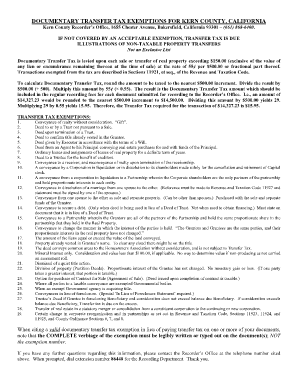

Kern County Property Tax Exemption Form

What is the Kern County Property Tax Exemption

The Kern County Property Tax Exemption is a financial benefit designed to reduce the property tax burden for eligible homeowners in Kern County, California. This exemption is particularly aimed at individuals who meet specific criteria, such as seniors, disabled individuals, and veterans. By applying for this exemption, qualifying residents can lower their assessed property value, resulting in decreased annual property taxes.

Eligibility Criteria

To qualify for the Kern County Property Tax Exemption, applicants must meet certain eligibility requirements. Generally, these include:

- Being a homeowner or a qualified resident of Kern County.

- Meeting age or disability criteria, typically being sixty-five years or older or having a qualifying disability.

- Providing proof of income, which may affect the amount of exemption granted.

It is essential for applicants to review the specific criteria set forth by the Kern County Assessor's Office to ensure they meet all requirements before applying.

Steps to Complete the Kern County Property Tax Exemption

Completing the Kern County Property Tax Exemption application involves several straightforward steps:

- Gather necessary documentation, including proof of age, disability, and income.

- Obtain the application form from the Kern County Assessor's Office or their official website.

- Fill out the application form accurately, ensuring all required fields are completed.

- Submit the application form along with any supporting documents to the appropriate office.

Following these steps carefully can help ensure a smooth application process and increase the chances of approval.

Required Documents

When applying for the Kern County Property Tax Exemption, applicants must provide several key documents to support their application. These typically include:

- Proof of age or disability, such as a birth certificate or disability certification.

- Income verification, which may include tax returns or pay stubs.

- Property ownership documentation, such as a deed or mortgage statement.

Having these documents ready can expedite the application process and help avoid delays.

Form Submission Methods

Applicants can submit their Kern County Property Tax Exemption forms through various methods to accommodate different preferences. The submission options typically include:

- Online submission via the Kern County Assessor's Office website.

- Mailing the completed form and documents to the designated office.

- In-person submission at the Kern County Assessor's Office.

Choosing the most convenient submission method can help ensure that the application is processed in a timely manner.

Legal Use of the Kern County Property Tax Exemption

The Kern County Property Tax Exemption is legally recognized and is governed by specific regulations that outline its application and use. Understanding these legal frameworks is crucial for applicants to ensure compliance. This exemption can significantly impact property tax obligations, making it essential for eligible residents to utilize this benefit appropriately.

Quick guide on how to complete kern county property tax exemption

Complete Kern County Property Tax Exemption seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents promptly without delays. Handle Kern County Property Tax Exemption on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Kern County Property Tax Exemption effortlessly

- Obtain Kern County Property Tax Exemption and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of your documents or hide sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from your preferred device. Modify and electronically sign Kern County Property Tax Exemption and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kern county property tax exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the kern county property tax exemption?

The kern county property tax exemption is a benefit available to eligible homeowners in Kern County, allowing them to reduce their property taxes. This exemption aims to ease the financial burden on those who qualify, including low-income seniors and disabled individuals. It's essential to understand the eligibility criteria to take full advantage of the kern county property tax exemption.

-

Who is eligible for the kern county property tax exemption?

Eligibility for the kern county property tax exemption typically includes homeowners who are seniors, disabled, or meet specific income requirements. To truly benefit from the kern county property tax exemption, it's advisable to review the detailed qualification criteria set by local authorities. Understanding your eligibility can help maximize your savings.

-

How can I apply for the kern county property tax exemption?

To apply for the kern county property tax exemption, you need to fill out the appropriate application form provided by the Kern County Assessor's office. Ensure that you gather all required documents, such as proof of income and residency. Completing the application accurately helps expedite the process of obtaining the kern county property tax exemption.

-

What documents are required when applying for the kern county property tax exemption?

When applying for the kern county property tax exemption, you'll generally need to provide proof of ownership, income documentation, and age verification if you're a senior citizen. Ensure all documents are recent and accurately reflect your current status. Having the right documents ready can help streamline your application process for the kern county property tax exemption.

-

How does the kern county property tax exemption impact my taxes?

The kern county property tax exemption can signNowly lower your property tax liability, providing financial relief for qualifying homeowners. By reducing the taxable value of your property, the exemption allows you to save money that can be used for other essential expenses. Understanding the exact impact of the kern county property tax exemption on your taxes is vital for planning your finances.

-

Is there a deadline for applying for the kern county property tax exemption?

Yes, there is typically a deadline for applying for the kern county property tax exemption, usually aligned with the property tax year's designation. Make sure to check with the Kern County Assessor's office to confirm specific dates and ensure your application is submitted in time. Missing the deadline can mean waiting another year to access the kern county property tax exemption.

-

Can I appeal a decision regarding the kern county property tax exemption?

If your application for the kern county property tax exemption is denied, you do have the right to appeal the decision. The appeals process involves submitting a formal request to the Kern County Assessor's office, outlining the reasons for your appeal. Understanding how to navigate this process can help you secure the kern county property tax exemption you believe you deserve.

Get more for Kern County Property Tax Exemption

Find out other Kern County Property Tax Exemption

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template