Minnesota Individual Income Tax Forms and Instructions 2024-2026

Understanding Minnesota Individual Income Tax Forms and Instructions

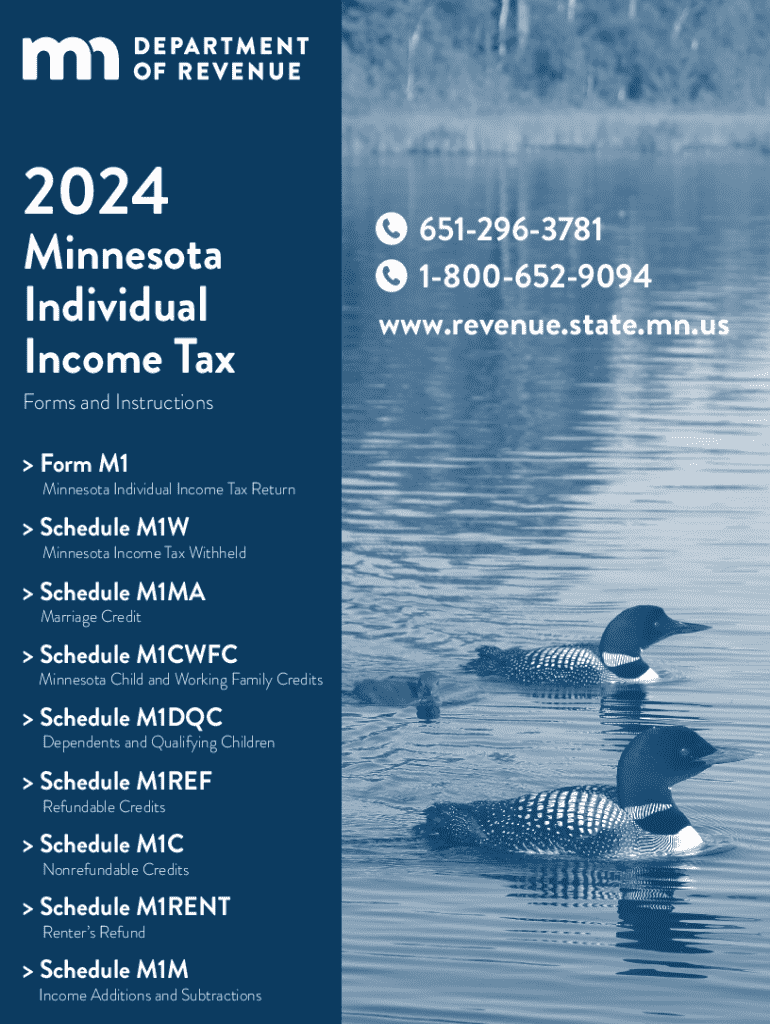

The Minnesota Individual Income Tax Forms and Instructions are essential documents for residents who need to report their income and calculate their tax obligations. These forms provide guidance on how to accurately fill out your tax return, ensuring compliance with state tax laws. The primary form used is the Minnesota Form M1, which is designed for individual taxpayers. It includes sections for reporting income, deductions, and credits, as well as detailed instructions for each line item.

Steps to Complete the Minnesota Individual Income Tax Forms and Instructions

Completing the Minnesota Individual Income Tax Forms involves several key steps:

- Gather necessary documentation, including W-2s, 1099s, and any other income statements.

- Download the Minnesota Form M1 and its accompanying instructions from the official Minnesota Department of Revenue website.

- Carefully read the instructions to understand the information required for each section of the form.

- Fill out the form, ensuring all income, deductions, and credits are accurately reported.

- Review the completed form for any errors or omissions before submitting.

How to Obtain the Minnesota Individual Income Tax Forms and Instructions

The Minnesota Individual Income Tax Forms and Instructions can be obtained in several ways:

- Visit the Minnesota Department of Revenue website to download the forms and instructions directly.

- Request paper forms to be mailed to you by contacting the Minnesota Department of Revenue.

- Visit local government offices or libraries where tax forms are often available during tax season.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines for the Minnesota Individual Income Tax Forms. Typically, the deadline for filing your state tax return is the same as the federal deadline, which is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers should be aware of any extensions that may apply and the due dates for estimated tax payments.

Required Documents for Filing

When preparing to file your Minnesota Individual Income Tax Forms, you will need several key documents, including:

- W-2 forms from employers, detailing your annual income.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical costs or charitable contributions.

- Any relevant tax documents from the previous year.

Form Submission Methods

Taxpayers in Minnesota have multiple options for submitting their Individual Income Tax Forms:

- Online submission through the Minnesota Department of Revenue's e-file system.

- Mailing a paper form to the appropriate address provided in the instructions.

- In-person submission at designated tax offices during tax season.

Legal Use of Minnesota Individual Income Tax Forms and Instructions

The Minnesota Individual Income Tax Forms and Instructions are legally binding documents that must be completed accurately to comply with state tax laws. Failure to provide correct information can result in penalties, interest, or audits. It is important for taxpayers to ensure they understand the legal implications of their submissions and to seek assistance if needed.

Create this form in 5 minutes or less

Find and fill out the correct minnesota individual income tax forms and instructions

Create this form in 5 minutes!

How to create an eSignature for the minnesota individual income tax forms and instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Minnesota Individual Income Tax Forms And Instructions?

Minnesota Individual Income Tax Forms And Instructions are official documents provided by the Minnesota Department of Revenue that guide taxpayers in filing their individual income tax returns. These forms include detailed instructions on how to complete them accurately, ensuring compliance with state tax laws.

-

How can airSlate SignNow help with Minnesota Individual Income Tax Forms And Instructions?

airSlate SignNow offers a streamlined solution for electronically signing and sending Minnesota Individual Income Tax Forms And Instructions. With our platform, you can easily manage your tax documents, ensuring they are completed and submitted on time without the hassle of printing and mailing.

-

Are there any costs associated with using airSlate SignNow for Minnesota Individual Income Tax Forms And Instructions?

Yes, airSlate SignNow provides various pricing plans that cater to different needs, including individual users and businesses. Our cost-effective solution allows you to efficiently manage your Minnesota Individual Income Tax Forms And Instructions without breaking the bank.

-

What features does airSlate SignNow offer for managing Minnesota Individual Income Tax Forms And Instructions?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage, all designed to simplify the process of handling Minnesota Individual Income Tax Forms And Instructions. These features enhance efficiency and ensure that your documents are always accessible.

-

Can I integrate airSlate SignNow with other software for my Minnesota Individual Income Tax Forms And Instructions?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to connect your workflow for managing Minnesota Individual Income Tax Forms And Instructions. This integration helps streamline your processes and enhances productivity.

-

Is airSlate SignNow secure for handling Minnesota Individual Income Tax Forms And Instructions?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Minnesota Individual Income Tax Forms And Instructions are protected. Our platform uses advanced encryption and security measures to safeguard your sensitive information.

-

What benefits can I expect from using airSlate SignNow for Minnesota Individual Income Tax Forms And Instructions?

Using airSlate SignNow for your Minnesota Individual Income Tax Forms And Instructions offers numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. Our user-friendly platform simplifies the tax filing process, allowing you to focus on what matters most.

Get more for Minnesota Individual Income Tax Forms And Instructions

Find out other Minnesota Individual Income Tax Forms And Instructions

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors