Form Sw 4

What is the Form SW-4

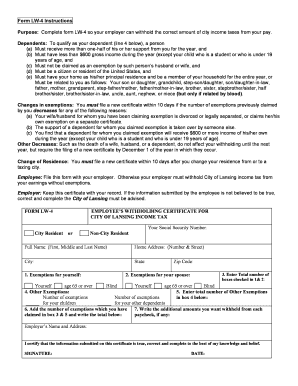

The Form SW-4 is a state-specific document used in the United States for tax withholding purposes. It is primarily utilized by employees to indicate their state tax withholding preferences to their employers. By completing this form, employees can ensure that the correct amount of state income tax is withheld from their paychecks, aligning with their individual tax situations. This form is vital for maintaining compliance with state tax regulations and avoiding under-withholding or over-withholding issues.

How to use the Form SW-4

To effectively use the Form SW-4, employees should first obtain the form from their employer or the relevant state tax authority. After acquiring the form, individuals need to fill it out accurately, providing necessary personal information such as name, address, and Social Security number. Employees should also indicate their desired withholding allowances based on their specific financial circumstances. Once completed, the form should be submitted to the employer's payroll department to ensure that the correct withholding is applied to future paychecks.

Steps to complete the Form SW-4

Completing the Form SW-4 involves several straightforward steps:

- Obtain the Form SW-4 from your employer or the state tax authority.

- Fill in your personal information, including your name, address, and Social Security number.

- Determine your withholding allowances based on your financial situation and family status.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer's payroll department.

Legal use of the Form SW-4

The legal use of the Form SW-4 is governed by state tax laws, which dictate how employees should report their withholding preferences. It is essential for the form to be completed accurately to ensure compliance with these laws. Employers are required to maintain the confidentiality of the information provided on the form and must use it solely for the purpose of calculating state income tax withholding. Failure to comply with these regulations can result in penalties for both the employee and the employer.

Filing Deadlines / Important Dates

Filing deadlines for the Form SW-4 can vary by state, but generally, employees should submit the form to their employers at the start of employment or whenever they wish to change their withholding preferences. It is advisable to check with the state tax authority for specific deadlines, especially during tax season, to ensure compliance and avoid any potential issues with tax withholding.

Required Documents

When completing the Form SW-4, employees typically need to provide certain documents to support their claims for withholding allowances. These may include:

- Proof of identity, such as a driver's license or Social Security card.

- Documentation of any dependents claimed for tax purposes.

- Previous tax returns, if applicable, to determine appropriate withholding amounts.

Who Issues the Form

The Form SW-4 is issued by state tax authorities in the United States. Each state may have its own version of the form, tailored to its specific tax regulations. Employers are responsible for providing the correct form to their employees and ensuring that it is completed and submitted properly. Employees can also access the form through the state tax authority's website or office.

Quick guide on how to complete form sw 4

Effortlessly Prepare Form Sw 4 on Any Device

Online document management has become increasingly popular with businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage Form Sw 4 on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to Easily Modify and eSign Form Sw 4

- Locate Form Sw 4 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your alterations.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious searches for forms, or corrections that require printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any chosen device. Modify and eSign Form Sw 4 and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form sw 4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form Sw 4 and how can it be used?

Form Sw 4 is a designated form utilized for various business processes. With airSlate SignNow, users can easily complete and eSign Form Sw 4 online, simplifying document management and facilitating quicker transactions.

-

How does airSlate SignNow enhance the process of handling Form Sw 4?

airSlate SignNow enhances the handling of Form Sw 4 by providing tools for secure eSigning and real-time collaboration. This ensures that all stakeholders can review, sign, and manage the form efficiently, reducing processing time.

-

Is there a cost associated with using airSlate SignNow for Form Sw 4?

Yes, there are various pricing plans available for using airSlate SignNow to manage Form Sw 4. These plans are designed to be cost-effective, catering to businesses of all sizes with features tailored to meet diverse needs.

-

What features does airSlate SignNow offer for Form Sw 4?

airSlate SignNow offers a range of features for Form Sw 4, including customizable templates, multi-user collaboration, and automatic reminders. These features streamline the process of preparing and signing the form, ensuring a hassle-free experience.

-

Can Form Sw 4 be integrated with other software using airSlate SignNow?

Absolutely! airSlate SignNow provides seamless integrations with various software applications. This allows users to connect their existing systems to streamline the management of Form Sw 4 with other business workflows.

-

What benefits does using airSlate SignNow for Form Sw 4 provide?

Using airSlate SignNow for Form Sw 4 offers multiple benefits such as time savings, improved document security, and enhanced team collaboration. By digitizing the signing process, businesses can operate more efficiently and reduce errors.

-

How secure is the signing process for Form Sw 4 with airSlate SignNow?

The signing process for Form Sw 4 with airSlate SignNow is highly secure, employing encryption and advanced authentication methods. This ensures that all signed documents are protected, meeting compliance standards and safeguarding sensitive information.

Get more for Form Sw 4

Find out other Form Sw 4

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple