Form 8879 F

What is the Form 8879 F

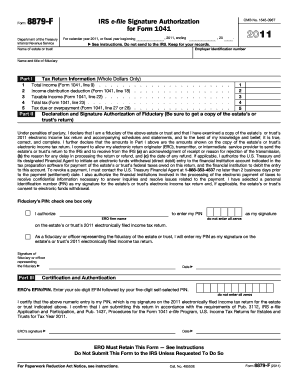

The Form 8879 F, also known as the IRS e-file Signature Authorization, is a crucial document for taxpayers in the United States who wish to electronically file their federal tax returns. This form allows taxpayers to authorize an electronic return originator (ERO) to file their tax return on their behalf. It serves as a declaration that the taxpayer has reviewed the return and agrees to its submission. The Form 8879 F is particularly important for ensuring compliance with IRS regulations regarding electronic filing.

How to use the Form 8879 F

Using the Form 8879 F involves a few straightforward steps. First, the taxpayer must complete their tax return using an ERO or tax preparation software. Once the return is ready, the taxpayer should review it carefully to ensure accuracy. After confirming that all information is correct, the taxpayer signs the Form 8879 F electronically or by hand, depending on the method used. This signed form is then submitted to the ERO, who will use it to file the return electronically with the IRS.

Steps to complete the Form 8879 F

Completing the Form 8879 F is a systematic process that requires attention to detail. Here are the steps:

- Gather all necessary tax documents, including W-2s, 1099s, and any relevant deductions.

- Fill out your tax return using tax preparation software or with the assistance of an ERO.

- Review the completed tax return for accuracy.

- Sign the Form 8879 F, ensuring that the signature matches the name on the tax return.

- Provide the signed form to your ERO for electronic submission.

Legal use of the Form 8879 F

The legal use of the Form 8879 F is governed by IRS regulations that ensure the authenticity and integrity of electronic tax filings. By signing this form, the taxpayer affirms that they have reviewed their tax return and authorize the ERO to submit it electronically. The form must be retained by the ERO for three years, as it serves as proof of consent and verification of the taxpayer's identity. Compliance with these legal requirements is essential to avoid potential penalties or issues with the IRS.

Key elements of the Form 8879 F

Several key elements make up the Form 8879 F, which are essential for its validity:

- Taxpayer Information: This includes the taxpayer's name, Social Security number, and address.

- Tax Return Information: Details about the tax return being filed, including the type of return and the tax year.

- Signature Section: The taxpayer's signature, which indicates their approval for electronic filing.

- ERO Information: The ERO's name and information, confirming their role in the filing process.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8879 F align with the general tax filing deadlines set by the IRS. Typically, individual taxpayers must file their federal tax returns by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial for taxpayers to be aware of these dates to ensure timely submission of their tax returns and avoid penalties.

Quick guide on how to complete form 8879 f

Effortlessly Prepare Form 8879 F on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the proper form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without any holdups. Handle Form 8879 F on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Simplest Method to Modify and eSign Form 8879 F with Ease

- Find Form 8879 F and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Mark important parts of your documents or conceal sensitive information with specialized tools that airSlate SignNow offers for this specific need.

- Generate your eSignature using the Sign feature, which takes only seconds and possesses the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 8879 F and guarantee seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8879 f

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8879 F?

Form 8879 F is an IRS form that allows taxpayers to electronically sign their tax returns. It serves as an e-signature authorization for tax preparers to submit returns on behalf of clients. Utilizing airSlate SignNow, you can easily create, send, and eSign Form 8879 F securely.

-

How does airSlate SignNow simplify the eSigning of Form 8879 F?

airSlate SignNow provides an intuitive platform that enables users to prepare and eSign Form 8879 F quickly and efficiently. With customizable templates and a user-friendly interface, businesses can streamline their workflow, reducing the time and effort needed in managing tax documents.

-

Is there a pricing plan for using airSlate SignNow for Form 8879 F?

Yes, airSlate SignNow offers flexible pricing plans tailored to meet different business needs, which include the ability to eSign Form 8879 F. Our plans are cost-effective and designed for both individual users and larger organizations, ensuring access to powerful signing features at any budget.

-

What are the key features of airSlate SignNow for handling Form 8879 F?

AirSlate SignNow boasts several features that facilitate handling Form 8879 F, including secure eSignature, document tracking, and customizable workflows. These features ensure that you can manage and sign your tax forms seamlessly, maintaining compliance and security throughout the process.

-

Can I integrate airSlate SignNow with other applications for Form 8879 F?

Absolutely! airSlate SignNow supports various integrations with popular applications, allowing you to manage Form 8879 F alongside your existing systems. This capability enhances your workflow, making it easier to keep all your documentation organized and accessible.

-

What benefits does airSlate SignNow offer for Form 8879 F users?

Users of airSlate SignNow benefit from faster document turnaround times and enhanced security for sensitive tax forms like Form 8879 F. The platform's easy-to-use interface minimizes the training required for your team, allowing for immediate productivity and reduced stress during tax season.

-

Is airSlate SignNow secure for eSigning Form 8879 F?

Yes, airSlate SignNow employs industry-leading security measures, including encryption and audit trails, to ensure that your eSigning of Form 8879 F is safe. You can trust that your sensitive information is protected while ensuring compliance with legal standards.

Get more for Form 8879 F

- Verivy student from devry form

- Keller transcript request form

- Dominican university transcript request form

- Registration form dominican university jicsweb1 dom

- Dominican university transcript request form 16195635

- Drake tuition rebate form

- Travel itinerary fillable form

- Walgreens tb test documentation form

Find out other Form 8879 F

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast