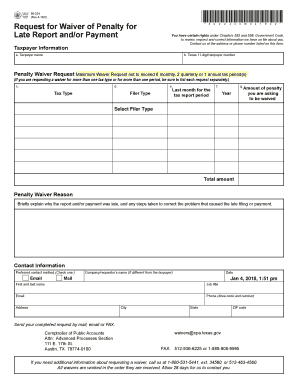

Request for Waiver of Penalty for Late Report and or Payment Form

What is the request for waiver of penalty for late report and or payment?

The request for waiver of penalty for late report and or payment is a formal application submitted to the relevant tax authority, typically in Texas, to seek relief from penalties incurred due to late submissions or payments. This form is particularly useful for individuals and businesses who may have faced extenuating circumstances that prevented timely compliance with tax obligations. By submitting the form 89 224, taxpayers can provide justification for their delay and request that penalties be waived based on their specific situation.

Steps to complete the request for waiver of penalty for late report and or payment

Completing the request for waiver of penalty involves several key steps to ensure that the form is filled out correctly and submitted properly. Here is a streamlined process:

- Gather necessary information: Collect all relevant financial documents and details regarding the late report or payment.

- Complete the form: Accurately fill out the 89 224 form, providing all required information, including your identification details and the reason for the delay.

- Attach supporting documentation: Include any documents that support your case, such as medical records or financial statements.

- Review the application: Double-check the form for accuracy and completeness to avoid delays in processing.

- Submit the form: Follow the submission guidelines, whether online, by mail, or in person, as specified by the tax authority.

Legal use of the request for waiver of penalty for late report and or payment

The legal use of the request for waiver of penalty hinges on compliance with established tax regulations. When properly executed, the form 89 224 serves as a legitimate means to contest penalties. It is essential that the reasons provided for the late submission are valid and supported by evidence. Tax authorities are more likely to grant waivers when taxpayers demonstrate that their circumstances were beyond their control, aligning with legal standards for penalty relief.

Eligibility criteria for the request for waiver of penalty for late report and or payment

Eligibility for submitting the request for waiver of penalty typically depends on several factors. Taxpayers must demonstrate that they have a valid reason for their late report or payment, such as:

- Serious illness or medical emergencies

- Natural disasters affecting business operations

- Unexpected financial hardship

- Errors made by tax preparation software or professionals

Additionally, taxpayers must have a history of compliance with tax obligations prior to the incident in question, as this can influence the approval of the waiver request.

How to obtain the request for waiver of penalty for late report and or payment

To obtain the request for waiver of penalty, taxpayers can typically access the form 89 224 through the official website of the Texas Comptroller or the relevant tax authority. The form is often available in downloadable PDF format, allowing users to print and fill it out. Alternatively, taxpayers may also request a physical copy by contacting the tax office directly. Ensuring that you have the most current version of the form is crucial for compliance.

Key elements of the request for waiver of penalty for late report and or payment

Understanding the key elements of the request for waiver can enhance the chances of approval. Important components include:

- Taxpayer identification: Clearly state your name, address, and tax identification number.

- Details of the late report or payment: Specify the nature of the report or payment that was late, including dates and amounts.

- Reason for the delay: Provide a thorough explanation of the circumstances that led to the late submission.

- Supporting documentation: Attach any relevant documents that substantiate your claims.

By addressing these elements comprehensively, taxpayers can present a more compelling case for waiver consideration.

Quick guide on how to complete request for waiver of penalty for late report and or payment

Complete Request For Waiver Of Penalty For Late Report And Or Payment effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely keep it online. airSlate SignNow offers you all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Request For Waiver Of Penalty For Late Report And Or Payment on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Request For Waiver Of Penalty For Late Report And Or Payment without difficulty

- Locate Request For Waiver Of Penalty For Late Report And Or Payment and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Select how you wish to send your form, whether through email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Request For Waiver Of Penalty For Late Report And Or Payment and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the request for waiver of penalty for late report and or payment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 89 224 and how does it work with airSlate SignNow?

Form 89 224 is a document primarily used for specific transactions and is compatible with airSlate SignNow’s eSignature solution. By utilizing this form within our platform, users can easily send, sign, and store documents securely, streamlining workflow and ensuring compliance.

-

How can airSlate SignNow simplify the completion of form 89 224?

airSlate SignNow simplifies the process of completing form 89 224 by offering intuitive tools for filling, signing, and tracking documents. Our platform enables users to quickly collect signatures and complete the form electronically, saving time and reducing errors.

-

What are the pricing options for using airSlate SignNow to manage form 89 224?

airSlate SignNow offers competitive pricing plans that cater to various business needs for managing form 89 224. Pricing typically includes options for individual users and teams, ensuring that all users can access our comprehensive features and functionality at an affordable rate.

-

Are there any integrations available for using form 89 224 with other applications?

Yes, airSlate SignNow supports various integrations that enhance the use of form 89 224 across different applications. This flexibility allows you to connect with popular tools such as CRMs, cloud storage, and more, simplifying document management and facilitating seamless workflows.

-

What features does airSlate SignNow offer for the secure handling of form 89 224?

With airSlate SignNow, handling form 89 224 securely is a top priority. Our platform includes advanced encryption, user authentication, and audit trails, ensuring that your sensitive documents are protected throughout the entire signing process.

-

What are the benefits of using airSlate SignNow for form 89 224?

The benefits of using airSlate SignNow for form 89 224 include increased efficiency, enhanced collaboration, and improved compliance. By digitizing the signing and management process, businesses can streamline operations and minimize the risk of lost or unaccounted documents.

-

Is it easy to track the status of form 89 224 with airSlate SignNow?

Yes, tracking the status of form 89 224 is straightforward with airSlate SignNow. Users can receive real-time notifications, view document history, and monitor who has signed the form, making it easier to manage and follow up on pending signatures.

Get more for Request For Waiver Of Penalty For Late Report And Or Payment

- Ohio bwc report 2014 2019 form

- Child care benefits columbus advanced learning academy inc form

- Swif app 2008 form

- Swif app 2016 2019 form

- Uce 1010 2018 2019 form

- Complete and file a written authorization form uce 1010 if you wish to appoint an individual firm or organization as your

- I 6 form tennesseepdffillercom 2017 2019

- Tngovlabor wfd c40a form 2018 2019

Find out other Request For Waiver Of Penalty For Late Report And Or Payment

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free