Form 8621 Increase in Tax and Interest Calculations

What is the Form 8621 Increase In Tax And Interest Calculations

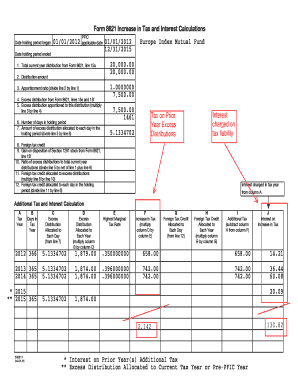

The Form 8621 Increase In Tax And Interest Calculations is a tax form used by U.S. taxpayers to report certain transactions involving foreign corporations. This form is particularly relevant for shareholders of passive foreign investment companies (PFICs). It helps in calculating the increase in tax and interest that may arise from these transactions. Understanding the implications of this form is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the Form 8621 Increase In Tax And Interest Calculations

Using the Form 8621 Increase In Tax And Interest Calculations involves filling out specific sections that detail your ownership in a PFIC and any distributions received. Taxpayers must provide information about the foreign corporation, including its name, address, and the nature of the income. Additionally, calculations regarding the increase in tax and interest must be accurately completed to ensure compliance with tax obligations.

Steps to complete the Form 8621 Increase In Tax And Interest Calculations

Completing the Form 8621 requires careful attention to detail. Here are the key steps:

- Gather necessary information about the foreign corporation.

- Fill in your personal information and tax identification number.

- Provide details on the PFIC, including income and distributions.

- Calculate the increase in tax and interest based on the provided data.

- Review the form for accuracy before submission.

Filing Deadlines / Important Dates

Timely filing of the Form 8621 is essential to avoid penalties. The form is typically due on the same date as your income tax return, which is usually April fifteenth for individual taxpayers. If you require an extension, be sure to file the form by the extended deadline to maintain compliance.

Penalties for Non-Compliance

Failure to file the Form 8621 or inaccuracies in reporting can lead to significant penalties. The IRS may impose fines, and taxpayers may also face interest on unpaid taxes. It is important to understand these consequences and ensure that the form is completed accurately and submitted on time.

Digital vs. Paper Version

Taxpayers have the option to complete the Form 8621 in either digital or paper format. The digital version offers advantages such as easier calculations and automatic error checking. However, some individuals may prefer the traditional paper format. Regardless of the method chosen, ensuring that the form is filled out correctly is paramount.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 8621 Increase In Tax And Interest Calculations. These guidelines include instructions on how to report income, calculate taxes, and understand the implications of PFIC ownership. Familiarizing yourself with these guidelines can help ensure compliance and avoid potential issues with the IRS.

Quick guide on how to complete form 8621 increase in tax and interest calculations

Effortlessly Complete Form 8621 Increase In Tax And Interest Calculations on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Handle Form 8621 Increase In Tax And Interest Calculations on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The easiest way to modify and eSign Form 8621 Increase In Tax And Interest Calculations hassle-free

- Obtain Form 8621 Increase In Tax And Interest Calculations and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors requiring the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form 8621 Increase In Tax And Interest Calculations and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8621 increase in tax and interest calculations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8621 and why is it important for tax calculations?

Form 8621 is vital for reporting interests in certain foreign corporations and calculating potential tax liabilities. Understanding Form 8621 Increase In Tax And Interest Calculations is crucial for those with foreign investments. Failing to file can result in signNow penalties and interest.

-

How can airSlate SignNow help with Form 8621 submissions?

airSlate SignNow streamlines the process of filling and submitting Form 8621 by providing an easy-to-use interface for document signing. With our solution, you can ensure accurate Form 8621 Increase In Tax And Interest Calculations without the hassle of manual paperwork. Our platform minimizes errors and speeds up document flows.

-

What features does airSlate SignNow offer for supporting tax documents?

airSlate SignNow offers a variety of features such as customizable templates, secure eSigning, and collaboration tools. These features help you manage Form 8621 Increase In Tax And Interest Calculations efficiently and ensure all collaborators are on the same page. You can easily store, track, and retrieve your documents within our system.

-

Is airSlate SignNow cost-effective for small businesses handling Form 8621?

Yes, airSlate SignNow is designed to be cost-effective for businesses of all sizes, including small businesses managing Form 8621 Increase In Tax And Interest Calculations. With flexible pricing plans, you can choose one that fits your budget while ensuring compliance with tax regulations. Our platform provides signNow ROI by saving time and reducing costs associated with traditional document handling.

-

Can I integrate airSlate SignNow with other business tools for better tax management?

Absolutely! airSlate SignNow integrates seamlessly with various business tools and platforms. This means you can incorporate our solution into your existing workflow for managing Form 8621 Increase In Tax And Interest Calculations alongside your accounting or CRM systems. These integrations enhance productivity and improve overall efficiency.

-

What benefits does electronic signing provide for tax-related forms like Form 8621?

Electronic signing offers numerous benefits for tax-related forms, including increased security and faster processing times. Using airSlate SignNow for Form 8621 Increase In Tax And Interest Calculations ensures that your documents are securely signed and stored, reducing the risk of loss or fraud. This expedites your filing process so you can meet deadlines seamlessly.

-

How does airSlate SignNow ensure the security of my Form 8621 documents?

At airSlate SignNow, we prioritize the security of your documents. All data related to Form 8621 Increase In Tax And Interest Calculations is encrypted both in transit and at rest. We also comply with industry standards and offer features like audit trails to help you maintain compliance and track document history.

Get more for Form 8621 Increase In Tax And Interest Calculations

Find out other Form 8621 Increase In Tax And Interest Calculations

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate