New Hampshire Limited Liability 2013-2026

What is the New Hampshire Limited Liability?

The New Hampshire Limited Liability Company (LLC) is a distinct legal entity that combines the flexibility of a partnership with the liability protection of a corporation. This structure allows business owners to protect their personal assets from business debts and liabilities. In New Hampshire, forming an LLC involves adhering to specific legal requirements, which include filing necessary documents with the Secretary of State and paying applicable fees. An LLC can have one or more members, making it an attractive option for both solo entrepreneurs and multi-member businesses.

How to use the New Hampshire Limited Liability?

Using a New Hampshire Limited Liability Company involves several key steps. First, ensure that you have a clear business plan and understand the nature of your business. Next, you will need to file the appropriate documents, such as the Certificate of Formation, with the New Hampshire Secretary of State. Once your LLC is established, you can operate your business under its name, open a business bank account, and enter into contracts. It is also important to maintain compliance with state regulations, including filing annual reports and paying any required fees.

Steps to complete the New Hampshire Limited Liability

To complete the formation of a New Hampshire LLC, follow these steps:

- Choose a unique name for your LLC that complies with state naming requirements.

- Designate a registered agent who will receive legal documents on behalf of the LLC.

- File the Certificate of Formation with the New Hampshire Secretary of State, including necessary information such as the LLC's name, registered agent, and duration.

- Pay the required filing fee, which is currently $100 for online submissions.

- Obtain any necessary business licenses or permits based on your industry and location.

- Draft an Operating Agreement to outline the management structure and operating procedures of your LLC, although this is not legally required in New Hampshire.

Required Documents

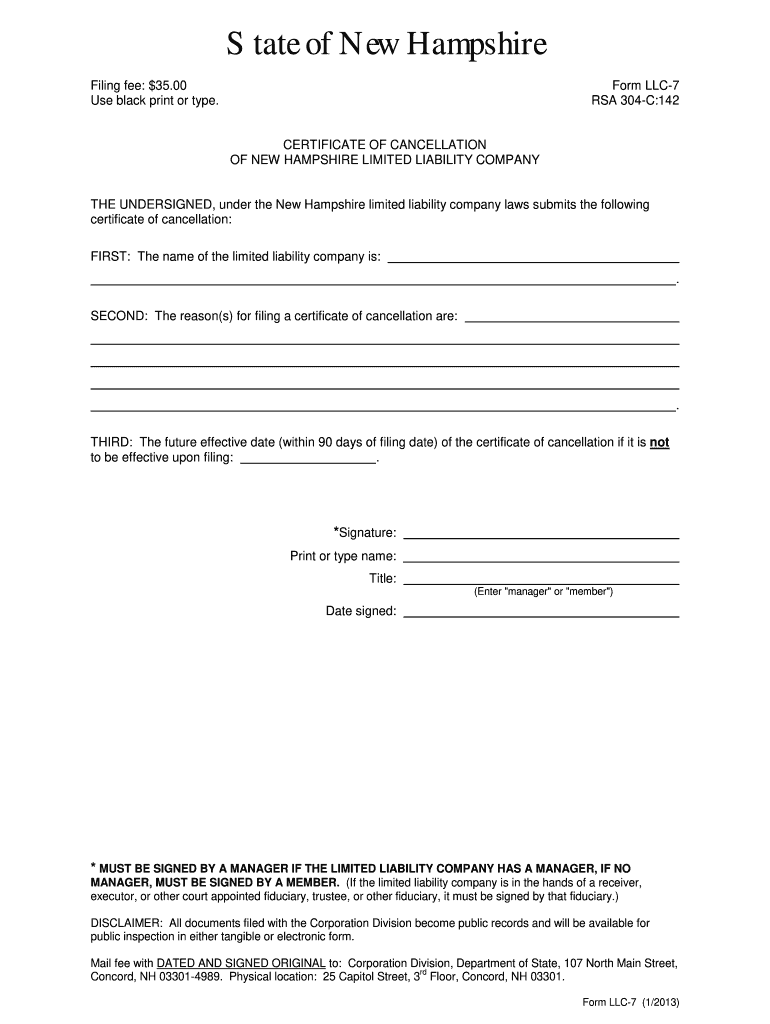

To form a New Hampshire LLC, you will need to prepare and submit the following documents:

- Certificate of Formation: This is the primary document filed with the Secretary of State, detailing the LLC's name, registered agent, and other essential information.

- Operating Agreement: While not mandatory, this document is recommended to clarify the management structure and member responsibilities.

