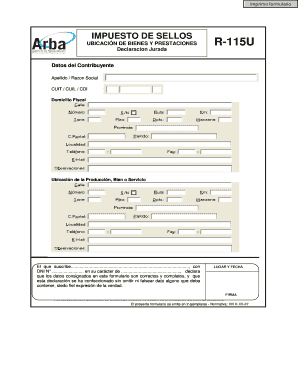

R115u Form

What is the R115u

The R115u is a specific form used for reporting certain tax-related information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses who need to disclose specific financial details, ensuring compliance with U.S. tax laws. Understanding the purpose of the R115u is crucial for accurate reporting and avoiding potential penalties.

How to use the R115u

Using the R115u involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents that pertain to the information you need to report. Next, carefully fill out the form, ensuring that each section is completed accurately. After completing the form, review it for any errors or omissions. Finally, submit the form to the IRS by the designated deadline to ensure compliance.

Steps to complete the R115u

Completing the R115u requires attention to detail. Follow these steps for successful completion:

- Collect all relevant financial records and documents.

- Obtain the R115u form from the IRS website or other official sources.

- Fill out the form, providing accurate information in each section.

- Double-check your entries for accuracy and completeness.

- Submit the form either electronically or via mail by the deadline.

Legal use of the R115u

The R115u must be used in accordance with IRS regulations to be considered legally valid. This includes ensuring that the information reported is truthful and complete. Misuse of the form or providing false information can lead to penalties, including fines or legal action. It is important to familiarize oneself with the legal implications of using the R115u to avoid any compliance issues.

Filing Deadlines / Important Dates

Filing deadlines for the R115u are critical to ensure compliance with IRS regulations. Typically, the form must be submitted by a specific date each year, which can vary based on the type of taxpayer and the nature of the information being reported. It is advisable to check the IRS website or consult a tax professional for the most current deadlines to avoid late filing penalties.

Required Documents

When completing the R115u, certain documents are required to support the information reported. These may include:

- Previous tax returns

- Financial statements

- W-2 forms or 1099s

- Any other relevant financial documentation

Having these documents ready will facilitate a smoother completion process and ensure accuracy in reporting.

Quick guide on how to complete r115u

Complete R115u effortlessly on any device

Web-based document management has become a trend among companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage R115u on any device using airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest method to alter and eSign R115u without any hassle

- Locate R115u and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive data with features that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Put aside concerns over lost or misfiled documents, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your requirements in document management in just a few clicks from any device you prefer. Modify and eSign R115u and guarantee excellent communication at any phase of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the r115u

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the formulario r115u in airSlate SignNow?

The formulario r115u is a specific document format used for various official purposes, and with airSlate SignNow, you can easily create, send, and eSign this form digitally. Utilizing this feature not only streamlines your document processing but also ensures compliance with necessary regulations.

-

How can I create a formulario r115u using airSlate SignNow?

Creating a formulario r115u in airSlate SignNow is simple. Just upload your document, customize the fields as needed, and prepare it for eSignature. Our intuitive interface allows for quick creation and customization tailored to your requirements.

-

What are the pricing options for using formulario r115u with airSlate SignNow?

AirSlate SignNow offers flexible pricing plans designed to cater to businesses of all sizes. Each plan includes the ability to manage your formulario r115u, along with other features that enhance document management and electronic signing.

-

What features does airSlate SignNow provide for formulario r115u?

AirSlate SignNow allows you to add interactive fields to your formulario r115u, enabling recipients to complete the document electronically. Additionally, our platform provides tracking, reminders, and the ability to securely store signed documents.

-

Are there benefits to using formulario r115u with airSlate SignNow for businesses?

Yes, utilizing formulario r115u with airSlate SignNow signNowly increases efficiency and reduces turnaround time for document approval. This helps businesses cut operational costs and maintain compliance while providing a better client experience.

-

Can I integrate formulario r115u with other applications using airSlate SignNow?

Absolutely! airSlate SignNow offers integrations with a variety of applications, allowing you to seamlessly incorporate formulario r115u into your existing workflows. Popular integrations include CRMs, cloud storage, and other productivity tools.

-

Is it safe to store my formulario r115u in airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. Your formulario r115u, along with other documents, is stored in a secure environment that leverages encryption and complies with industry standards to protect your sensitive information.

Get more for R115u

- Dts constructed worksheet form

- Example of a supervisor evaluation of internship rubric iacbe iacbe form

- I 20 application form massasoit community college

- Transfer student form mountain view college

- A primer on psychotropic medications michael flaum md medicine uiowa form

- Welcome to the 2016 hacr yhca nomination form about the hacr hacr

- Holt physics problem 2a answers form

- Be sure to complete the front back of form stc

Find out other R115u

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free