Form 479 Fillable

What is the Form 479 Fillable

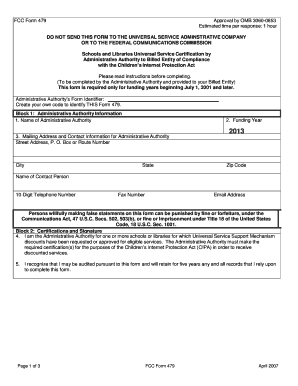

The Form 479 Fillable is a specific document used for reporting certain tax-related information to the Internal Revenue Service (IRS) in the United States. This form is primarily utilized by individuals or entities that need to disclose information regarding their tax liabilities or credits. It is designed to streamline the process of filing by allowing users to fill it out electronically, ensuring accuracy and efficiency. The fillable format enables users to easily input their information, making it accessible and user-friendly for taxpayers.

How to use the Form 479 Fillable

Using the Form 479 Fillable involves several straightforward steps. First, access the form through a reliable electronic platform that supports fillable PDFs. Once opened, users can input their information directly into the designated fields. It is important to review each section carefully to ensure that all data is accurate and complete. After filling out the form, users should save a copy for their records. Finally, the completed form can be submitted electronically or printed for mailing, depending on the specific submission requirements set by the IRS.

Steps to complete the Form 479 Fillable

Completing the Form 479 Fillable requires careful attention to detail. Follow these steps to ensure proper completion:

- Download the form from a trusted source.

- Open the form in a PDF reader that supports fillable fields.

- Enter your personal information, including name, address, and Social Security number.

- Fill in the required financial details, ensuring accuracy in all entries.

- Review the form for any errors or omissions.

- Save the completed form to your device.

- Submit the form according to IRS guidelines, either electronically or by mail.

Legal use of the Form 479 Fillable

The legal use of the Form 479 Fillable is governed by IRS regulations. When completed accurately and submitted on time, the form serves as a legally binding document that fulfills the taxpayer's reporting obligations. It is crucial to ensure compliance with all applicable laws and regulations to avoid potential penalties. Utilizing electronic signatures and secure submission methods can further enhance the legal standing of the form, providing assurance that it meets all necessary legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Form 479 Fillable are critical to ensure compliance with IRS regulations. Typically, the form must be submitted by the designated due date, which may vary based on the taxpayer's specific circumstances. It is advisable to check the IRS website or consult a tax professional for the most current deadlines. Missing these deadlines can result in penalties or interest on unpaid taxes, making timely submission essential for all taxpayers.

Examples of using the Form 479 Fillable

The Form 479 Fillable can be used in various scenarios. For instance, self-employed individuals may use it to report their income and expenses accurately. Additionally, businesses may utilize the form to disclose specific tax credits or deductions they are eligible for. Each use case emphasizes the importance of accurate reporting to avoid complications with the IRS and ensure compliance with tax obligations.

Quick guide on how to complete form 479 fillable

Complete Form 479 Fillable effortlessly on any device

Web-based document management has gained popularity among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can locate the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, adjust, and electronically sign your documents swiftly without delays. Manage Form 479 Fillable on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

The simplest way to modify and eSign Form 479 Fillable with ease

- Find Form 479 Fillable and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow supplies specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a standard wet ink signature.

- Verify all the details and then click the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, cumbersome form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 479 Fillable to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 479 fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Form 479 Fillable and how can it be used?

A Form 479 Fillable is a digital version of the IRS Form 479 that allows users to enter their information directly into the fields. Using airSlate SignNow, businesses can easily create, fill out, and eSign this form, streamlining tax information submissions. This enhances efficiency and reduces the likelihood of errors associated with paper forms.

-

How does airSlate SignNow ensure the security of Form 479 Fillable?

airSlate SignNow takes security seriously by employing advanced encryption technologies to protect your Form 479 Fillable and other sensitive documents. Additionally, the platform complies with regulations like GDPR and HIPAA, ensuring data privacy and compliance. Users can rest assured that their information remains secure while utilizing our eSignature services.

-

Can I integrate airSlate SignNow with other applications for Form 479 Fillable?

Yes, airSlate SignNow offers seamless integrations with a wide range of third-party applications, enabling you to enhance your workflow for the Form 479 Fillable. This includes popular platforms like Google Drive, Salesforce, and Dropbox. These integrations help streamline your document management processes, making it easier to access and share your fillable forms.

-

What features does airSlate SignNow offer for managing Form 479 Fillable?

AirSlate SignNow provides multiple features for managing Form 479 Fillable, including drag-and-drop fields, pre-built templates, and automated workflows. With these tools, users can customize their forms, gather eSignatures, and ensure a smooth completion process. This simplifies the handling of tax forms and enhances overall productivity.

-

Is there a pricing plan for using Form 479 Fillable on airSlate SignNow?

Yes, airSlate SignNow offers several pricing plans tailored to different business needs for using Form 479 Fillable. These plans range from affordable basic options to comprehensive solutions for larger organizations. By evaluating your requirements, you can choose the plan that best fits your budget and allows for effective document management.

-

What are the benefits of using airSlate SignNow for Form 479 Fillable?

Using airSlate SignNow for Form 479 Fillable provides numerous benefits, including increased efficiency, reduced paperwork, and faster processing times. The user-friendly platform simplifies document handling, allowing for quicker turnaround on signatures. Additionally, the cloud-based solution ensures that you can access your forms anytime, anywhere.

-

Can I track the status of my Form 479 Fillable sent through airSlate SignNow?

Absolutely! AirSlate SignNow includes tracking features that allow users to monitor the status of their Form 479 Fillable throughout the signing process. You will receive notifications when your form is viewed, signed, or completed. This transparency enhances communication and enables better workflow management.

Get more for Form 479 Fillable

- The executive summary of chevron39s responses the amazon post form

- Myacuvue rewards mail in submission form

- Demolition permit application pueblo county colorado county pueblo form

- Limited risk distributor agreement bcnbbtpab bglobalbbcomb form

- Compliance questionnaire individuals form

- Seguin police department mission statement to provide professional law enforcement service to the citizens and guests of seguin form

- Request for reconsideration appeal hrciorg form

- Virtual make up lab form

Find out other Form 479 Fillable

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now