state tax regulations. This application allows businesses to voluntarily address any tax liabilities efficiently, ensuring clarity and compliance with state laws.

-

How can airSlate SignNow help with the North Carolina Department Of Revenue Application For Voluntary Dor State Nc?

airSlate SignNow provides an easy-to-use platform for securely eSigning and managing documents related to the North Carolina Department Of Revenue Application For Voluntary Dor State Nc. Our solution enhances efficiency by allowing businesses to send, sign, and manage their applications without the hassle of paper forms.

-

What features does airSlate SignNow offer for the North Carolina Department Of Revenue Application For Voluntary Dor State Nc?

Our platform offers features such as customizable templates, real-time tracking, and secure storage, making it ideal for the North Carolina Department Of Revenue Application For Voluntary Dor State Nc. These features help businesses streamline their application process while ensuring that all documentation is organized and easily accessible.

-

What are the pricing options for airSlate SignNow when handling the North Carolina Department Of Revenue Application For Voluntary Dor State Nc?

airSlate SignNow offers competitive pricing plans that cater to various business sizes. Our pricing is designed to be cost-effective for businesses managing the North Carolina Department Of Revenue Application For Voluntary Dor State Nc, providing essential features without unnecessary costs.

-

Are there any benefits of using airSlate SignNow for the North Carolina Department Of Revenue Application For Voluntary Dor State Nc?

Using airSlate SignNow for the North Carolina Department Of Revenue Application For Voluntary Dor State Nc simplifies the eSigning process, reduces processing time, and enhances compliance. Additionally, our platform's user-friendly interface allows users to manage applications efficiently, ensuring a smooth experience.

-

Can I integrate airSlate SignNow with other tools for managing the North Carolina Department Of Revenue Application For Voluntary Dor State Nc?

Yes, airSlate SignNow seamlessly integrates with various business tools and applications. This capability allows businesses to enhance their workflow when dealing with the North Carolina Department Of Revenue Application For Voluntary Dor State Nc by connecting with existing software solutions.

-

Is airSlate SignNow secure for handling sensitive information related to the North Carolina Department Of Revenue Application For Voluntary Dor State Nc?

Absolutely! airSlate SignNow prioritizes security, employing industry-standard encryption and secure data practices to protect sensitive information. This commitment to security ensures that all documents related to the North Carolina Department Of Revenue Application For Voluntary Dor State Nc remain confidential and safe.

Get more for North Carolina Department Of Revenue Application For Voluntary Dor State Nc

- Residency requirement form

- Checkbook balance worksheet form

- Hud 52515 form

- Pdf section 8 application form

- Global assessment functioning gaf form

- Application for export certificate food safety and inspection service fsis usda form

- I 9 form 100304848

- Modelo sc 6042 departamento de hacienda de puerto rico hacienda gobierno form

Find out other North Carolina Department Of Revenue Application For Voluntary Dor State Nc

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile