Closing Cost Addendum to Contract 2014-2026

What is the Closing Cost Addendum To Contract

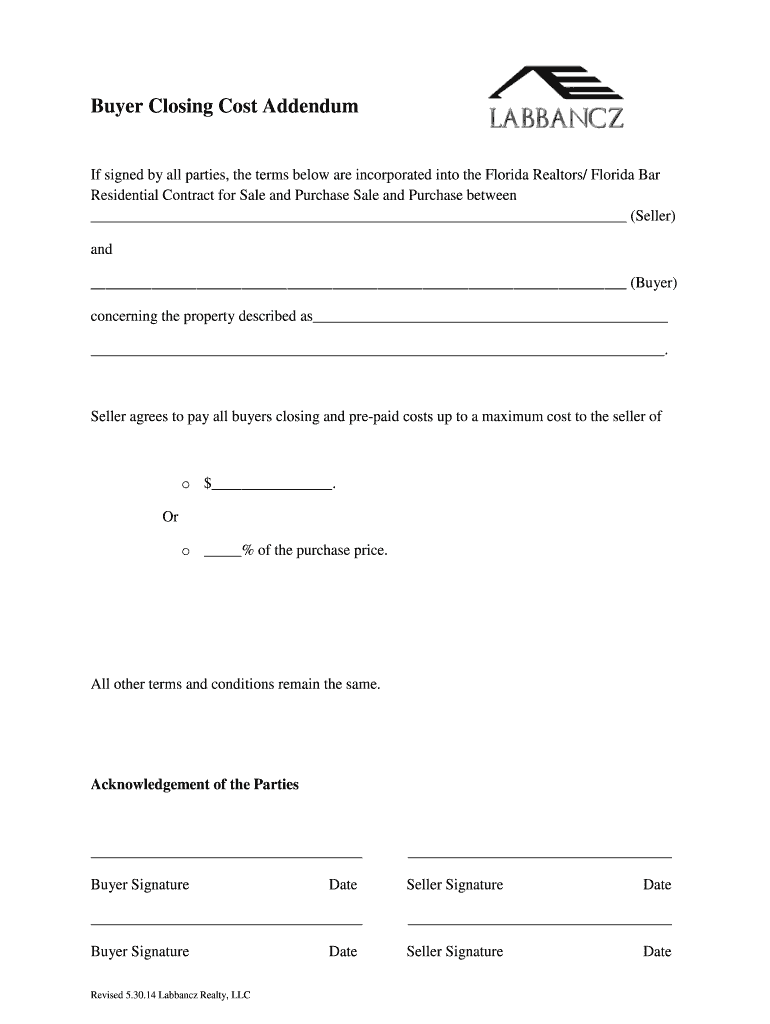

The closing cost addendum is a vital document in real estate transactions, specifically designed to outline the costs associated with closing a property sale. This addendum typically accompanies the purchase agreement and details the financial responsibilities of both the buyer and seller. It serves to clarify who will cover specific closing costs, such as title insurance, appraisal fees, and settlement charges, ensuring transparency in the transaction.

Key elements of the Closing Cost Addendum To Contract

Several key elements must be included in a closing cost addendum to ensure its effectiveness and legal validity. These elements typically include:

- Identification of Parties: Clearly state the names of the buyer and seller involved in the transaction.

- Property Description: Provide a detailed description of the property, including its address and any relevant identifiers.

- Closing Costs Breakdown: Itemize the specific closing costs being addressed, indicating which party is responsible for each cost.

- Signatures: Ensure that all parties sign the addendum to affirm their agreement to the terms outlined.

- Date: Include the date of execution to establish a timeline for the agreement.

Steps to complete the Closing Cost Addendum To Contract

Completing a closing cost addendum involves several straightforward steps. Begin by gathering all necessary information regarding the transaction, including the purchase agreement and any relevant financial documents. Then, follow these steps:

- Draft the Addendum: Use a standard template or create a new document that includes all required elements.

- Review Costs: Discuss with all parties involved to determine which closing costs will be covered by whom.

- Fill in Details: Accurately fill in the property details, parties' names, and the breakdown of costs.

- Obtain Signatures: Ensure that all parties sign the completed addendum to make it legally binding.

- Distribute Copies: Provide copies of the signed addendum to all parties for their records.

How to use the Closing Cost Addendum To Contract

The closing cost addendum is used to clarify financial responsibilities in a real estate transaction. Once completed, it should be attached to the purchase agreement. This addendum serves as a reference point during the closing process, ensuring that all parties understand their obligations. It can also be used to negotiate terms before the final agreement is signed, allowing for adjustments based on the buyer's and seller's needs.

Legal use of the Closing Cost Addendum To Contract

For a closing cost addendum to be legally valid, it must comply with state laws governing real estate transactions. This includes ensuring that all parties are fully informed of their rights and obligations. The addendum should be clear and concise, avoiding ambiguous language that could lead to disputes. Additionally, it is advisable to consult with a real estate attorney to ensure that the addendum meets all legal requirements and protects the interests of all parties involved.

Examples of using the Closing Cost Addendum To Contract

In practice, a closing cost addendum can be used in various scenarios. For instance, if a seller agrees to cover a portion of the buyer's closing costs as an incentive, this arrangement should be documented in the addendum. Another example is when the buyer requests that the seller pay for specific fees, such as home inspection costs or title insurance. Documenting these agreements helps prevent misunderstandings and ensures that all parties are on the same page throughout the closing process.

Quick guide on how to complete buyer closing cost addendum cdn2mediazp cdncom

Ensure Precision on Closing Cost Addendum To Contract

Negotiating agreements, managing listings, coordinating calls, and property showings—realtors and real estate specialists handle a multitude of tasks daily. Many of these tasks require extensive documentation, such as Closing Cost Addendum To Contract, that need to be filled out in accordance with established timelines and with the utmost accuracy.

airSlate SignNow is a comprehensive solution that allows professionals in the real estate sector to alleviate the burden of paperwork, enabling them to focus more on their clients’ goals throughout the entire negotiation phase and assist them in securing the most favorable terms on the transaction.

Steps to Complete Closing Cost Addendum To Contract with airSlate SignNow:

- Visit the Closing Cost Addendum To Contract page or utilize our library's search function to find the one you require.

- Click on Get form—you will be promptly directed to the editor.

- Begin filling out the form by selecting editable fields and entering your information in them.

- Add new text and adjust its settings if necessary.

- Select the Sign option in the upper toolbar to create your eSignature.

- Explore additional features to annotate and refine your document, such as drawing, highlighting, adding shapes, and more.

- Access the comment tab to leave notes regarding your form.

- Conclude the process by downloading, sharing, or sending your document to the designated individuals or organizations.

Eliminate paper for good and modernize the homebuying process with our user-friendly and powerful solution. Experience increased convenience when completing Closing Cost Addendum To Contract and other real estate documents online. Try our tool today!

Create this form in 5 minutes or less

FAQs

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

-

I recently opened a Fidelity Roth IRA and it says my account is closed and I need to submit a W-9 form. Can anyone explain how this form relates to an IRA and why I need to fill it out?

Financial institutions are required to obtain tax ID numbers when opening an account, and the fact that it's an IRA doesn't exempt them from that requirement. They shouldn't have opened it without the W-9 in the first place, but apparently they did. So now they had to close it until they get the required documentation.

Create this form in 5 minutes!

How to create an eSignature for the buyer closing cost addendum cdn2mediazp cdncom

How to generate an eSignature for the Buyer Closing Cost Addendum Cdn2mediazp Cdncom in the online mode

How to generate an electronic signature for the Buyer Closing Cost Addendum Cdn2mediazp Cdncom in Google Chrome

How to generate an eSignature for putting it on the Buyer Closing Cost Addendum Cdn2mediazp Cdncom in Gmail

How to make an eSignature for the Buyer Closing Cost Addendum Cdn2mediazp Cdncom from your smartphone

How to generate an electronic signature for the Buyer Closing Cost Addendum Cdn2mediazp Cdncom on iOS

How to make an eSignature for the Buyer Closing Cost Addendum Cdn2mediazp Cdncom on Android devices

People also ask

-

What is a seller credit addendum example?

A seller credit addendum example is a document that outlines the financial contributions a seller agrees to provide to the buyer at closing. This type of addendum is typically included in real estate transactions to help cover closing costs or repairs, making it a valuable tool for buyers.

-

How can I create a seller credit addendum example using airSlate SignNow?

Creating a seller credit addendum example with airSlate SignNow is straightforward. Simply use our user-friendly template library to find a seller credit addendum sample, customize it to your needs, and use our eSigning feature to collect signatures from all parties involved.

-

What are the benefits of using airSlate SignNow for addendums?

Using airSlate SignNow for seller credit addendum examples offers numerous benefits, including faster turnaround times and enhanced document security. Our platform allows for easy collaboration, ensuring that all parties can review and sign the addendum quickly and efficiently.

-

Are there any integration options for airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various platforms such as Google Drive, Dropbox, and CRM systems. This means you can easily manage your seller credit addendum examples alongside your existing workflows, enhancing productivity and organization.

-

What pricing plans does airSlate SignNow offer?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including individual, team, and enterprise solutions. Each plan provides access to essential features for creating and managing seller credit addendum examples and other documents.

-

Is it easy to modify a seller credit addendum example in airSlate SignNow?

Absolutely! Modifying a seller credit addendum example in airSlate SignNow is quick and simple. Our intuitive interface allows you to easily edit text, add or remove clauses, and make adjustments to ensure the document meets your specific requirements.

-

Can I track the status of my seller credit addendum example?

Yes, airSlate SignNow provides robust tracking features that allow you to monitor the status of your seller credit addendum example. You’ll receive notifications when it’s viewed, signed, or completed, making it easy to stay updated on your document’s progress.

Get more for Closing Cost Addendum To Contract

- Cs2716 form

- Phs form adm 009 usphs

- Erd 10584 form

- Regulated firearms collector application and affidavit form

- Application for duplicate or corrected certificate of title by form

- Gvms overview great valley school district form

- Ceh 14 form philasd

- Guest speaker request form joint school district no 2 meridianschools

Find out other Closing Cost Addendum To Contract

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast