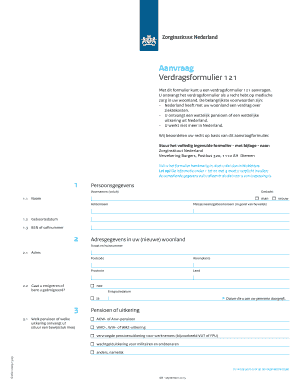

Formulier 121

What is the Formulier 121

The Formulier 121, also known as the verdragsformulier 121, is a specialized document used primarily for tax purposes in the United States. It is designed to facilitate the reporting of certain income and tax obligations, particularly for individuals who have foreign income or are involved in international transactions. Understanding the purpose and requirements of this form is essential for ensuring compliance with U.S. tax laws.

How to use the Formulier 121

Using the Formulier 121 involves several key steps to ensure accurate completion and submission. First, gather all necessary financial information related to foreign income and any applicable deductions. Next, fill out the form with precise details, ensuring that all figures are correctly calculated. Once completed, the form can be submitted electronically or via traditional mail, depending on your preference and the specific requirements of the IRS.

Steps to complete the Formulier 121

Completing the Formulier 121 requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, including income statements and tax records.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your foreign income accurately, ensuring to convert amounts to U.S. dollars if necessary.

- Include any deductions or credits you are eligible for, based on your financial situation.

- Review the form for accuracy before submission to avoid delays or penalties.

Legal use of the Formulier 121

The legal use of the Formulier 121 is governed by U.S. tax laws, which require accurate reporting of foreign income. This form must be completed in compliance with the Internal Revenue Code to ensure that it is recognized as valid by the IRS. Failure to properly use the Formulier 121 can result in penalties, including fines or additional tax liabilities.

Key elements of the Formulier 121

Several key elements must be included when filling out the Formulier 121:

- Personal Information: Your full name, address, and Social Security number.

- Income Reporting: Detailed reporting of foreign income, including the source and amount.

- Deductions and Credits: Information on any applicable deductions or credits that may reduce your tax liability.

- Signature: Your signature is required to validate the form, confirming that the information provided is accurate.

Who Issues the Form

The Formulier 121 is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. It is important to obtain the most current version of the form directly from the IRS to ensure compliance with any updates or changes in tax regulations.

Quick guide on how to complete formulier 121

Effortlessly Prepare Formulier 121 on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to acquire the appropriate format and securely keep it online. airSlate SignNow provides all the resources necessary to swiftly create, modify, and eSign your documents without any delays. Manage Formulier 121 on any system using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to Modify and eSign Formulier 121 with Ease

- Find Formulier 121 and select Get Form to initiate the process.

- Utilize our tools to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using the specialized tools provided by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all entered information and click the Done button to finalize your changes.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it directly to your computer.

Eliminate worries about lost or disorganized documents, tedious searches for forms, or errors that require new document prints. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and eSign Formulier 121 to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the formulier 121

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'verdragsformulier 121' and what role does it play in document signing?

The 'verdragsformulier 121' is a crucial document that simplifies the signing process for businesses. With airSlate SignNow, you can easily create, send, and eSign this form, ensuring compliance and smooth transactions. This feature enhances efficiency by making document management straightforward and digital.

-

How can I access the 'verdragsformulier 121' using airSlate SignNow?

You can access the 'verdragsformulier 121' directly through the airSlate SignNow dashboard. Once you log in, simply navigate to the document templates and select the 'verdragsformulier 121' for immediate use. This accessibility allows you to streamline your document signing process effortlessly.

-

What are the pricing options for using the 'verdragsformulier 121'?

airSlate SignNow offers various pricing plans that cater to different business needs. All plans include access to features like the 'verdragsformulier 121,' with pricing starting at a competitive rate. This makes it a cost-effective solution for companies looking to enhance their document management.

-

Are there any special features available for the 'verdragsformulier 121'?

Yes, the 'verdragsformulier 121' comes with several unique features on airSlate SignNow. You can customize this form, set signing order, and add password protection for enhanced security. These options help ensure that your documents are both professional and secure.

-

What benefits does airSlate SignNow provide for businesses using 'verdragsformulier 121'?

Using airSlate SignNow with the 'verdragsformulier 121' offers numerous benefits, including time savings and improved accuracy in document handling. The electronic signature feature reduces the turnaround time signNowly while ensuring compliance with legal standards. This ultimately leads to a more productive workflow.

-

Can I integrate the 'verdragsformulier 121' with other software?

Absolutely! airSlate SignNow allows seamless integration with various software platforms, enhancing the functionality of the 'verdragsformulier 121.' This integration capability means that you can streamline your workflow by connecting with CRM, accounting, and other business tools easily.

-

Is the 'verdragsformulier 121' legally binding?

Yes, when signed electronically via airSlate SignNow, the 'verdragsformulier 121' is legally binding and compliant with eSignature laws. This ensures that your documents hold up in legal matters just like traditional signatures. It's a reliable choice for businesses engaged in contractual agreements.

Get more for Formulier 121

- Gsa 7437 art in architecture program national artist registry form

- Internal control audit tracking system icats access request form

- Government purchase card gpc program dau form

- Gsa form 7662 us bank travel card approval application

- Chapter 14 title 66 public utilities pa general assembly form

- Fire protection safety and health programs fsh gsa form

- Stubs for last c form

- State application std 678 california department of developmental form

Find out other Formulier 121

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now