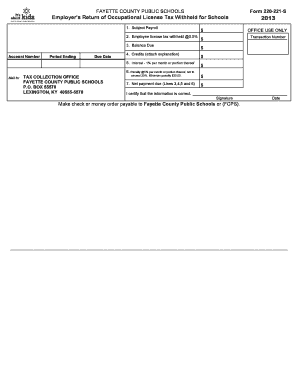

Form 220 221 S

What is the Form 222 S 2020

The Form 222 S 2020 is a specific document used primarily for tax-related purposes in the United States. It is essential for individuals or businesses that need to report certain financial information to the Internal Revenue Service (IRS). This form is designed to streamline the reporting process, ensuring compliance with federal regulations. Understanding its purpose and requirements is crucial for accurate and timely submissions.

How to use the Form 222 S 2020

Using the Form 222 S 2020 involves several steps to ensure proper completion and submission. First, gather all necessary financial documents and information required for the form. Next, fill out the form accurately, paying close attention to each section to avoid errors. Once completed, review the form for accuracy before submitting it to the IRS. Utilizing digital tools can facilitate this process, allowing for easier editing and signing of the document.

Steps to complete the Form 222 S 2020

Completing the Form 222 S 2020 involves a systematic approach:

- Gather all relevant financial information, including income statements and expense records.

- Access the form through the IRS website or a reliable digital platform.

- Fill in each section of the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before finalizing it.

- Submit the completed form electronically or via mail, depending on your preference and IRS guidelines.

Legal use of the Form 222 S 2020

The legal use of the Form 222 S 2020 is governed by IRS regulations. It must be filled out accurately and submitted within the designated deadlines to avoid penalties. The form serves as a formal declaration of financial information, and any discrepancies can lead to legal repercussions. Therefore, it is essential to ensure that all entries are truthful and verifiable, maintaining compliance with federal laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form 222 S 2020 are critical to ensure compliance with IRS regulations. Typically, forms must be submitted by specific dates, which may vary depending on the type of taxpayer or the nature of the financial information being reported. It is advisable to keep track of these deadlines and plan submissions well in advance to avoid late penalties.

Required Documents

To complete the Form 222 S 2020, several documents are required. These may include:

- Income statements, such as W-2s or 1099s.

- Expense records that support deductions claimed.

- Previous year's tax returns for reference.

- Any additional documentation requested by the IRS.

Having these documents readily available will facilitate a smoother completion process and ensure accuracy in reporting.

Quick guide on how to complete form 220 221 s

Easily Prepare Form 220 221 S on Any Device

Online document management has gained popularity among businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delay. Manage Form 220 221 S on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Effortlessly Modify and eSign Form 220 221 S

- Locate Form 220 221 S and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight key sections of your documents or obscure sensitive information using tools specifically designed for this purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Form 220 221 S to ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 220 221 s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 222 s 2020 and why is it important?

Form 222 s 2020 is a crucial document used for the registration and scheduling of specific controlled substances. It provides a streamlined process for healthcare professionals and organizations to comply with federal regulations. Understanding and utilizing form 222 s 2020 helps ensure legal compliance in the handling of such substances.

-

How does airSlate SignNow help with form 222 s 2020?

airSlate SignNow allows users to quickly eSign and send form 222 s 2020, streamlining the documentation process. With its intuitive interface, businesses can ensure accuracy and enhance compliance by effectively managing their eSignatures. This efficiency helps organizations save time and improve productivity.

-

What are the pricing options for using airSlate SignNow with form 222 s 2020?

airSlate SignNow offers competitive pricing plans that cater to various business needs when handling documents like form 222 s 2020. Whether you're a small business or a large enterprise, you can choose a plan that fits your budget. Each plan includes unlimited eSigning and document management features.

-

Are there any special features for managing form 222 s 2020 within airSlate SignNow?

Yes, airSlate SignNow includes special features designed for managing sensitive documents like form 222 s 2020. These features include customizable templates, secure cloud storage, and audit trails that help ensure compliance. The platform enhances your ability to manage crucial forms with ease.

-

Can I integrate airSlate SignNow with other software for handling form 222 s 2020?

Absolutely! airSlate SignNow offers seamless integrations with various software solutions, making it easy to handle form 222 s 2020 alongside your existing tools. Whether you use CRM systems, project management platforms, or cloud storage, these integrations enhance your efficiency in managing documents.

-

What benefits do I gain from using airSlate SignNow for form 222 s 2020?

Using airSlate SignNow for form 222 s 2020 provides signNow benefits, including streamlined workflows and faster processing times. The platform simplifies the eSigning process, reduces paper consumption, and allows for real-time collaboration. These advantages contribute to improved compliance and operational efficiency.

-

Is airSlate SignNow secure for handling form 222 s 2020?

Yes, airSlate SignNow prioritizes security, especially for handling critical documents like form 222 s 2020. The platform employs advanced encryption methods, multi-factor authentication, and complies with industry standards to protect sensitive information. Users can trust in the security measures in place when using this service.

Get more for Form 220 221 S

Find out other Form 220 221 S

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template