Cua Health Insurance Form

What is the Cua Health Insurance Form

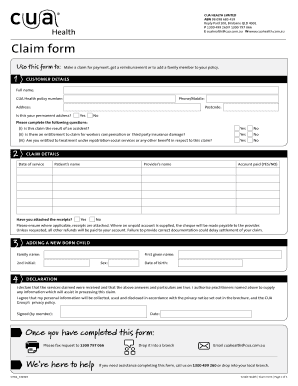

The Cua Health Insurance Form is a crucial document used to apply for health insurance coverage under the Cua program. This form collects essential information about the applicant, including personal details, income, and household size. It is designed to determine eligibility for various health insurance options available to individuals and families. Understanding the purpose of this form is vital for ensuring that applicants receive the appropriate coverage and benefits.

How to use the Cua Health Insurance Form

Using the Cua Health Insurance Form involves several steps to ensure accurate completion and submission. First, gather all necessary documents, such as proof of income and identification. Next, fill out the form carefully, providing all required information. It is essential to review the form for accuracy before submission. Once completed, the form can be submitted electronically or via traditional mail, depending on the specific requirements of the health insurance provider.

Steps to complete the Cua Health Insurance Form

Completing the Cua Health Insurance Form requires careful attention to detail. Begin by entering your personal information, including your name, address, and contact details. Next, provide information about your household composition and income. Ensure that all figures are accurate and reflect your current financial situation. After filling out all sections, review the form to confirm that no information is missing or incorrect. Finally, sign and date the form before submitting it to the appropriate agency or insurance provider.

Legal use of the Cua Health Insurance Form

The Cua Health Insurance Form must be filled out and submitted in compliance with federal and state regulations. Legal requirements include providing truthful information and adhering to deadlines for submission. Failure to comply with these regulations may result in delays in processing or denial of coverage. It is important to understand the legal implications of the information provided on the form to ensure that applicants remain eligible for health insurance benefits.

Key elements of the Cua Health Insurance Form

Key elements of the Cua Health Insurance Form include personal identification details, income verification, and household information. Each section of the form is designed to capture specific data necessary for assessing eligibility for health insurance. Additionally, the form may require applicants to provide information about any existing health coverage and any special medical needs. Understanding these key elements can help applicants prepare the necessary documentation and complete the form accurately.

Form Submission Methods

The Cua Health Insurance Form can be submitted through various methods, including online submission, mailing a physical copy, or in-person delivery to designated offices. Online submission is often the most efficient method, allowing for quicker processing times. When submitting by mail, ensure that the form is sent to the correct address and consider using a trackable mailing option. In-person submissions may require scheduling an appointment, depending on local regulations and office policies.

Quick guide on how to complete cua health insurance form

Complete Cua Health Insurance Form effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Cua Health Insurance Form on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The easiest way to modify and electronically sign Cua Health Insurance Form without hassle

- Find Cua Health Insurance Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select relevant sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes just a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click the Done button to save your changes.

- Decide how you'd like to deliver your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Cua Health Insurance Form and maintain excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cua health insurance form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Cua Health Insurance Form, and why do I need it?

The Cua Health Insurance Form is a vital document used to enrol in health insurance plans, ensuring you receive necessary medical coverage. It helps you provide essential details about your health and personal information to insurers. By completing this form, you can select the best health insurance options tailored to your needs.

-

How can I fill out the Cua Health Insurance Form using airSlate SignNow?

airSlate SignNow offers a user-friendly platform to fill out the Cua Health Insurance Form electronically. You can easily access the form, enter your information, and make necessary modifications with just a few clicks. This simplifies the enrolment process, allowing for quicker submission and improved accuracy.

-

Is there a cost associated with using the Cua Health Insurance Form on airSlate SignNow?

Using the Cua Health Insurance Form on airSlate SignNow is cost-effective, offering a range of pricing plans to suit different business needs. The platform’s plans include features that enhance document management, ensuring that you can eSign forms without worrying about hidden costs. It's designed to save you time and money while preparing important documents.

-

What features does airSlate SignNow offer for the Cua Health Insurance Form?

airSlate SignNow provides an array of features for the Cua Health Insurance Form, including electronic signatures, customizable templates, and secure storage. You can track the status of your forms, send reminders, and access your documents from any device. These features enhance efficiency and simplify the signing process.

-

Can the Cua Health Insurance Form be integrated with other applications?

Yes, the Cua Health Insurance Form on airSlate SignNow can seamlessly integrate with various applications, including CRM and document management systems. This integration allows for more streamlined workflows as you can manage your documents without switching between different platforms. It promotes better collaboration and data management.

-

How does airSlate SignNow ensure the security of the Cua Health Insurance Form?

Security is paramount when using the Cua Health Insurance Form on airSlate SignNow. The platform utilizes advanced encryption methods and complies with strict data protection regulations to safeguard your information. Rest assured, your sensitive data is protected during the entire signing and submission process.

-

What benefits can I expect from using airSlate SignNow for the Cua Health Insurance Form?

Using airSlate SignNow for the Cua Health Insurance Form offers numerous benefits, including improved efficiency, reduced paperwork, and faster processing times. The platform simplifies the signing process, allowing for more accessible communication and collaboration. This ensures that you can focus on what matters most—your health and insurance coverage.

Get more for Cua Health Insurance Form

- Disaster preparedness plan tool form

- 74 157 rev squaremeals form

- Ramona convent secondary school service verification record ramonaconvent form

- Icfmr disaster preparedness plan tool hm composite form

- Patient photography consent form bellafill portrait

- Ocd institute form

- Restoration wood timber harvest 2013 yurok tribe yuroktribe form

- Pemex di sel form

Find out other Cua Health Insurance Form

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now