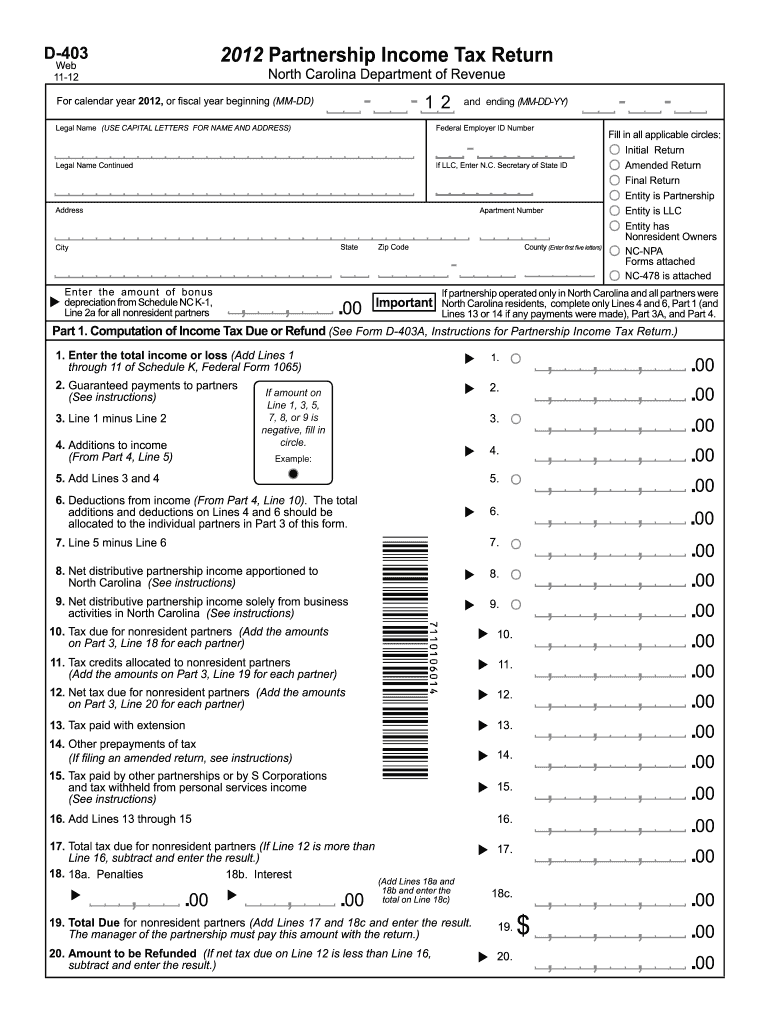

Nc K 1 Fillable Form 2012

What is the Nc K 1 Fillable Form

The Nc K 1 Fillable Form is a tax document used by partnerships, S corporations, estates, and trusts to report income, deductions, and credits to their partners or shareholders. This form provides detailed information about each partner's share of the entity's income, which is essential for accurate tax reporting. It is designed to be filled out electronically, making it easier for users to input their data and submit it to the IRS. The fillable format ensures that all required fields are completed, reducing the risk of errors that can lead to delays or penalties.

How to use the Nc K 1 Fillable Form

Using the Nc K 1 Fillable Form involves several straightforward steps. First, access the form through a reliable platform that supports electronic signatures and submissions. Next, enter the necessary information, including the partnership or corporation's details, the partner's name, and their share of income. Ensure that all fields are filled out accurately to comply with IRS regulations. After completing the form, review it for any errors before eSigning and submitting it electronically. This process not only streamlines filing but also enhances security and compliance.

Steps to complete the Nc K 1 Fillable Form

Completing the Nc K 1 Fillable Form can be broken down into clear steps:

- Access the Nc K 1 Fillable Form from a trusted source.

- Fill in the entity's name, address, and tax identification number.

- Input the partner's name, address, and tax identification number.

- Detail the partner's share of income, deductions, and credits.

- Review all entries for accuracy and completeness.

- eSign the form using a secure electronic signature platform.

- Submit the completed form electronically or print it for mailing.

Legal use of the Nc K 1 Fillable Form

The Nc K 1 Fillable Form is legally recognized for reporting purposes under IRS regulations. When properly completed and submitted, it serves as an official record of a partner's income and tax obligations. The use of electronic signatures on this form is permissible, aligning with the ESIGN Act, which allows for digital signatures to hold the same legal weight as handwritten ones. This legal recognition facilitates timely and efficient tax reporting, ensuring compliance with federal and state laws.

Filing Deadlines / Important Dates

Filing deadlines for the Nc K 1 Fillable Form are critical for compliance. Generally, partnerships and S corporations must provide the completed form to their partners by March 15 of the following tax year. If the entity files for an extension, the deadline may be extended to September 15. It is essential for partners to receive this form on time to accurately report their income on their individual tax returns, typically due by April 15. Keeping track of these dates helps avoid penalties and ensures smooth tax filing.

Who Issues the Form

The Nc K 1 Fillable Form is issued by partnerships, S corporations, estates, and trusts. These entities are responsible for preparing and distributing the form to their partners or shareholders. Each entity must ensure that the information provided is accurate and compliant with IRS guidelines. By issuing this form, the entities help their partners fulfill their tax obligations, making it an essential component of the tax reporting process.

Quick guide on how to complete nc k 1 fillable 2012 form

Your assistance manual on how to prepare your Nc K 1 Fillable Form

If you are looking to learn how to generate and submit your Nc K 1 Fillable Form, here are some brief instructions on how to streamline tax processing.

To begin, you simply need to set up your airSlate SignNow account to revolutionize your online document management. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to modify, draft, and finalize your tax documents effortlessly. With its editing tool, you can toggle between text, checkboxes, and eSignatures, as well as return to amend information as needed. Enhance your tax administration with advanced PDF editing, eSigning, and straightforward sharing options.

Follow the instructions below to finalize your Nc K 1 Fillable Form in just a few minutes:

- Create your account and start working on PDFs in no time.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Click Obtain form to access your Nc K 1 Fillable Form in our editor.

- Complete the mandatory fillable fields with your details (text, numbers, checkmarks).

- Employ the Signature Tool to add your legally-binding eSignature (if required).

- Examine your document and correct any inaccuracies.

- Save your changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Keep in mind that submitting in traditional paper format can lead to increased return errors and delayed reimbursements. Obviously, before e-filing your taxes, check the IRS website for declaring guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct nc k 1 fillable 2012 form

FAQs

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How do we know the eligibility to fill out Form 12 BB?

Every year as a salaried employee many of you must have fill Form 12BB, but did you ever bothered to know its purpose. Don’t know ??It is indispensable for both, you and your employer. With the help of Form 12BB, you will be able to figure out how much income tax is to be deducted from your monthly pay. Further, with the help of Form 12BB, you will be in relief at the time of filing returns as at that time you will not have to pay anything due to correct TDS deduction.So, before filing such important form keep the below listed things in your mind so that you may live a tax hassle free life.For More Information:- 7 key points which must be known before filling Form 12BB

-

How do I create a fillable HTML form online that can be downloaded as a PDF? I have made a framework for problem solving and would like to give people access to an online unfilled form that can be filled out and downloaded filled out.

Create PDF Form that will be used for download and convert it to HTML Form for viewing on your website.However there’s a lot of PDF to HTML converters not many can properly convert PDF Form including form fields. If you plan to use some calculations or validations it’s even harder to find one. Try PDFix Form Converter which works fine to me.

Create this form in 5 minutes!

How to create an eSignature for the nc k 1 fillable 2012 form

How to make an eSignature for the Nc K 1 Fillable 2012 Form in the online mode

How to create an eSignature for the Nc K 1 Fillable 2012 Form in Chrome

How to make an eSignature for signing the Nc K 1 Fillable 2012 Form in Gmail

How to generate an eSignature for the Nc K 1 Fillable 2012 Form from your mobile device

How to generate an eSignature for the Nc K 1 Fillable 2012 Form on iOS devices

How to make an electronic signature for the Nc K 1 Fillable 2012 Form on Android devices

People also ask

-

What is an Nc K 1 Fillable Form?

An Nc K 1 Fillable Form is a tax document used to report income, deductions, and credits for partnerships and S corporations. It allows users to input their financial information digitally, streamlining data entry and minimizing errors. Businesses can benefit from the convenience and accuracy offered by the Nc K 1 Fillable Form.

-

How can I access the Nc K 1 Fillable Form?

You can access the Nc K 1 Fillable Form through our airSlate SignNow platform. Simply create an account, then navigate to the document library where you can find this form. Once located, you can easily fill it out online and eSign it securely.

-

Is the Nc K 1 Fillable Form secure?

Yes, the Nc K 1 Fillable Form on airSlate SignNow is secured with advanced encryption technology. This ensures that your sensitive information remains confidential and protected during transmission and storage. We prioritize the security of your data while you complete and eSign documents.

-

What features does the Nc K 1 Fillable Form offer?

The Nc K 1 Fillable Form includes features such as easy online filling, digital signatures, and automatic saving of completed documents. Additionally, users can collaborate with team members and track the completion status of the form. These features enhance efficiency and improve the overall document management process.

-

What are the benefits of using the Nc K 1 Fillable Form?

Using the Nc K 1 Fillable Form helps reduce manual errors and saves time in tax preparation. Its fillable format allows for quick data entry, while eSigning features expedite the process of obtaining signatures from partners or stakeholders. Overall, it simplifies tax reporting for businesses.

-

Are there any integration options for the Nc K 1 Fillable Form?

Absolutely! The Nc K 1 Fillable Form can integrate seamlessly with various accounting and financial software applications. This integration streamlines the workflow by allowing users to import data directly, reducing the need for repetitive data entry and ensuring accuracy.

-

What is the pricing structure for using the Nc K 1 Fillable Form?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose a monthly or annual subscription based on your usage needs. Each plan includes access to features such as the Nc K 1 Fillable Form, ensuring value for money while meeting your document management requirements.

Get more for Nc K 1 Fillable Form

Find out other Nc K 1 Fillable Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document