Ftcrws Form

What is the Ftcrws

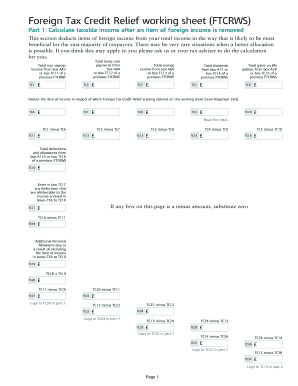

The Ftcrws form, also known as the Federal Tax Classification and Reporting Worksheet, is a crucial document used for tax classification purposes. It helps individuals and businesses determine their tax obligations and ensures compliance with federal tax regulations. This form is particularly important for those who are self-employed, freelancers, or part of a partnership, as it outlines how income should be reported to the IRS.

How to use the Ftcrws

Using the Ftcrws involves several steps to ensure accurate completion. First, gather all necessary information about your business structure and income sources. Next, fill out the form by providing details such as your name, business name, and tax identification number. Ensure that you classify your income correctly according to the guidelines provided on the form. Once completed, review the form for accuracy before submission to avoid any potential issues with the IRS.

Steps to complete the Ftcrws

Completing the Ftcrws requires careful attention to detail. Follow these steps:

- Gather your financial documents, including income statements and previous tax returns.

- Identify your business structure (sole proprietorship, LLC, corporation, etc.).

- Fill out the personal and business information sections accurately.

- Classify your income correctly based on the IRS guidelines.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Ftcrws

The Ftcrws is legally binding when completed correctly and submitted to the appropriate tax authorities. It is essential to ensure that all information is accurate and complies with IRS regulations. Misclassification or errors on the form can lead to penalties or audits. Therefore, understanding the legal implications of the Ftcrws is crucial for individuals and businesses to maintain compliance and avoid legal issues.

Key elements of the Ftcrws

Several key elements are essential for the Ftcrws to be valid:

- Tax Identification Number: This is required to identify the taxpayer.

- Business Structure: Clearly indicate whether you are a sole proprietor, partnership, or corporation.

- Income Classification: Accurately classify your income sources to ensure proper tax treatment.

- Signature: A signed form is necessary to validate the information provided.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Ftcrws is crucial for compliance. Typically, the form should be submitted by the tax filing deadline, which is usually April fifteenth for individuals. However, specific deadlines may vary based on business structure and tax year. It is advisable to check the IRS guidelines for any updates or changes to filing dates to avoid penalties.

Quick guide on how to complete ftcrws

Complete Ftcrws effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Handle Ftcrws on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to alter and eSign Ftcrws without any hassle

- Obtain Ftcrws and click Get Form to initiate the process.

- Utilize the tools we provide to finalize your form.

- Select relevant sections of your documents or redact sensitive details using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to preserve your edits.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from any device of your choice. Modify and eSign Ftcrws to ensure excellent communication at any stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ftcrws

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ftcrws and how does it relate to airSlate SignNow?

Ftcrws represents an innovative approach to document management with airSlate SignNow. It streamlines the process of sending and eSigning documents, making it easier for businesses to handle their workflows efficiently. By utilizing ftcrws, companies can enhance their document management experience.

-

How does pricing work for airSlate SignNow with ftcrws?

AirSlate SignNow offers flexible pricing plans that cater to different business needs. With ftcrws, users can choose a plan that best fits their usage requirements and budget. The cost-effectiveness of these plans ensures that businesses can access essential features without overspending.

-

What key features does ftcrws include?

Ftcrws includes several key features such as customizable templates, advanced security options, and real-time tracking of documents. These capabilities within airSlate SignNow enable businesses to enhance their productivity and maintain control over their document processes. Users can efficiently manage their documents with these robust features.

-

What are the benefits of using airSlate SignNow's ftcrws?

Using the ftcrws feature within airSlate SignNow offers numerous benefits, including increased efficiency, reduced turnaround times for documents, and enhanced collaboration among team members. This powerful solution allows businesses to focus on growth while minimizing the time spent on administrative tasks. Adopting ftcrws can lead to signNow improvements in workflow management.

-

Can I integrate airSlate SignNow with other tools using ftcrws?

Yes, airSlate SignNow's ftcrws is designed to integrate seamlessly with various third-party tools and applications. This connectivity expands the functionality of your document management workflow and ensures you can use your preferred tools alongside airSlate SignNow. Integrations enable a more cohesive work environment, making data management easier.

-

Is there a mobile app for airSlate SignNow's ftcrws?

Yes, airSlate SignNow offers a mobile app that features ftcrws, allowing users to eSign and send documents on the go. This flexibility ensures that you can manage important documents from anywhere, enhancing productivity and responsiveness. The mobile app complements the web platform perfectly, providing a consistent experience across devices.

-

Is training available for using ftcrws with airSlate SignNow?

Absolutely! AirSlate SignNow provides extensive training resources and support for users implementing ftcrws. These resources include video tutorials, user guides, and personalized onboarding sessions to help you maximize the benefits of the platform. Proper training ensures that users can effectively utilize all features of airSlate SignNow.

Get more for Ftcrws

Find out other Ftcrws

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form