Mortgage Denial Letter Form

What is the Mortgage Denial Letter

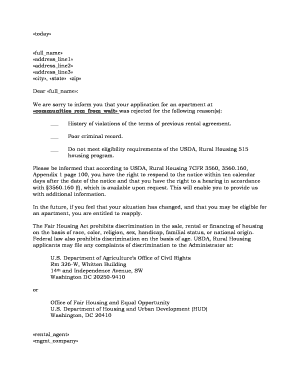

A mortgage denial letter is a formal document issued by a lender to inform a borrower that their application for a mortgage loan has been rejected. This letter typically outlines the reasons for the denial, which can include factors such as insufficient credit history, low income, or high debt-to-income ratios. Understanding this letter is crucial for borrowers, as it provides insight into the lender's decision and can guide them in addressing any issues for future applications.

Key Elements of the Mortgage Denial Letter

When reviewing a mortgage denial letter, it is important to identify its key components. These elements typically include:

- Borrower Information: The name and contact details of the borrower.

- Lender Information: The name and contact details of the lending institution.

- Reason for Denial: A clear explanation of why the mortgage application was not approved.

- Credit Report Disclosure: Information on how to obtain a free copy of the credit report used in the decision-making process.

- Next Steps: Guidance on what the borrower can do next, including potential options for appeal or reapplication.

Steps to Complete the Mortgage Denial Letter

Completing a mortgage denial letter requires careful attention to detail. Here are the steps to ensure accuracy:

- Gather Information: Collect all relevant details, including the borrower's name, address, and loan application specifics.

- State the Denial: Clearly state that the mortgage application has been denied.

- Explain the Reasons: Provide specific reasons for the denial based on the lender's evaluation.

- Include Contact Information: Offer a way for the borrower to reach out for further clarification or to discuss their options.

- Review for Accuracy: Ensure all information is correct and complies with legal standards before sending the letter.

How to Obtain the Mortgage Denial Letter

Borrowers can obtain a mortgage denial letter directly from their lender. If a loan application is denied, it is standard practice for the lender to issue this letter automatically. If it is not received, borrowers should:

- Contact the Lender: Reach out to the loan officer or customer service representative to request the letter.

- Verify Application Status: Confirm the status of the mortgage application to ensure that a denial has been issued.

- Request Written Documentation: Ask for a formal written letter outlining the denial reasons and any relevant details.

Legal Use of the Mortgage Denial Letter

The mortgage denial letter serves as an important legal document. It outlines the lender's decision and provides the borrower with the necessary information to understand their rights. Key legal aspects include:

- Fair Lending Laws: Lenders must comply with regulations that prohibit discrimination based on race, gender, or other protected characteristics.

- Disclosure Requirements: The letter must include specific disclosures regarding the reasons for denial and the borrower's right to review their credit report.

- Record Keeping: Both lenders and borrowers should keep copies of the denial letter for their records, as it may be needed for future applications or legal purposes.

Examples of Using the Mortgage Denial Letter

Understanding how to utilize a mortgage denial letter can help borrowers navigate their options. Common scenarios include:

- Appealing the Decision: Borrowers can use the letter to identify specific reasons for denial and address those issues when reapplying.

- Seeking Alternative Financing: The letter can guide borrowers in exploring other lending options or programs that may be more suitable for their financial situation.

- Consulting with Professionals: Sharing the denial letter with financial advisors or legal experts can provide insights into potential next steps and strategies for improvement.

Quick guide on how to complete mortgage denial letter 26350665

Complete Mortgage Denial Letter effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Handle Mortgage Denial Letter on any device with airSlate SignNow Android or iOS applications and enhance any document-driven task today.

How to modify and eSign Mortgage Denial Letter with ease

- Obtain Mortgage Denial Letter and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize relevant sections of your documents or redact sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require new document copies to be printed. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and eSign Mortgage Denial Letter and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mortgage denial letter 26350665

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a mortgage denial letter?

A mortgage denial letter is a formal document issued by a lender that outlines the reasons for denying a mortgage application. Understanding this letter is crucial for applicants, as it provides insights into factors affecting their creditworthiness and eligibility. With airSlate SignNow, you can easily eSign and manage your mortgage-related documents efficiently.

-

How can airSlate SignNow help with my mortgage denial letter?

airSlate SignNow allows you to quickly and securely eSign mortgage denial letters and other documents, streamlining the process for you. This way, you can address any issues presented in the denial letter faster by organizing the necessary paperwork. An easy-to-use interface makes it simple, even if you're unfamiliar with electronic signatures.

-

Are there any fees associated with using airSlate SignNow for mortgage denial letters?

airSlate SignNow offers cost-effective pricing plans tailored to diverse business needs, including the handling of mortgage denial letters. You can choose the plan that best fits your frequency of use and required features. Our transparent pricing ensures you know exactly what you're paying for.

-

What features does airSlate SignNow offer for managing mortgage denial letters?

Key features of airSlate SignNow include electronic signatures, document tracking, and customizable workflows. These features facilitate the efficient handling of mortgage denial letters, ensuring you can respond swiftly to your lender's requirements. Additionally, templates can be created for commonly used documents.

-

Can I integrate airSlate SignNow with other software for mortgage-related processes?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions to enhance your mortgage management processes. This makes it easier to share and manage mortgage denial letters across different platforms, improving your overall efficiency. Popular integrations include CRM systems and document management tools.

-

What benefits can I expect from using airSlate SignNow for my mortgage documents?

Using airSlate SignNow for your mortgage documents, including denial letters, offers several benefits such as increased efficiency, enhanced security, and reduced turnaround time. You can eSign documents from anywhere, ensuring that you don’t miss any crucial deadlines. This streamlined approach not only saves time but also helps you manage your mortgage applications more effectively.

-

Is airSlate SignNow easy to use for someone unfamiliar with electronic signing?

Yes, airSlate SignNow is designed with user-friendliness in mind. Even if you're new to electronic signing and mortgage denial letters, our intuitive interface guides you through the process step-by-step. Comprehensive support resources are also available to assist you whenever needed.

Get more for Mortgage Denial Letter

Find out other Mortgage Denial Letter

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free