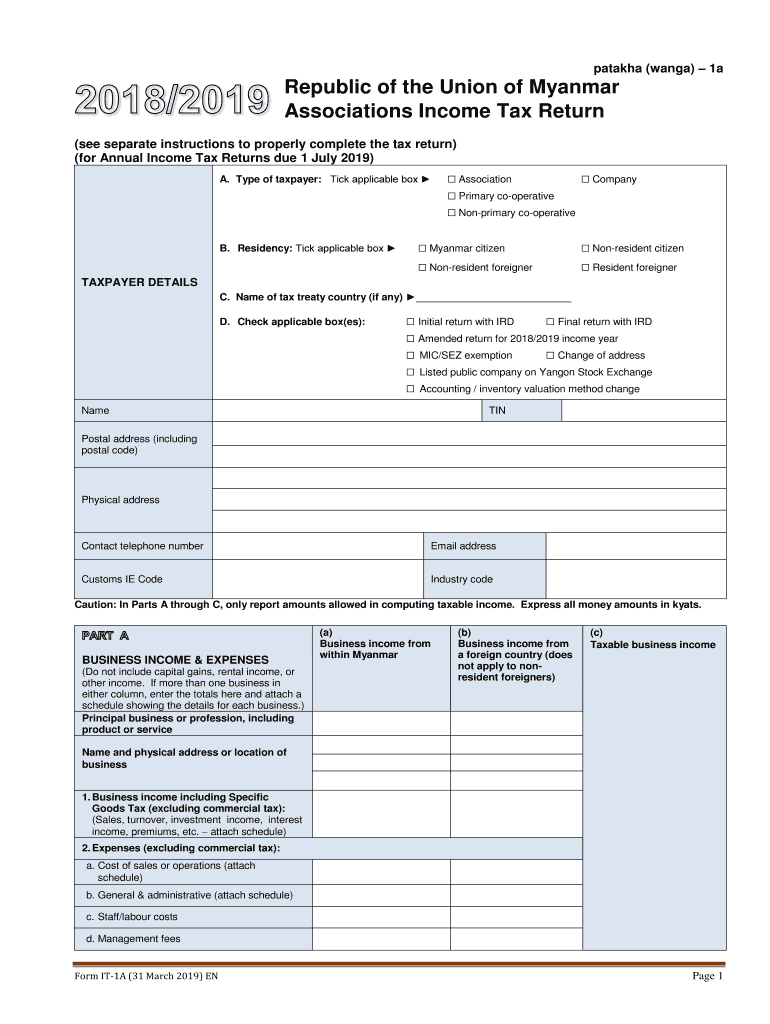

Republic of the Union of Myanmar Associations Income Tax Return Form

What is the Republic Of The Union Of Myanmar Associations Income Tax Return

The Republic Of The Union Of Myanmar Associations Income Tax Return is a tax document required for associations operating in Myanmar. This form is essential for reporting income, deductions, and tax liabilities to the government. It ensures that associations comply with local tax regulations and fulfill their financial obligations. Understanding the purpose and requirements of this form is crucial for accurate tax reporting and maintaining good standing with tax authorities.

Steps to complete the Republic Of The Union Of Myanmar Associations Income Tax Return

Completing the Republic Of The Union Of Myanmar Associations Income Tax Return involves several key steps:

- Gather financial records: Collect all relevant financial documents, including income statements, expense reports, and previous tax returns.

- Fill out the form: Accurately enter your association's income, deductions, and other required information on the form.

- Review for accuracy: Double-check all entries to ensure there are no mistakes or omissions that could lead to penalties.

- Sign and date the form: Ensure that the form is signed by an authorized representative of the association.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person.

Legal use of the Republic Of The Union Of Myanmar Associations Income Tax Return

The legal use of the Republic Of The Union Of Myanmar Associations Income Tax Return is governed by local tax laws. This form must be completed and submitted in accordance with these regulations to ensure compliance. Failure to adhere to legal requirements can result in penalties, including fines or audits. It is important to understand the legal implications of submitting this form and to keep thorough records of all related transactions.

Required Documents

To successfully complete the Republic Of The Union Of Myanmar Associations Income Tax Return, several documents are typically required:

- Income statements detailing all sources of revenue

- Expense reports outlining operational costs

- Previous tax returns for reference

- Bank statements and financial records

- Any additional documentation requested by tax authorities

Filing Deadlines / Important Dates

Filing deadlines for the Republic Of The Union Of Myanmar Associations Income Tax Return are critical to avoid penalties. Associations should be aware of the following important dates:

- Annual filing deadline: Typically set for the end of the fiscal year

- Extensions: Information on how to apply for extensions if needed

- Payment deadlines: Dates for any tax payments due

Form Submission Methods (Online / Mail / In-Person)

The Republic Of The Union Of Myanmar Associations Income Tax Return can be submitted through various methods:

- Online submission: Many associations prefer to file electronically for convenience and speed.

- Mail: Physical copies of the form can be sent to the appropriate tax authority.

- In-person submission: Associations may choose to deliver their forms directly to tax offices.

Quick guide on how to complete republic of the union of myanmar associations income tax return

Prepare Republic Of The Union Of Myanmar Associations Income Tax Return effortlessly on any device

Web-based document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, amend, and electronically sign your documents quickly without delays. Handle Republic Of The Union Of Myanmar Associations Income Tax Return on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to modify and eSign Republic Of The Union Of Myanmar Associations Income Tax Return easily

- Obtain Republic Of The Union Of Myanmar Associations Income Tax Return and click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to finalize your modifications.

- Choose how you wish to send your form, whether by email, text (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that require reprinting document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign Republic Of The Union Of Myanmar Associations Income Tax Return and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the republic of the union of myanmar associations income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Republic Of The Union Of Myanmar Associations Income Tax Return?

The Republic Of The Union Of Myanmar Associations Income Tax Return is a mandatory document that organizations in Myanmar must submit to report their income and calculate taxes owed. This return ensures compliance with local tax laws and regulations. Accurate filing is essential for avoiding penalties and maintaining good standing with tax authorities.

-

How can airSlate SignNow assist with the Republic Of The Union Of Myanmar Associations Income Tax Return?

airSlate SignNow provides a user-friendly platform for organizations to prepare and eSign their Republic Of The Union Of Myanmar Associations Income Tax Return. Our solution streamlines the document preparation process, making it easier to gather necessary signatures and submit forms electronically. This ensures a more efficient and effective handling of your tax return.

-

What are the pricing options for using airSlate SignNow for tax returns?

airSlate SignNow offers flexible pricing plans tailored to different organizational needs. Our plans are cost-effective and include various features to assist in the preparation and submission of the Republic Of The Union Of Myanmar Associations Income Tax Return. You can choose a plan that fits your budget while ensuring access to essential tools for tax compliance.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow features comprehensive document management tools that simplify the process of preparing the Republic Of The Union Of Myanmar Associations Income Tax Return. Easy-to-use templates, intuitive eSign capabilities, and secure cloud storage come together to enhance your tax document workflow. These features ensure that all your documents are organized and easily accessible.

-

Can airSlate SignNow integrate with other accounting software?

Yes, airSlate SignNow integrates seamlessly with various accounting and finance software to enhance the management of the Republic Of The Union Of Myanmar Associations Income Tax Return. These integrations help ensure that your financial data is accurately reflected in your tax documents. This streamlines your workflow and minimizes the chances of errors.

-

What benefits does airSlate SignNow provide for filing tax returns?

Using airSlate SignNow for filing the Republic Of The Union Of Myanmar Associations Income Tax Return offers numerous benefits, including increased efficiency, improved accuracy, and faster turnaround times. The ease of eSigning documents accelerates the process and reduces paper waste. Additionally, you remain compliant with local tax regulations while simplifying your administrative workload.

-

Is airSlate SignNow secure for filing sensitive tax documents?

Absolutely! airSlate SignNow prioritizes the security of your documents, utilizing advanced encryption and data protection measures. When filing the Republic Of The Union Of Myanmar Associations Income Tax Return, you can trust that your sensitive information is safe from unauthorized access. Our commitment to security allows you to focus on compliance without worrying about data bsignNowes.

Get more for Republic Of The Union Of Myanmar Associations Income Tax Return

- Private career school pcs renewal application state of new jersey form

- Private career school pcs renewal application department of form

- Nycers power of attorney 2016 2019 form

- Letter of representationletter of representation form

- Building 12 room 158 form

- Sh 9001 2018 2019 form

- Ls 55s 0117 labor ny form

- Medco 31 request for prior authorization of ohio bwc form

Find out other Republic Of The Union Of Myanmar Associations Income Tax Return

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form