- Business Licenses: Depending on your business type, you may need additional licenses or permits at the local or state level.

Eligibility Criteria

To form a New Hampshire LLC, you must meet certain eligibility criteria. These include:

- Being at least eighteen years old to serve as a member or manager of the LLC.

- Choosing a unique name for your LLC that complies with New Hampshire naming regulations.

- Designating a registered agent with a physical address in New Hampshire who can receive legal documents.

Penalties for Non-Compliance

Failure to comply with New Hampshire LLC regulations can result in various penalties. These may include:

- Late fees for not filing annual reports on time.

- Potential loss of good standing status, which can affect your ability to conduct business legally.

- Personal liability for members if the LLC is not properly maintained, potentially exposing personal assets to business debts.

Quick guide on how to complete of new hampshire limited liability company sos nh

Manage New Hampshire Limited Liability wherever, whenever

Your routine corporate operations may require additional attention when handling state-specific business paperwork. Recover your office hours and reduce the printing costs linked to document-oriented processes with airSlate SignNow. airSlate SignNow provides a variety of pre-uploaded business documents, including New Hampshire Limited Liability, which you can utilize and share with your business associates. Manage your New Hampshire Limited Liability effortlessly with powerful editing and eSignature features and send it directly to your recipients.

How to access New Hampshire Limited Liability in just a few clicks:

- Choose a form pertinent to your state.

- Click on Learn More to view the document and confirm it is correct.

- Select Get Form to begin using it.

- New Hampshire Limited Liability will open instantly in the editor. No additional steps are needed.

- Utilize airSlate SignNow’s sophisticated editing tools to complete or modify the form.

- Locate the Sign feature to create your personal signature and eSign your document.

- When ready, click Done, save changes, and access your document.

- Email or SMS the form, or use a link-to-fill option with partners or allow them to download the documents.

airSlate SignNow greatly reduces the time spent managing New Hampshire Limited Liability and allows you to find necessary documents in one location. A comprehensive library of forms is organized and designed to address essential business processes for your operation. The advanced editor decreases the likelihood of mistakes, as you can easily correct errors and review your documents on any device before sending them out. Start your free trial today to explore all the advantages of airSlate SignNow for everyday business workflows.

Create this form in 5 minutes or less

FAQs

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

I'm the founder of a new startup and recently I heard that when I employ someone, I need to fill out form I-9 for them. The employee needs to fill it out, but I also need to check their identity and status. Is it true that I am required to do that? Is it true that all companies, even big companies that employ thousands of people, do this?

In addition to both you and the employee filling out the form, you need to do it within a certain time period, usually the first day of work for the employee. And as mentioned, you do need to keep them on file in case of an audit. You need to examine their eligibility documents (most often their passport, or their driver's license and social security card, and the list of acceptable documents is included on the form). You just need to make sure it looks like it's the same person and that they aren't obvious fakes.You can find the forms as well as instructions on how to fill them out here: Employment Eligibility Verification | USCIS On the plus side, I-9's aren't hard or time-consuming to do. Once you get the hang of it, it only takes a few minutes.

-

How long does it take for a new boss from outside the company to figure out which existing employees have been more productive and which have been more of a liability?

How long does it take for a new boss from outside the company to figure out which existing employees have been more productive and which have been more of a liability?Depends on the company and the new leader or boss. If many leading and lagging indicators (KPI) are in place, a picture of where improvement needs to happen will become clearer each day. Depending on the frequency of who needs help, this could become apparent by the end of the week. If it takes longer, it will still be clear according to the measurement system (KPI).If the company doesn't use or have metrics (KPI), it might take 6 months to start to get an understanding on where problems occur.Good leaders will recognize if metrics are not in place to measure performance and will work to establish them. This way they can control the process and not vice versa. This is how good leaders get in front of problems.Bad ones will use old school tactics such as spying, taking into account other people's opinion (which cannot be substantiated due to a lack of data) and trying (and sometimes failing) to identify the point of cause. This is often confused with point of observation. That is when the wrong people are targeted. It also speaks to their style of problem solving- the attempt to fix the person instead of the process. This is how bad bosses go from putting out one fire to the next.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

I am about to start a new venture in the form of a website, and I have a few investors who are interested in making an investment in return for a stake in the company. How can I accurately figure out what percent of ownership to allocate to each person relative to his/her investment value?

