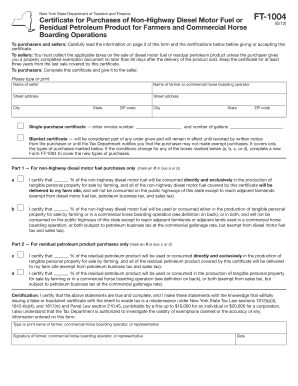

Ft 1004 Form

What is the Ft 1004

The Ft 1004 form, also known as the Uniform Residential Appraisal Report, is a standardized document used primarily in the mortgage lending industry. It provides a comprehensive assessment of a property's value based on various factors, including location, condition, and comparable sales in the area. This form is essential for lenders to determine the worth of a property before approving a mortgage loan. The Ft 1004 is typically completed by a licensed appraiser who evaluates the property and compiles the necessary data to support their valuation.

How to use the Ft 1004

Using the Ft 1004 form involves several key steps that ensure accurate completion and submission. First, the appraiser must gather relevant information about the property, including its dimensions, features, and any improvements made. Next, the appraiser will research comparable properties in the vicinity to establish a fair market value. Once all necessary data is collected, the appraiser fills out the Ft 1004, detailing the findings and providing a final valuation. This completed form is then submitted to the lender as part of the mortgage application process.

Steps to complete the Ft 1004

Completing the Ft 1004 form requires careful attention to detail. Here are the essential steps:

- Gather property information: Collect details such as the address, square footage, number of rooms, and any unique features.

- Research comparable sales: Look for similar properties that have sold recently in the area to help determine market value.

- Fill out the form: Enter the collected data into the Ft 1004, ensuring accuracy in all sections, including property description and valuation.

- Review and finalize: Double-check all entries for correctness and completeness before submitting the form to the lender.

Legal use of the Ft 1004

The Ft 1004 form holds significant legal weight in the context of real estate transactions. It is recognized by lenders and regulatory bodies as a valid document for assessing property value. For the form to be legally binding, it must be completed by a certified appraiser who adheres to industry standards and regulations. This ensures that the valuation is credible and can be relied upon by financial institutions during the mortgage approval process.

Key elements of the Ft 1004

Several key elements are essential to the Ft 1004 form, contributing to its effectiveness in property valuation. These include:

- Property description: Detailed information about the property, including its size, age, and condition.

- Market analysis: Data on comparable properties that have sold, which helps establish a fair market value.

- Appraiser's qualifications: Information about the appraiser's credentials and experience, ensuring the report's credibility.

- Valuation conclusion: The appraiser's final assessment of the property's value based on the collected data.

Examples of using the Ft 1004

The Ft 1004 form is commonly used in various scenarios, including:

- Home purchases: Lenders require the Ft 1004 to assess the value of a property before approving a mortgage.

- Refinancing: Homeowners seeking to refinance their mortgage may need an updated appraisal using the Ft 1004.

- Investment properties: Investors often use the Ft 1004 to evaluate potential rental properties and determine their investment viability.

Quick guide on how to complete ft 1004

Effortlessly Prepare Ft 1004 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect environmentally friendly substitute to conventional printed and signed documents, allowing you to obtain the required form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Ft 1004 on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related processes today.

The simplest method to alter and eSign Ft 1004 with ease

- Locate Ft 1004 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark signNow sections of your documents or obscure sensitive details using features specifically offered by airSlate SignNow.

- Generate your signature via the Sign tool, which only takes seconds and has the same legal validity as a conventional hand-signed signature.

- Review all details and click on the Done button to apply your changes.

- Choose how you wish to send your form, either through email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, laborious form searches, or errors that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Modify and eSign Ft 1004 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ft 1004

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ft 1004 document, and why is it important?

The ft 1004, also known as the Uniform Residential Appraisal Report, is a standardized document used in real estate transactions. It is important because it provides a reliable assessment of a property's value, ensuring transparency and fairness in the buying or selling process. Using airSlate SignNow, you can easily manage and sign ft 1004 documents to streamline your transactions.

-

How can I use airSlate SignNow to manage my ft 1004 documents?

With airSlate SignNow, you can upload, edit, and send your ft 1004 documents for eSignature quickly and easily. The platform provides a user-friendly interface that allows you to customize the document, add signers, and track the signing process in real-time. This eliminates delays and simplifies your workflow.

-

Is there a cost associated with using airSlate SignNow for ft 1004 document signing?

Yes, airSlate SignNow offers different pricing plans based on your needs, including a plan that caters specifically to businesses handling ft 1004 documents. Each plan provides specific features to enhance your document management experience. You can choose a plan that fits your budget while benefiting from cost-effective eSigning solutions.

-

What features does airSlate SignNow offer for ft 1004 authorization?

airSlate SignNow offers robust features for managing ft 1004 documents, including customizable templates, in-person signing options, and secure cloud storage. You can also integrate with other applications to streamline your workflow further. These features enhance efficiency and reduce the time needed for document processing.

-

Can I track the signing status of my ft 1004 documents?

Yes, airSlate SignNow provides real-time tracking for all your sent ft 1004 documents. You’ll receive notifications as signers interact with the document, allowing you to stay informed and manage your transactions effectively. This feature helps you ensure that all necessary signatures are collected promptly.

-

Are there any integrations available with airSlate SignNow for managing ft 1004 documents?

Absolutely! airSlate SignNow integrates with various CRM and productivity tools to help you manage your ft 1004 documents more efficiently. These integrations facilitate seamless data transfer and enhance collaboration among team members, allowing you to work smarter and faster.

-

What are the benefits of using airSlate SignNow for ft 1004 e-signatures?

Using airSlate SignNow for ft 1004 e-signatures provides numerous benefits, including increased speed, enhanced security, and reduced paperwork. It allows for asynchronous signing, which means parties can sign documents at their convenience. Plus, digital records help maintain compliance and simplify audit processes.

Get more for Ft 1004

- Va reserves the right to confirm the authenticity of all dbqs form

- Va form 21 526ez 2018 2019

- Buy in application 2016 2019 form

- School health record format 2013 2019

- Eaedc medical report form 2014 2019

- Adoption paperwork for mass printable 2016 2019 form

- Virtual gateway access designation form 2014 2019

- Masshealth child 2015 2019 form

Find out other Ft 1004

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online