Iht419 Form

What is the IHT419?

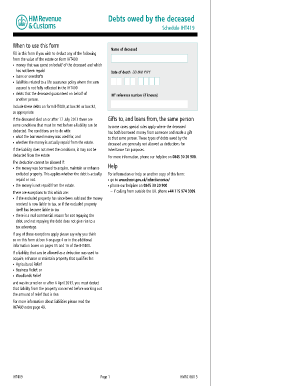

The IHT419 form is a crucial document used in the United States for reporting inheritance tax information. It is typically required when an individual passes away, and their estate is subject to inheritance tax. This form helps the tax authorities assess the value of the estate and determine the tax obligations of the beneficiaries. Understanding the IHT419 is essential for executors and beneficiaries to ensure compliance with tax regulations and to facilitate the smooth transfer of assets.

How to Use the IHT419

Using the IHT419 involves several steps to ensure accurate completion and submission. First, gather all necessary information regarding the deceased's estate, including asset valuations, liabilities, and details of beneficiaries. Next, fill out the form carefully, providing accurate data as required. It is important to review the completed form for any errors before submission. Once finalized, the IHT419 can be submitted to the appropriate tax authority, either electronically or by mail, depending on local regulations.

Steps to Complete the IHT419

Completing the IHT419 requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, including bank statements, property deeds, and investment records.

- Determine the total value of the estate by assessing all assets and liabilities.

- Fill out the IHT419 form, ensuring that all sections are completed accurately.

- Double-check the form for any mistakes or missing information.

- Submit the form to the appropriate tax authority, adhering to any specific submission guidelines.

Legal Use of the IHT419

The IHT419 must be used in accordance with U.S. tax laws to ensure its legal validity. This includes adhering to deadlines for submission and maintaining accurate records of the estate's value. Failure to comply with legal requirements can result in penalties or delays in the distribution of the estate. It is advisable for executors and beneficiaries to consult with a tax professional to navigate the legal aspects of the IHT419 effectively.

Required Documents

When completing the IHT419, several documents are required to support the information provided. These may include:

- Death certificate of the deceased.

- Valuations of all assets, including real estate and personal property.

- Records of any debts or liabilities owed by the deceased.

- Information on beneficiaries and their respective shares of the estate.

Form Submission Methods

The IHT419 can be submitted through various methods, depending on the regulations of the state in which the estate is being processed. Common submission methods include:

- Online submission through the tax authority's website.

- Mailing a physical copy of the completed form to the appropriate office.

- In-person submission at designated tax offices, if applicable.

Quick guide on how to complete iht419

Effortlessly Prepare Iht419 on Any Device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the right forms and safely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without hassle. Manage Iht419 on any platform using airSlate SignNow's Android or iOS applications and streamline your document-centric processes today.

How to Modify and Electronically Sign Iht419 with Ease

- Locate Iht419 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure private information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Iht419 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iht419

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is iht419 and how does it relate to airSlate SignNow?

IHT419 is a powerful solution offered by airSlate SignNow that streamlines the eSigning process for businesses. It allows users to securely sign documents online, enhancing efficiency and reducing turnaround time.

-

What pricing plans are available for the iht419 feature?

AirSlate SignNow offers flexible pricing plans that include the iht419 feature at competitive rates. These plans are designed to fit various business needs, ensuring you only pay for what you use while maximizing value.

-

What are the key features of the iht419 solution?

The iHT419 solution includes essential features like customizable templates, real-time tracking, and secure cloud storage. These functionalities enable seamless collaboration and enhance document management for your team.

-

How does iht419 enhance workflow efficiency?

IHT419 enhances workflow efficiency by automating the document signing process. This functionality eliminates the need for printing, mailing, or faxing documents, allowing businesses to save time and reduce operational costs.

-

Can the iht419 be integrated with other software applications?

Yes, the iht419 feature can be easily integrated with various software applications including CRM and project management tools. This integration helps create a cohesive working environment, making it easier to manage documents.

-

What benefits can my business gain from using iht419?

By using iht419, your business gains signNow benefits such as improved customer satisfaction through faster document turnaround and reduced paper usage. This sustainable approach not only saves resources but also enhances your company's reputation.

-

Is it secure to use the iht419 eSigning feature?

Absolutely, the iht419 eSigning feature is designed with advanced security measures to protect your data. All documents are encrypted, and user authentication ensures that only authorized parties can access and sign documents.

Get more for Iht419

- Tutoring for proficiency the escobedo counseling department form

- Equipment fault report form radiology directorate heft radiology co

- Drug and alcohol testing policy boerne isdnet form

- T amp t ultimate adventure 3rd 4th grade book award placement form

- Mammography amp outpatient nuclear imaging referral form

- I being duly sworn do hereby depose and state form

- Va form 21 534 2014 2019

- Appellants informal brief form

Find out other Iht419

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later