Don't give up too much but also be realistic in estimating the profibility of your venture. If you think you'll have $50k in sales the first year and 100k in year two don't sell 50% of the company for a total of $10k. Make each split representative of how much each is investing. If you have an idea that everyone thinks is a $500k business then investor #1 at $10k should get approx 2% of the business, so on and so forth. This is a basic "presale" of estimated worth example but honestly all you should keep in mind is that they stakes should be proportionate at the outset to make sure there aren't grumblings of being treated unfairly. Don't sell one stake of 25% for less than another at 10%. And lastly always retain at the very minimum 51% of the business for yourself.

-

I am a working software professional in the Bay Area and looking to switch jobs. I can't openly write in my LinkedIn profile about the same. How do I approach recruiters/companies? Is there an easier way than filling out 4 - 5 page forms in the career website of the company?

I'd say that you should just seek out the jobs that interest you and apply for them. Many don't have such onerous application forms. Some even allow you to apply through LinkedIn. And if you target a small set of companies that really interest you, then it's worth the extra effort to customize each application. Many recruiters and hiring managers, myself included, give more weight to candidates who seem specifically interested in an opportunity, as compared to those who seem to be taking a shotgun approach to the job seeking process.

Create this form in 5 minutes!

How to create an eSignature for the of new hampshire limited liability company sos nh

How to generate an electronic signature for your Of New Hampshire Limited Liability Company Sos Nh online

How to create an electronic signature for the Of New Hampshire Limited Liability Company Sos Nh in Chrome

How to make an eSignature for putting it on the Of New Hampshire Limited Liability Company Sos Nh in Gmail

How to generate an eSignature for the Of New Hampshire Limited Liability Company Sos Nh right from your smartphone

How to generate an eSignature for the Of New Hampshire Limited Liability Company Sos Nh on iOS devices

How to create an electronic signature for the Of New Hampshire Limited Liability Company Sos Nh on Android OS

People also ask

-

What is the nh sos business lookup service?

The nh sos business lookup service allows you to easily find detailed information about registered businesses in New Hampshire. This tool is particularly valuable for entrepreneurs and business owners who need to verify company details or conduct due diligence before partnerships. By utilizing the nh sos business lookup, you can ensure that your business decisions are informed and reliable.

-

How can I integrate airSlate SignNow with the nh sos business lookup?

Integrating airSlate SignNow with the nh sos business lookup can streamline your document signing processes when handling business verifications. By accessing business information directly through SignNow, you can reduce manual entry errors and increase efficiency. This integration enhances your workflow and ensures that all necessary documents are accurately prepared.

-

Is the nh sos business lookup tool user-friendly?

Yes, the nh sos business lookup tool is designed to be user-friendly and accessible to all users. The interface is intuitive, allowing you to search for business information with ease. Additionally, airSlate SignNow complements this feature by providing a straightforward eSigning process that simplifies documentation.

-

What are the pricing plans for using airSlate SignNow and accessing the nh sos business lookup?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes, ensuring that you can access essential tools like the nh sos business lookup without breaking the bank. Pricing typically includes features for document eSigning, collaboration, and integrations. For detailed pricing, visit our website or contact our sales team for personalized options.

-

Can I use the nh sos business lookup for compliance checks?

Absolutely! The nh sos business lookup is an excellent resource for conducting compliance checks on businesses in New Hampshire. By obtaining accurate and up-to-date information, you can ensure that your business operations adhere to state regulations, providing peace of mind in your compliance efforts.

-

What benefits does airSlate SignNow provide for businesses using nh sos business lookup?

Using airSlate SignNow alongside the nh sos business lookup maximizes the efficiency of your business processes. SignNow allows you to prepare, send, and store signed documents electronically, which saves time and reduces paperwork. Together, these tools enhance your operational capabilities and enable better management of business documentation.

-

Does airSlate SignNow provide any customer support for using nh sos business lookup?

Yes, airSlate SignNow offers comprehensive customer support to assist you with using the nh sos business lookup effectively. Our support team is available via chat, email, and phone to help you navigate the features and resolve any questions you may have. We are committed to ensuring that you have a seamless experience while using our platform.

Get more for New Hampshire Limited Liability

- Short form awi vpk 03s attendance verification 09 21 doc m jpeg s m e earlylearningcoalitionsarasota

- Henrico county sports physical form

- Usfj form 178 r

- Jeep wrangler jk repair manual pdf form

- Instructions form 1651 0012

- John deere 6081 engine torque specs form

- Trigonometry word problems form

- Comprehensive education plans schools nyc gov form

Find out other New Hampshire Limited Liability

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample