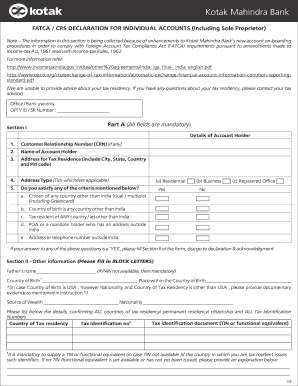

Fatca Form

What is the FATCA Form

The FATCA form, officially known as the Foreign Account Tax Compliance Act form, is a crucial document for U.S. taxpayers with foreign financial assets. It is designed to ensure compliance with U.S. tax laws by requiring individuals and entities to report certain foreign financial accounts and assets. The primary aim is to combat tax evasion by U.S. taxpayers holding assets outside the United States. This form is typically required to be filed with the Internal Revenue Service (IRS) and may involve reporting various types of accounts, including bank accounts and investment accounts.

How to Use the FATCA Form

Using the FATCA form involves several steps to ensure accurate reporting of foreign financial assets. Taxpayers must first determine if they meet the reporting thresholds, which can vary based on filing status and the total value of foreign assets. Once eligibility is confirmed, individuals can obtain the form from the IRS website or through tax preparation software. After filling out the necessary information, including details about foreign accounts, the form must be submitted alongside the annual tax return. It is essential to review the form for accuracy to avoid potential penalties.

Steps to Complete the FATCA Form

Completing the FATCA form requires careful attention to detail. Follow these steps for proper completion:

- Gather all necessary information about foreign financial accounts, including account numbers, names of financial institutions, and balances.

- Determine the reporting threshold based on your filing status and total value of foreign assets.

- Fill out the FATCA form accurately, ensuring all required fields are completed.

- Double-check the information for accuracy to minimize errors.

- Submit the form with your annual tax return to the IRS by the specified deadline.

Legal Use of the FATCA Form

The legal use of the FATCA form is governed by U.S. tax laws, which mandate compliance for individuals with foreign financial assets. Failure to file the form when required can result in significant penalties, including fines and interest on unpaid taxes. It is important for taxpayers to understand their obligations under FATCA to avoid legal repercussions. The form serves as a critical tool for the IRS to monitor compliance and ensure transparency in foreign financial dealings.

Required Documents

When preparing to complete the FATCA form, certain documents are necessary to provide accurate information. These include:

- Statements from foreign financial institutions detailing account balances and transactions.

- Identification documents, such as a Social Security number or taxpayer identification number.

- Any prior year tax returns that may include foreign asset disclosures.

Having these documents ready can streamline the process and ensure compliance with reporting requirements.

Filing Deadlines / Important Dates

Filing deadlines for the FATCA form align with the annual tax return due dates. Typically, individual taxpayers must submit their forms by April fifteenth of each year. If additional time is needed, a six-month extension can be requested, but it is crucial to note that this does not extend the time to pay any taxes owed. Staying aware of these deadlines is essential to avoid late fees and penalties.

Quick guide on how to complete fatca form

Effortlessly prepare Fatca Form on any device

Digital document management has gained traction among companies and individuals. It serves as an excellent environmentally-friendly alternative to conventional printed and signed documents, as you can easily find the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and smoothly. Manage Fatca Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to alter and electronically sign Fatca Form with ease

- Find Fatca Form and click Get Form to begin.

- Use the tools we provide to fill in your form.

- Highlight key sections of your documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to preserve your changes.

- Choose how you want to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Fatca Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fatca form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FATCA full form and why is it important?

The FATCA full form is the Foreign Account Tax Compliance Act. It is crucial for financial institutions to understand this regulation as it aims to prevent tax evasion by U.S. citizens through foreign accounts.

-

How does airSlate SignNow assist with FATCA compliance?

airSlate SignNow simplifies document management and eSigning, making it easier for businesses to stay FATCA compliant. Our solution helps you securely collect and manage the necessary forms required for FATCA reporting.

-

What features does airSlate SignNow offer for FATCA-related documents?

Our platform offers robust features such as customizable templates, secure eSigning, and automated workflows specifically designed for FATCA-related documents. This streamlines your compliance processes efficiently.

-

Is there a free trial available for airSlate SignNow to address FATCA requirements?

Yes, airSlate SignNow offers a free trial that allows businesses to explore how our solutions can assist in managing FATCA requirements. You can test our features without any commitment.

-

What kind of integration options does airSlate SignNow provide for FATCA compliance?

airSlate SignNow integrates seamlessly with popular CRMs and productivity tools, enhancing your workflow for FATCA-related tasks. This integration ensures that you can manage all documents related to the FATCA full form without switching platforms.

-

Can airSlate SignNow help reduce costs associated with FATCA compliance?

Absolutely! By using airSlate SignNow, businesses can reduce costs linked to paper-based processes and increase efficiency through our digital solution. This is especially beneficial when navigating the complexities of FATCA compliance.

-

How secure is airSlate SignNow for handling FATCA documentation?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and authorization measures to safeguard your documents, ensuring that all FATCA documentation is handled securely.

Get more for Fatca Form

- A guide for organizing domestic corporations spanish form

- Talking book and braille service teacherclassroom book order form

- Toby tires recipe for school safety form

- Victim of violence brochure form

- Qu es el comercio electrnico o ecommerceblog de marketing form

- Illinois remittance agents bond form

- Illinois notary public application checklist form

- Dr 2300a 101817 colorado department of revenue required form

Find out other Fatca Form

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer